Leading crypto analyst Rekt Capital recently outlined why Bitcoin could still see significant downside despite breaking its macro downtrend and entering a new bull market.

In a Twitter thread, Rekt Capital noted that at comparable points in previous cycles, Bitcoin has retraced 25-38% before continuing its bull run.

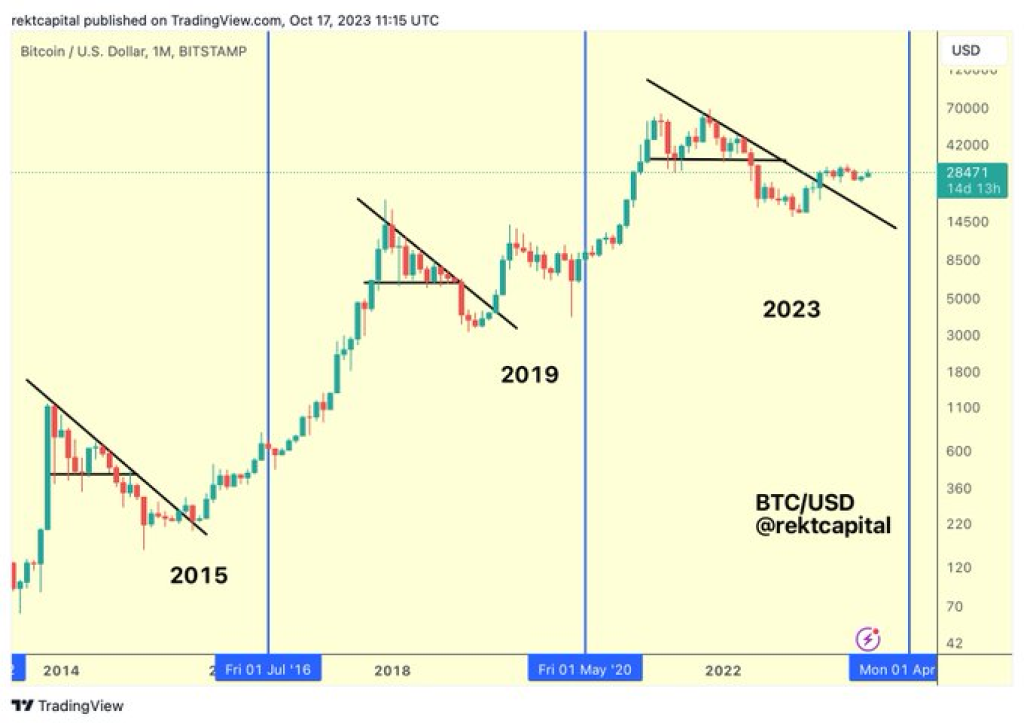

Looking at market stages less than 190 days before Bitcoin’s halving events, there was a 25% pullback in 2015/2016 and a 38% correction in 2019. Rekt Capital suggests 2023 more closely mirrors 2015 so far.

Even if this cycle rhymes with 2015, that would still imply a roughly 30% drop is possible from current levels over the next 4-6 months according to historical precedents.

While Bitcoin has shown strength breaking its downtrend, Rekt Capital cautions that substantial volatility is very common at this phase. The analyst’s message underscores smart risk management.

Past performance does not guarantee future results. However, analyzing market cycles often provides helpful context on probable scenarios for Bitcoin’s path ahead.

According to Rekt Capital, Bitcoin remains in a confirmed bull market. The question is whether an expected retracement arrives sooner or later. Maintaining a long-term perspective is key amidst interim fluctuations.

For now, the analyst’s takeaway is that investors should not rule out the likelihood of a 30% or greater pullback even amid an extended recovery. Bitcoin has seen similar drawdowns near halving events before continuing its ascent.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.