Data analytics firm Lookonchain reports that some top ORDI holders have dumped significant amounts following tweets from Bitcoin developer Luke Dashjr about vulnerabilities. These panic sales come before the crypto’s disturbing price action. However, ORDI has gained 13% over the past 24 hours per CoinMarketCap.

What you'll learn 👉

Whales Accumulate Ahead of Major Sale

According to Lookonchain, whales were actively accumulating ORDI leading up to Dashjr’s tweets, likely anticipating further upside. Two major OKX exchange users purchased over $3 million worth in December alone as the price ran up to $55.

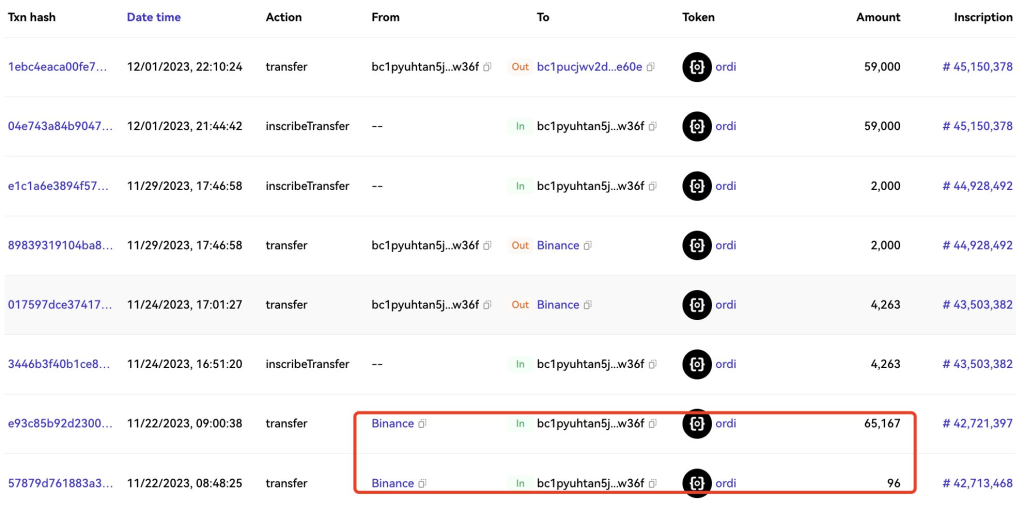

Other whales were buying up ORDI throughout 2023, with one receiving 184,637 ORDI worth $4.26 million from Binance between November 17-23 at around $23 per token. Another got nearly $2 million worth from Binance and Gate.io back in May for just $13.50 each.

10 Addresses Refuse to Sell Newly Minted Coins

Per Lookonchain’s analysis, 10 separate whale addresses hold a combined 1.2 million ORDI worth $68 million obtained via minting. Despite major volatility and Dashjr’s warnings, these whales notably have yet to sell any of their newly minted supply.

Panic Sets In Among Other Large Holders

However, as Lookonchain reports, some large holders did panic amid Dashjr’s tweets about Bitcoin upgrade vulnerabilities that could affect ORDI as well. One whale address in particular quickly dumped 59,000 ORDI worth $3.54 million.

By rapidly selling right before the drop, this holder pocketed around $2.3 million in profits. And that’s just one example – there were surely more panic sales among frightened whales worried about lost gains.

Read also:

- Bitcoin (BTC) Skyrocketed The Last Three Times This Bullish Signal Appeared

- Solana Loses Uptrend; Analyst Warns Failure to Hold Support Could Result in SOL Falling to This Price

So while a segment of ORDI whales weathered the storm and volatility, others given into fear uncertainty and doubt. Despite recent bullish momentum and 24 hour gains, worrying technical vulnerabilities discussed by Bitcoin developers plunged sections of the ORDI market into chaos. Some holders kept accumulating, but enough dumped in a panic to spark a correction right as optimism was building.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.