Cryptocurrency investor Ash Crypto (@Ashcryptoreal on Twitter) recently posted an analysis on Twitter explaining why Bitcoin holders should hold onto their BTC despite the recent price drop. He argues that the dump has been driven primarily by outflows from the Grayscale Bitcoin Trust (GBTC) and that money will likely rotate into new Bitcoin spot ETFs soon.

Outflows from GBTC Behind the Dump

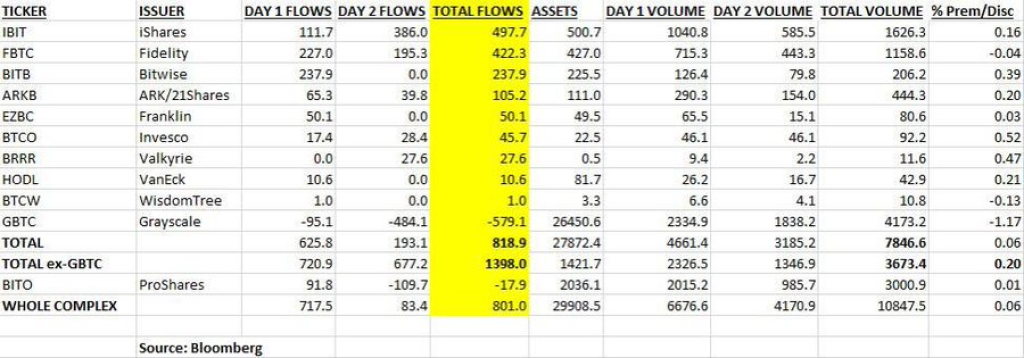

As Ash Crypto explains, Bitcoin spot ETFs overall have seen significant inflows totaling $1.4 billion over the past two days. However, Grayscale’s GBTC alone accounts for $579 million of outflows over the same period. This represents over 70% of total outflows from Bitcoin funds.

With GBTC historically being one of the main Bitcoin investment vehicles for institutional investors, these outflows have contributed significantly to the downward price pressure on Bitcoin. Now that new spot ETFs have been launched, assets are rotating out of GBTC and into these new products. But this selling of GBTC’s Bitcoin is temporarily weighing on prices.

Rotation into Spot ETFs Coming

While GBTC has faced heavy outflows, Ash Crypto expects this selling pressure to subside over the next 1-2 weeks. Furthermore, he anticipates the majority of money leaving GBTC will ultimately rotate into other Bitcoin spot ETFs instead of exiting the asset class altogether.

“In the next 1-2 weeks, most of the outflows from Grayscale will stop and the same money will enter into other spot ETFs,” he tweeted.

With $1.4 billion flowing into spot ETF products overall compared to $579 million leaving just GBTC, there is clearly still net demand for Bitcoin exposure through these investment vehicles. Once GBTC outflows stabilize, this pent up spot ETF demand should drive the next leg higher for Bitcoin prices.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Key Takeaways for Bitcoin Holders

Given these dynamics, Ash Crypto urges Bitcoin holders to hold onto their BTC and not panic sell during this temporary dip driven by GBTC outflows. Within a few weeks, tailwinds from spot ETF inflows should outweigh any lingering negative pressure from GBTC.

For long-term focused Bitcoin investors, short-term price volatility is expected. But understanding the underlying catalysts driving these moves can help determine whether they represent buying opportunities or warning signs. In this case, Ash Crypto makes the case that fundamentals remain strong and the headwinds rocking the price should reverse course soon.

So rather than selling into temporary fear, Bitcoin holders would be wise to hold onto their core positions, or even strategically buy the dip. If demand rotates into spot ETFs as expected, Bitcoin prices should regain their upward trajectory shortly. Patience and keeping emotions in check can pay off for investors with a longer time horizon.

You may also be interested in:

- A Sleeping Crypto Giant? Why One Ripple Analyst Sees XRP Surging to $333

- Fibonacci Reveals Shiba Inu’s SHIB Next Key Levels, But This Support Must Hold First

- Bonk 90-Day Growth Hits 6390% As Shiba Inu Successor Gains Steam

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.