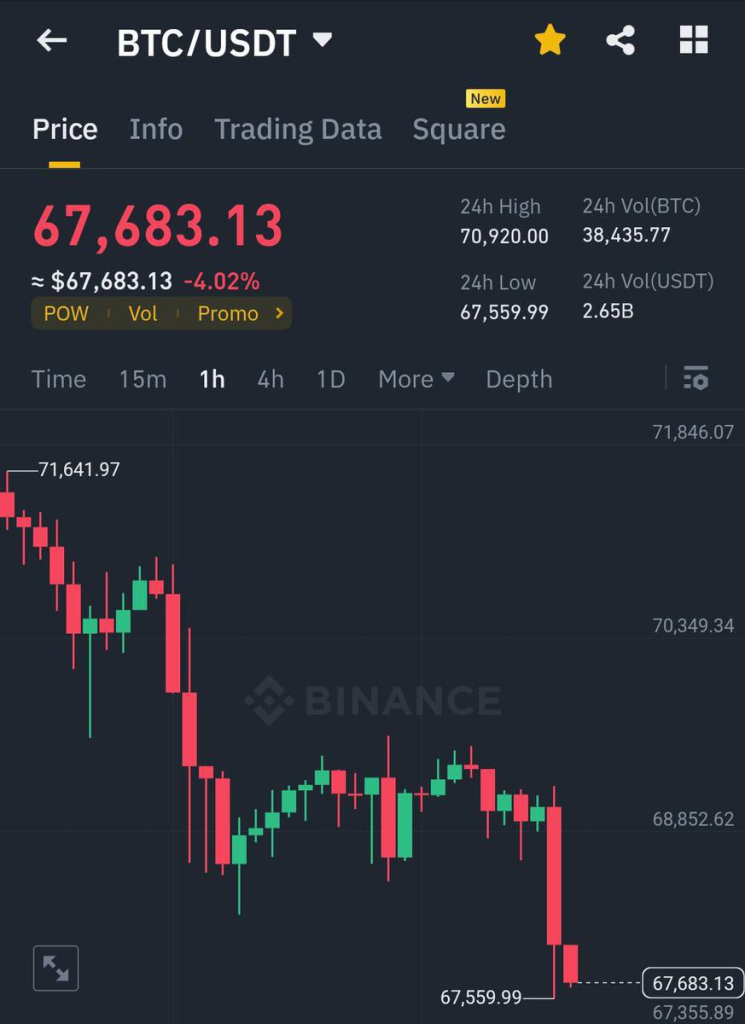

The price of Bitcoin, although has seen quite a bullish move this year, continues to dump, failing to reach its new all-time high of $73,000 again despite a number of attempts. Although many experts expect a bullish move to above $100,000, its actualization is now looking longer than anticipated. The price is now trading above $70,000 again at the time of writing, but what was behind the recent dumps? According to analyst Ash Crypto, recently released U.S. inflation data seems to be the primary culprit.

The Consumer Price Index (CPI), which measures the cost of a basket of consumer goods and services, came in hotter than expected at 3.5% versus an anticipated 3.4%. A higher CPI reading suggests persistent inflationary pressures, potentially forcing the Federal Reserve to maintain its aggressive monetary tightening path.

“A higher than expected CPI means the Fed can continue its hawkish stance,” explained Ash Crypto in a viral Twitter thread. “The market was expecting a rate cut in June, but after today’s CPI data, the probability of it happening has gone down.”

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Prior to the inflation report, markets had priced in expectations for a 75 basis point rate cut from the Fed as soon as June. However, the elevated CPI print has traders ratcheting back those dovish forecasts.

“Now, the Fed swaps is pricing in 50 basis point rate cuts rather than 75 basis points, and that too will happen after June,” added the popular analyst.

Higher interest rates make holding non-yielding assets like bitcoin less attractive, while also potentially curbing speculative investing activity. The Fed’s continued hawkish stance creates a challenging environment for risk assets like crypto.

Of course, bitcoin has overcome headwinds in the past and many investors remain bullish long-term. But this latest inflation scare appears to be weighing on prices for now as the market recalibrates its Fed expectations. The road ahead for the leading digital asset remains rocky.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.