Bitcoin (BTC) hit a new all-time high of $69,170.63, only to plunge sharply to a low of $59,323.91 within a matter of hours. While the market has since recovered, with BTC trading at around $65,800 at press time, analysts are still trying to unravel the cause of this sudden volatility.

What you'll learn 👉

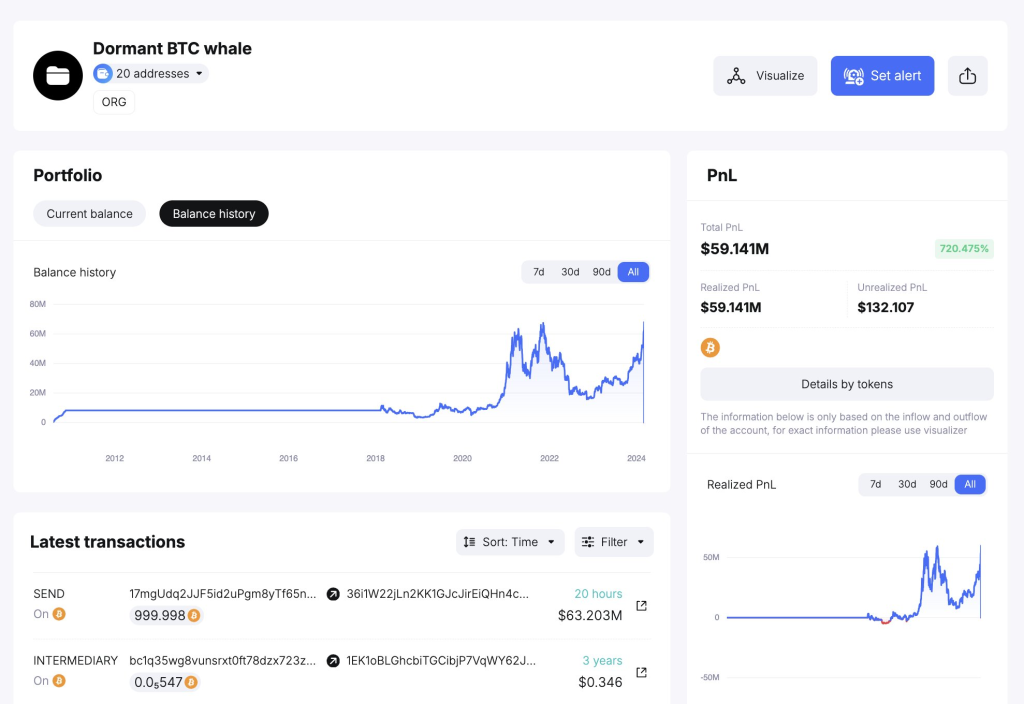

1,000 BTC Deposited to Coinbase by Dormant Whale

According to on-chain intelligence provider Spot On Chain, a dormant Bitcoin whale who had been inactive for 14 years suddenly woke up and deposited all 1,000 BTC (worth approximately $67.1 million) to Coinbase just 20 hours before the market crash.

This unexpected move has led many to speculate that the whale’s actions may have contributed to the sharp sell-off.

Spot On Chain’s analysis reveals that the whale minted these BTC back in 2010, when the price was below $0.28 per coin. By depositing the funds at a price of $67,116, the whale likely realized a staggering profit of over $60 million, highlighting the incredible growth of Bitcoin over the past decade.

Market Volatility Expected as Bitcoin Breaches Previous Cycle High

Despite the recent turbulence, trader Jelle reminds investors that Bitcoin rarely breaks through its previous cycle high in a single attempt. Instead, the process often involves significant volatility and requires patience from market participants.

“Bitcoin generally does not just break through the previous cycle high in one go. It takes time, and lots of volatility to fully break out. Be patient. The rewards will come soon enough,” Jelle tweeted, urging investors to maintain a long-term perspective and not be discouraged by short-term fluctuations.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Institutional Demand Fuels Bullish Sentiment

While the awakening of the dormant whale may have contributed to the recent market crash, many analysts remain bullish on Bitcoin’s prospects, citing growing institutional demand as a key driver of future price appreciation.

Crypto Rover, a prominent trader, predicts that Bitcoin will surge to $100,000 within weeks, driven by increasing interest from institutional investors. The trader points to recent purchases by BlackRock, the world’s largest asset manager, as evidence of this trend.

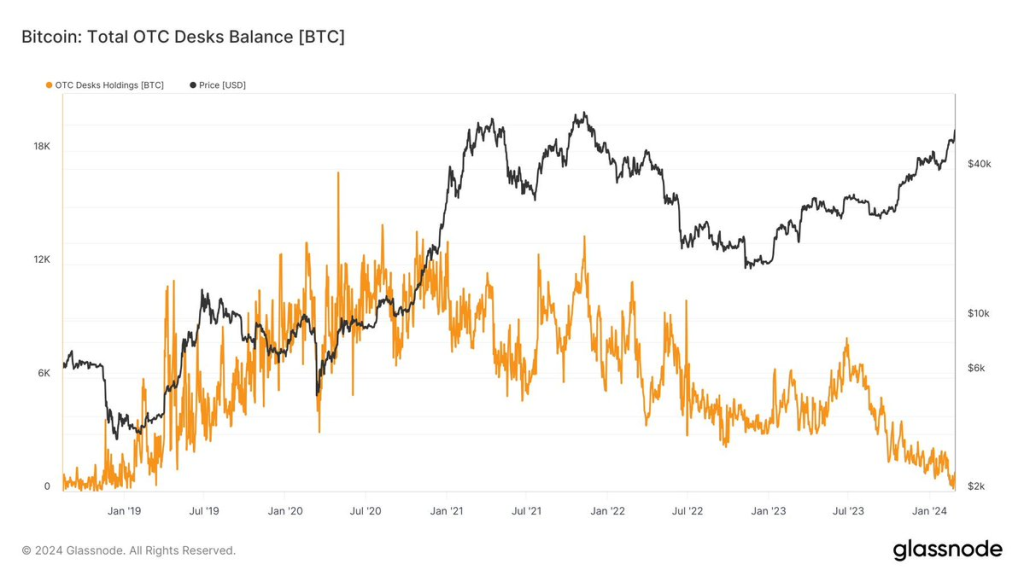

“Bitcoin will pump to $100k within weeks. And yet many still don’t to see why. BlackRock bought another $788,000,000 worth of BTC yesterday. With no available BTC on OTC desks they are buying from the open market. Institutional FOMO is starting,” Crypto Rover tweeted.

As more institutional investors allocate funds to Bitcoin, the supply of BTC available on over-the-counter (OTC) desks has reportedly dwindled, forcing these large players to purchase from the open market. This increased demand could potentially drive prices higher, as Crypto Rover suggests, leading to a new wave of institutional FOMO (fear of missing out).

The recent awakening of a dormant Bitcoin whale and the subsequent market volatility serve as a reminder of the unpredictable nature of the cryptocurrency market. However, despite short-term fluctuations, the overall sentiment remains bullish, with many analysts predicting significant price appreciation in the coming weeks and months.

You may also be interested in:

- Top 7 Token Unlocks to Watch This Week: Ethereum Name Service(ENS), Near Protocol (NEAR), and More

- Theta Network’s (THETA) Price Rallies: Expert Highlights Potential Retest Level, But There’s a Catch

- Advertising Potential Propels DeeStream (DST) Presale As 100X Rumours Circulate Post Binance Coin (BNB) & Cardano (ADA) Whales Buy-In

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.