The prices of Ethereum Name Service (ENS) and Ethena (ENA) have surged, largely driven by the rise in the price of Ethereum (ETH). The primary catalyst for this market movement is the U.S. Securities and Exchange Commission’s (SEC) decision to stop its investigation into Ethereum 2.0, which has boosted overall market sentiment and confidence in the Ethereum ecosystem.

What you'll learn 👉

Ethereum Name Service (ENS) Gains Momentum

Ethereum Name Service, a distributed, open, and extensible naming system based on the Ethereum blockchain, has seen its native token, ENS, surge by 17.23% in the past 24 hours. Currently trading at $26.44, ENS has recorded a 24-hour low of $21.54 and a high of $27.08.

Several analysts have expressed bullish sentiments towards ENS, with Degen Lordy noting that the token has quietly entered the top 100 cryptocurrencies by market capitalization while the broader market experienced a downturn. The analyst believes that if Ethereum performs as expected during the bull market, ENS could easily become a top 25 token.

Astekz, another analyst, has identified ENS as a potential performer heading into 2025 and is looking to accumulate the token, even if it means buying at higher prices than initially desired.

Ethena (ENA) Showcases Strong Performance

Ethena, a decentralized finance (DeFi) platform, has also witnessed a price increase, with its native token, ENA, rising by 6.64% in the past 24 hours. ENA is currently trading at $0.6514, with a 24-hour low of $0.5801 and a high of $0.6841.

Smartestmoney, an analyst, has purchased ENS at $22 as part of their strategy to accumulate more Ethereum beta. The analyst believes that ENS is clearly outperforming alongside other earlier purchases like LDO and considers this a rare occasion where Ethereum beta makes sense in an attempt to front-run traditional finance investments in the Ethereum ecosystem.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Furthermore, ENS has recently proposed its own Layer 2 network as part of the ENSv2 upgrade, which the analyst believes could propel the token straight to $40 if it manages to conquer the $29 level.

Crypto Rand, another analyst, has noted that ENS is bouncing over its main support level and appears to be in good shape so far.

Ethena Introduces New Tokenomics and Utility for ENA

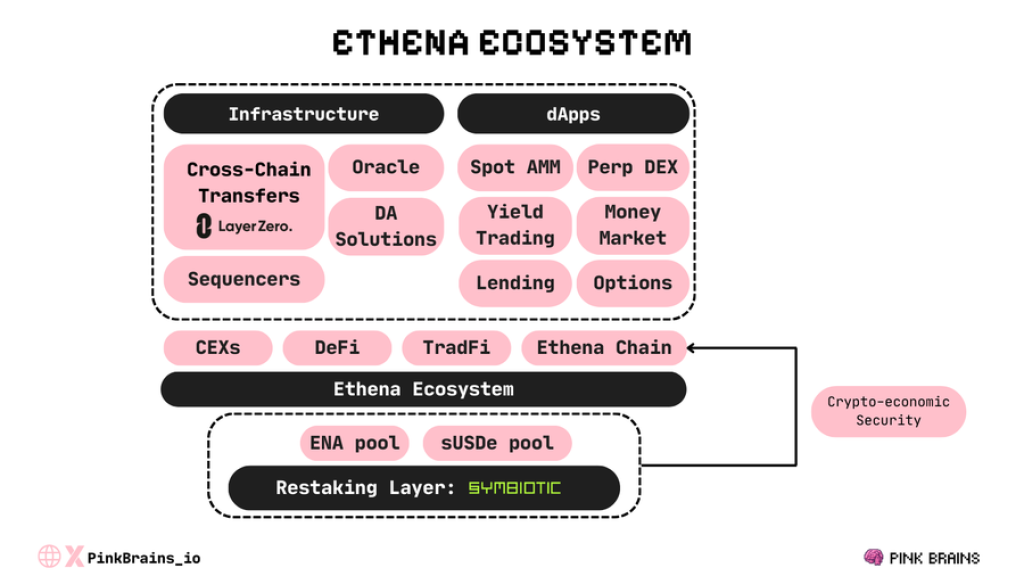

Pink Brains, a crypto analyst, has highlighted Ethena’s recent moves to add more utilities to its ecosystem, including new staking options using restaked ENA and sUSDe for crypto-economic security on the Ethena Chain.

The analyst outlines several key points regarding ENA’s new tokenomics:

- Boosting USDe’s utility through partnerships with various protocols, making it one of the fastest-growing ‘money’ with $3.53B in circulation in just 6 months.

- Current uses for ENA, including being locked in Ethena’s Vaults for Sats boosting and in Pendle’s PT-ENA pools.

- Generalized restaking, which introduces new utility for ENA by providing economic security for LayerZero’s DVN network and supporting LayerZero ecosystem partners.

- Restaking on the Ethena Chain, where USDe will be used as the gas token and ENA will provide security, with various applications and infrastructure solutions planned for the chain.

- Farming opportunities for ENA holders through staking in Symbiotic, earning Sats points, Symbiotic points, Mellow points, and potential future LayerZero RFP allocations.

- Updates on ENA locks and vesting, requiring users receiving the S1 airdrop to lock at least 50% of their vesting ENA in Ethena’s Vault, Pendle PT, or Symbiotic Restaking to avoid redistribution of unvested tokens.

With the SEC’s investigation into Ethereum 2.0 now halted and the overall market sentiment improving, these tokens may experience further growth and development in the coming months.

Read more: Top Crypto Unlocks This Week: SPACE ID (ID) and Merlin Chain (MERL) Joins the Top 7

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.