A sudden burst of energy has returned to Bitcoin (BTC), and the timing has caught many eyes. The price climbed from $83,000 just 3 days ago to around $93,000 today, and the move has sparked a fresh round of questions. What exactly pushed BTC higher again, and how far can this momentum stretch if current conditions keep building?

A powerful wave of buying has been flowing into Bitcoin, and several analysts have pointed directly at institutional activity as the spark. Crypto Rover captured the shift clearly, noting that the rally began right after the US market opened. Bitcoin jumped almost 6% within that window.

THIS IS WHY BITCOIN PUMPED:

— Crypto Rover (@cryptorover) December 3, 2025

Right after the US market opened, Bitcoin surged nearly 6%.

Not a coincidence.

Vanguard just lifted its Bitcoin ETF ban reversal, and a wave of new institutional investors rushed in through BlackRock’s $IBIT ETF.

BlackRock’s $IBIT alone hit over… pic.twitter.com/CFtAIjvydY

The move lined up with a major policy shift at Vanguard, which lifted its ban on Bitcoin ETF trading. That shift unlocked fresh demand through BlackRock’s IBIT ETF, which recorded more than $1.8B in trading volume during its first 2 hours of activity.

This is the kind of volume that normally supports sustained moves. The fast push higher shows that institutions have not stepped back from BTC. They appear to be expanding their exposure instead.

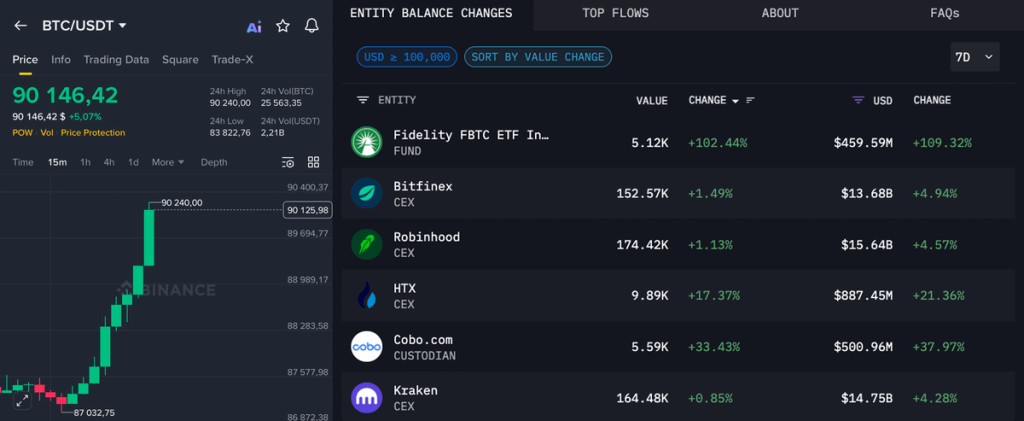

A similar view came from Tracer, who highlighted heavy buying from large platforms including Robinhood, BlackRock, Fidelity, Binance, Strategy, and Kraken. Tracer estimated that these firms collectively bought more than $21.8B in BTC within a single hour.

The exact figure is difficult to verify, although the overall direction of inflows is clear enough. Fresh liquidity has been entering the market quickly, and BTC responded with an immediate jump.

Bitcoin (BTC) Price Momentum and Chart Structure

A key chart shared by Crypto Patel shows that BTC is forming an inverse head and shoulders pattern on the 3h chart. This is one of the more recognizable reversal structures, often signaling a shift from a downtrend to renewed strength.

The chart shows 3 rounded dips, with the middle one being deeper. The neckline sits around the $92,000–$93,000 region, which BTC is currently testing. Patel noted that if BTC breaks above this neckline with conviction, the next major target lands near $105,000 to $107,000. These numbers come from measuring the height of the pattern from the head to the neckline and projecting it upward once the breakout confirms.

A large resistance block also waits above. The chart marks a zone around $104,000 to $107,000 where sellers previously stepped in heavily. If BTC climbs into that area again, traders may treat it as the next big decision point.

The current bounce from the $82,000 zone aligns with the structure of the pattern. Each valley in the formation shows buyers stepping in faster than before, creating a rounded shape that points toward strengthening confidence. The neckline retest now becomes the most important part of the setup. BTC is sitting right at that level, and the price action here decides whether the pattern plays out or resets.

Bitcoin (BTC) Price Outlook If Current Momentum Holds

A mix of institutional inflows, ETF activity, and technical structure forms a strong blend for short-term strength. The question now revolves around follow-through. BTC needs a clean move above the $92,000–$93,000 zone to confirm everything discussed so far. A breakout there unlocks the chance to revisit the $100,000 zone and possibly stretch into the $105,000–$107,000 range.

Read Also: 3 Factors That Could Decide Hyperliquid (HYPE) Price in 2026

A rejection at the neckline would cool the pace. It would not erase the move from $83,000, although it would slow the momentum and likely pull BTC back toward recent support levels.

The next few days set the tone for December. BTC has the structure and demand to climb higher, and the chart shows that buyers are not backing away from the bigger picture. A clean breakout could begin the next major push that many have been waiting for.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.