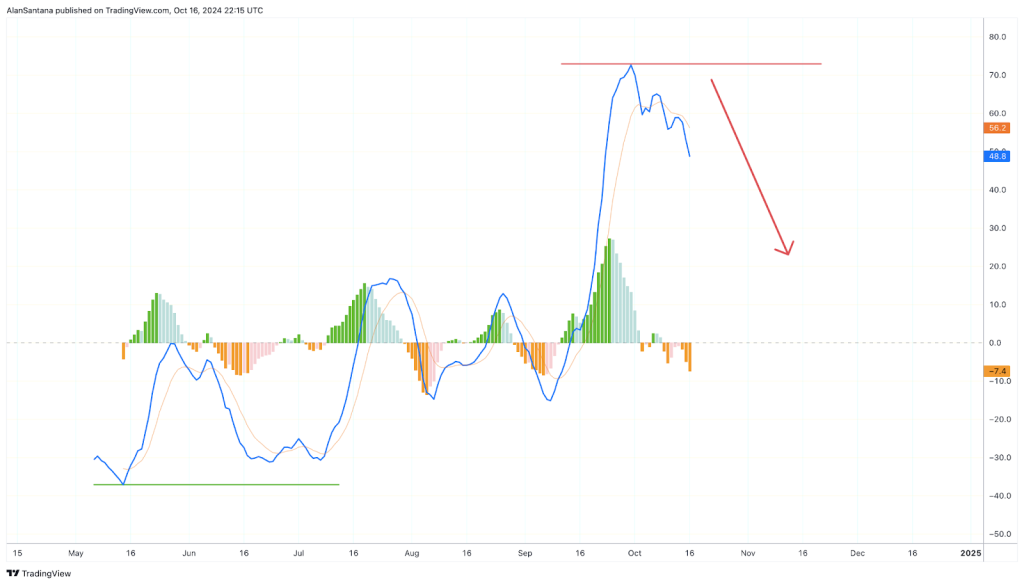

Recent technical analysis suggests Bittensor’s TAO token may face a bearish correction after its rally lately. Trader and analyst Alan Santana shared charts on TradingView indicating potential downward pressure on TAO/USDT.

The analysis points to several bearish signals, including a rising wedge pattern and weakening momentum indicators.

What you'll learn 👉

TAO Indicators Signal Potential Reversal

Alan Santana’s analysis of the TAO chart reveals a rising wedge pattern, often considered a bearish reversal signal. The token reached a high on October 7th but has since shown signs of weakness. Several red candles and increasing bearish volume suggest selling pressure is mounting.

The price has closed below both the 8 and 13-period Exponential Moving Averages, indicating a possible shift towards bearish momentum. This breakdown below key support levels could signal further downside potential for TAO.

Santana also noted the RSI is trending downward, while the MACD appears weak. These indicators provide additional evidence of waning bullish momentum in the market.

Fibonacci Levels Offer Potential Support

The analyst identified key Fibonacci retracement levels that could serve as support zones for TAO. The 0.618 retracement level sits around $338.4, while the 0.786 level is near $262.1. These areas may provide temporary stability for the price if a correction unfolds.

Santana’s chart indicates a possible price target around the $338 area, corresponding to the 0.618 Fibonacci level. However, he suggests there’s potential for the TAO price to extend its decline to the 0.786 level near $262 if selling pressure persists.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Read also: Dogecoin (DOGE) and BONK Memecoin Prices Are Pumping: Here’s Why

MACD Analysis Confirms Bearish Outlook

A separate chart focusing on the MACD indicator reinforces the bearish sentiment. Originally peaking in late September, the MACD has since generated a bearish crossover. Usually indicating a trend reversal, this indication strengthens the case for more price reduction.

Declining MACD histograms further confirm the declining upward momentum. This technical arrangement gives the bearish view for TAO more weight in combination with the bearish crossover between the MACD line and the signal line.

While the analysis suggests a potential correction, it’s important to note that TAO has seen substantial growth since early August, with gains exceeding 300%. Given this rally, a short-term pullback wouldn’t be surprising and could be viewed as a healthy consolidation phase for the token.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.