The price of the Injective Protocol’s INJ token has pumped over 80% in the last week, spiking to $31 at the time of writing after a 28% 24-hour increase. Crypto analyst Olof Hakansson (@olof_hakanss) explains how the launch of INJ 2.0 is causing this epic price run.

Injective is a blockchain platform designed for finance, offering an open and interoperable layer-one blockchain for next-gen DeFi applications. It aims to provide advanced decentralized capabilities for crypto markets.

INJ 2.0 Launch Driving Major Burns

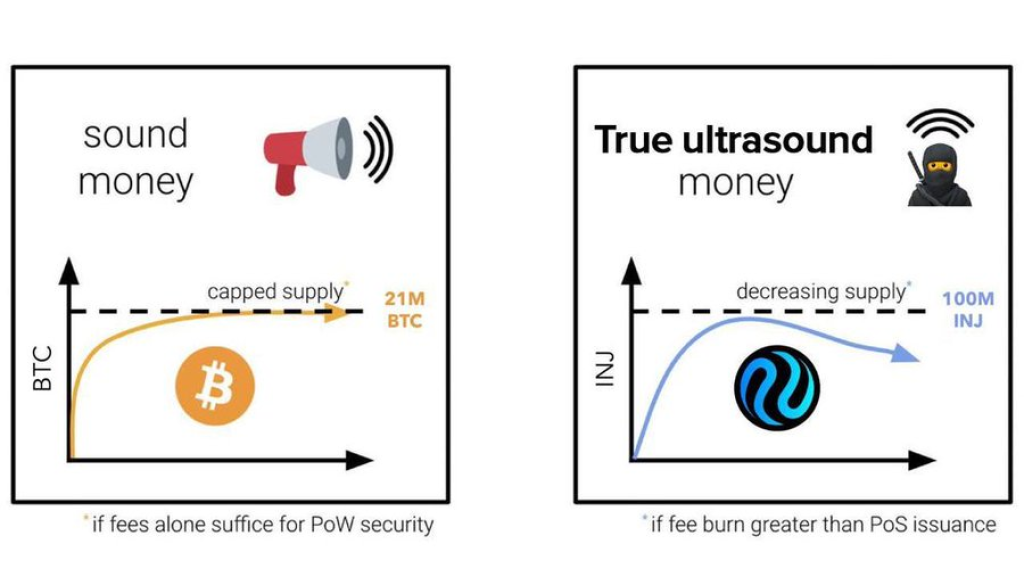

The main driver behind INJ’s recent price explosion is the launch of INJ 2.0, which Hakansson notes represents “the largest tokenomics update for $INJ.” A key part of the 2.0 updates are mechanisms to significantly increase token burning.

One major change is opening up burn auctions to any dApp built on Injective, rather than just the exchange. Hakansson highlights that “All dApps have more flexibility in choosing the amount they would like to contribute to the auction.” This allows up to 100% of fees collected to be contributed.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Supply Shock Causing Massive Spike

This radical increase in weekly token burns is making INJ’s supply lower. As Hakansson notes, “There is an increase in the number of tokens burned, and consequently a decrease in the supply of tokens.” This supply squeeze alongside surging demand is rocketing prices higher.

Moreover, this represents a completely new dynamic compared to other DeFi tokens which generally have an increasing supply over time. INJ 2.0 introduces a decreasing supply schedule, which combined with the various burn mechanisms, suggests much further upside if increased burn rates are maintained.

The launch of INJ 2.0 has shocked the crypto markets and could permanently turn INJ into a deflationary asset. If burn mechanisms work as intended, prices could spike exponentially higher from here.

You may also be interested in:

- How to Get Free Crypto During Christmas?

- Bitcoin Has Two Major Possibilities If BTC Holds $39,000, Analyst Cautions

- These Are The Only Two Crypto Tokens You’ll Need Heading Into 2024

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.