AAVE’s price has shot up lately, rising more than other DeFi tokens in the crypto market. Right now it’s trading at $366.56, which is a 32.02% jump from yesterday. More people are trading it too – volume is up 36.15%.

Two main things are driving this rise: the price finally broke out of a pattern it was stuck in for two years, and word is going around about some big token purchases.

What you'll learn 👉

AAVE Technical Analysis

The AAVE chart illustrates a decisive breakout from a two-year price range between $55 and $115. This breakout signals strong bullish momentum and has propelled the token into a clear uptrend. The price has steadily moved upwards, reaching levels not seen in years, with higher highs and higher lows confirming the trend.

Support zones around $75–$115 and $195–$225 have provided stability during the rally, while resistance levels at $260 and $450 now define AAVE’s price potential range, as suggested by Daan Crypto Trades on X (formerly Twitter).

He noted that AAVE’s weekly candle is shaping up favorably, with the $260-$450 range expected to dominate price movements in the near term. A spike in trading volume during the breakout supports the momentum, while the current weekly candle reflects strong buying pressure.

Institutional Interest Drives Momentum

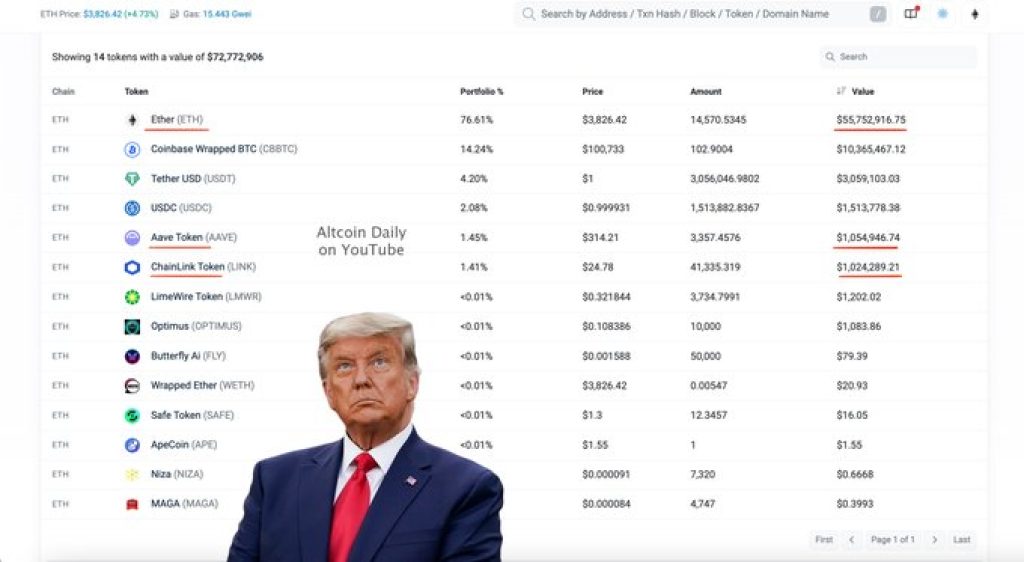

Institutional interest has played a key role in AAVE’s recent price movement. According to a tweet by Altcoin Daily, Donald Trump’s World Liberty Financial reportedly swapped $5 million USDC for Ethereum, raising its total ETH holdings to $55 million.

The same wallet acquired $1 million each of AAVE and Chainlink (LINK), sparking speculation about future acquisitions. This development has drawn significant attention to AAVE, highlighting its appeal among high-profile investors.

Future Price Movements

With AAVE’s price trading above $360, analysts are watching for the token to form a range between $260 and $450.

Resistance around $450 could be tested if the uptrend holds, while support around $260 may provide a safety net if the price retraces. AAVE’s performance, fueled by technical and fundamental factors, demonstrates its growing prominence in the DeFi sector.

The combined influence of market trends and high-profile acquisitions underscores AAVE’s price rise, positioning it as a standout performer in the crypto space.

Read Also: Can HBAR Skyrocket to $5 by 2025? Hedera Price Prediction

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.