Cryptocurrency trader Miya raises concerns about coordinated manipulation driving INJ’s 150% price spike over recent weeks. She points to suspicious exchange order flow data showing massive buying pressure from 2-3 AM UTC a few days ago during Bitcoin’s flash crash, allowing INJ to hit all-time highs. This perfectly timed activity reeks of market makers engineering opportunities to lure in retail traders at optimal moments.

Artificially Inflated Demand and Usage

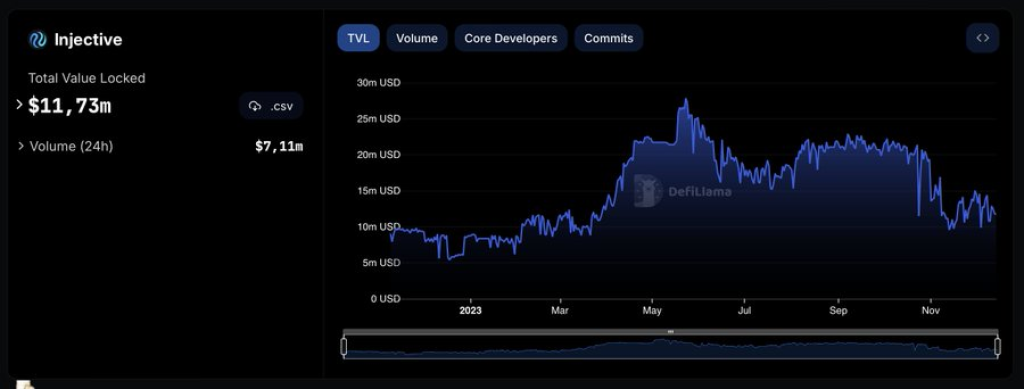

Adding doubt, Injective’s underlying protocol usage and total value locked (TVL) paint a contradictory picture to its surging token price, sitting at a paltry $11 million TVL against a nearly $3 billion fully diluted valuation. The disconnect implies actual retail and institutional demand remains lacking, making manipulative tactics necessary to attract capital.

VC and Insider Self-Interests

Miya further connects the motivations behind the pump to INJ insiders, backers, and VCs looking to offload holdings. With unlocks distributed at lower prices during the bear market, orchestrating a speculative frenzy allows large holders to distribute tokens profitably before coordinated sell-offs later.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Incentivizing Influencers and Airdrops

Suspiciously, the way INJ structures promotional airdrops also raises questions. Requiring staking locks retail holders into set vesting periods, preventing selling while insiders unload. In addition, rumors suggest some influencers may have been directly compensated to tout INJ.

Pump Scheme Following Predictable Playbook

INJ’s parabolic surge mirrors a formulaic pump-and-dump blueprint including manufactured exchange volume, hype-building marketing, and strategic distribution of tokens to retail before eventual dumping. Miya correctly predicted this sequence based on identifying the schemes of self-interested market makers.

While INJ shows long-term technology promise, investors should remain skeptical of short-term price signals divorced from actual platform usage. As Miya bluntly asserts, “You are all falling for it.” Questionable forces seem to be strategically manipulating perceptions and access to benefit large INJ holders ahead of everyday investors.

You may also be interested in:

- Top BTC Analyst Explains Why Another Big Bitcoin Move is Imminent, Reveals the Key Support to Look Out for

- Polkadot (DOT) to Continue Upward Rally as Critical Retest Proves Successful: Here Are the Next Price Targets

- BorroeFinance Sets Sights on Outperforming Cardano (ADA) and Polkadot (DOT)

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.