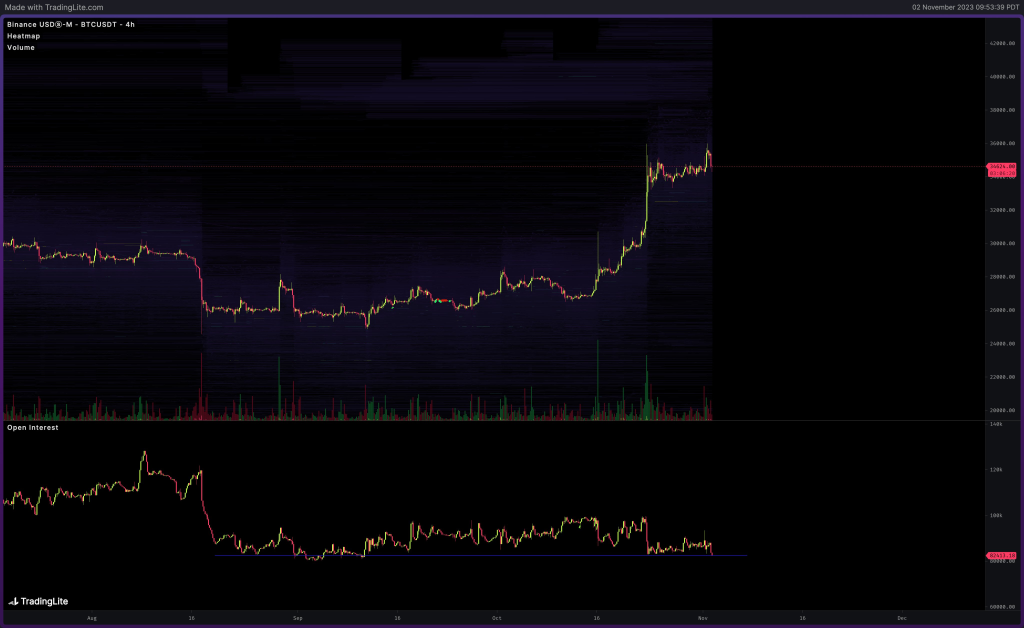

Bitcoin has seen significant price increases in 2023, jumping over 100% from lows around $16,000 in January to current levels around $34,000-$35,000. However, data on open interest in Bitcoin futures markets suggests limited downside may remain.

As noted by crypto analyst CrediBULL Crypto, open interest on Binance – the largest crypto derivatives exchange – is currently at similar levels to when Bitcoin was trading around $25,000 earlier this year. This suggests there is not much leverage left to flush out of the market compared to previous lows.

With Bitcoin having already increased over 100% from its lows in 2023, the open interest data indicates the market may be reaching a bottom in terms of how much more downside is left. Though Bitcoin could still see some volatility and test lower support levels, the leverage has largely been flushed out at this point.

The current open interest levels compared to the $25,000 price mark implies the market has less fragility now compared to previous lows. With less exaggerated leverage in the system, the potential for major cascading sell-offs and volatility spikes may be reduced as well.

In summary, while further downside is still possible, the open interest data signals Bitcoin is getting closer to finding a bottom according to key derivatives market metrics. The comparisons to open interest levels at lower prices suggests there is limited leverage left to unwind, meaning Bitcoin may not have much further to fall from its 100%+ increase this year.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.