A prominent crypto analyst who goes by “Deezy.eth” on X has made a comprehensive bullish case for Chainlink (LINK), arguing it represents one of the best opportunities in crypto and the general digital asset space. According to the analyst, Chainlink’s pivotal role in the emerging real-world asset (RWA) narrative and its deep integration with major players make it a standout amid the current crypto landscape.

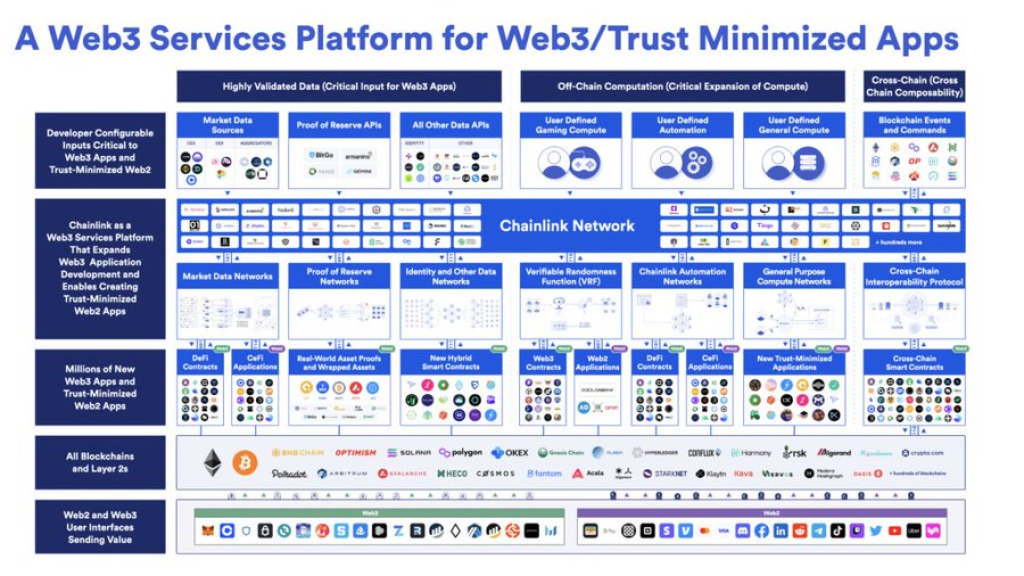

Deezy highlights Chainlink’s strong positioning as a bridge between traditional financial systems and blockchain technology as a key catalyst. As an oracle network, Chainlink aims to connect banks to the blockchain world, introducing core crypto tenets like transparency, security, and efficiency to legacy systems.

A major focus for the Chainlink team is facilitating the tokenization of real-world assets like real estate, commodities, and securities. This RWA market is projected to swell to a staggering $10 trillion by 2030 according to expert forecasts. As Chainlink’s Head of Communications Chris Barrett stated, the team anticipates “a swift transition” over the next five years “where virtually all value will adopt this tokenized format.”

Crucially, Deezy argues Chainlink has the robust technology to back up its ambitious RWA objectives. The project’s developer activity has been soaring, staying ahead of major layer 1 and layer 2 blockchain upgrades. Chainlink is also renowned for its highly accurate oracle services, utilized by top decentralized finance (DeFi) projects that pay for its offerings – a key revenue stream.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +But Chainlink’s advantages don’t stop at the tech level, according to the analyst. The project has cultivated an unparalleled business development ecosystem spanning big tech, crypto, and legacy finance. Partners include Amazon Web Services, Google Cloud, Vodafone, SWIFT (the world’s largest banking communications system), BlackRock (the biggest asset manager), Visa, and JPMorgan Chase.

With this powerful combination of cutting-edge tech integral to the RWA boom and unmatched institutional integration, Deezy contends Chainlink is primed to be “the #1 player” in the tokenized asset space. As he concludes, “Now ask yourself: ‘Is the train about to leave the station?’ You know the answer…”

For crypto investors looking to capitalize on the convergence of blockchain and traditional finance through RWAs, Chainlink certainly emerges as one of the most compelling opportunities based on Deezy’s analysis. With a plethora of high-profile partnerships already secured, the oracle network appears positioned for exponential growth in the coming years.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.