The price of bitcoin (BTC) has been struggling since January 11 after the approval of a spot BTC exchange-traded fund (ETF) in the US. BTC has declined more than 18% from $49,000 to $39,900 at the time of writing. However, experts insist the price action remains decidedly bullish overall.

Large Inflows Support Bull Case

Ash Crypto, a popular crypto analyst on X highlighted large inflows into major bitcoin funds to support the bullish perspective.

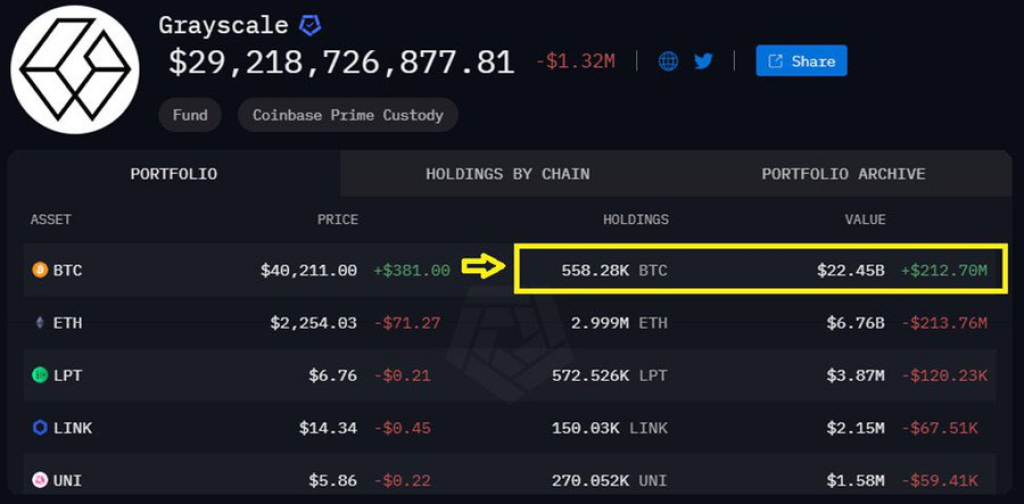

Since the approval of the spot BTC ETF, Grayscale has deposited a total of 79,213 BTC, equivalent to $3.27 billion, into Coinbase Prime. As of now, Grayscale’s holdings total 558.28k BTC, valued at $22.45 billion.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Most Selling Pressure Exhausted

Furthermore, most of the recent selling pressure appears to have come from FTX, which finished selling about 2.5 million shares every day for 8 days. Even with the Grayscale Bitcoin Trust (GBTC) sell-off, there’s a net inflow of $1.1 billion, equal to 28,000 Bitcoins at current prices.

Other major bitcoin funds also continue to grow quickly. For example, the Fidelity Bitcoin Fund (FBTC) is expanding faster than the bitcoin fund from BlackRock.

So while the recent dip may have shaken out some weak hands, the data supports the bull case for bitcoin in 2024. Major institutional inflows continue unabated, suggesting the long-term adoption trend remains healthy.

You may also be interested in:

- Can Ripple’s XRP Reach $1,000?

- Why is AltLayer (ALT) Price Pumping?

- Rebel Satoshi’s Rising Popularity Challenges Top Meme Coins Dogecoin and Shiba Inu

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.