Spotonchain, an onchain analytics platform, reported two notable instances of whale activity. Amid the 8% correction in the Ethereum (ETH) price over the past 24 hours, several whales have been aggressively accumulating ETH. Per the latest price information from CoinMarketCap, ETH trades $3,085.26. This highlights a 5.30% value dip in the last day.

What you'll learn 👉

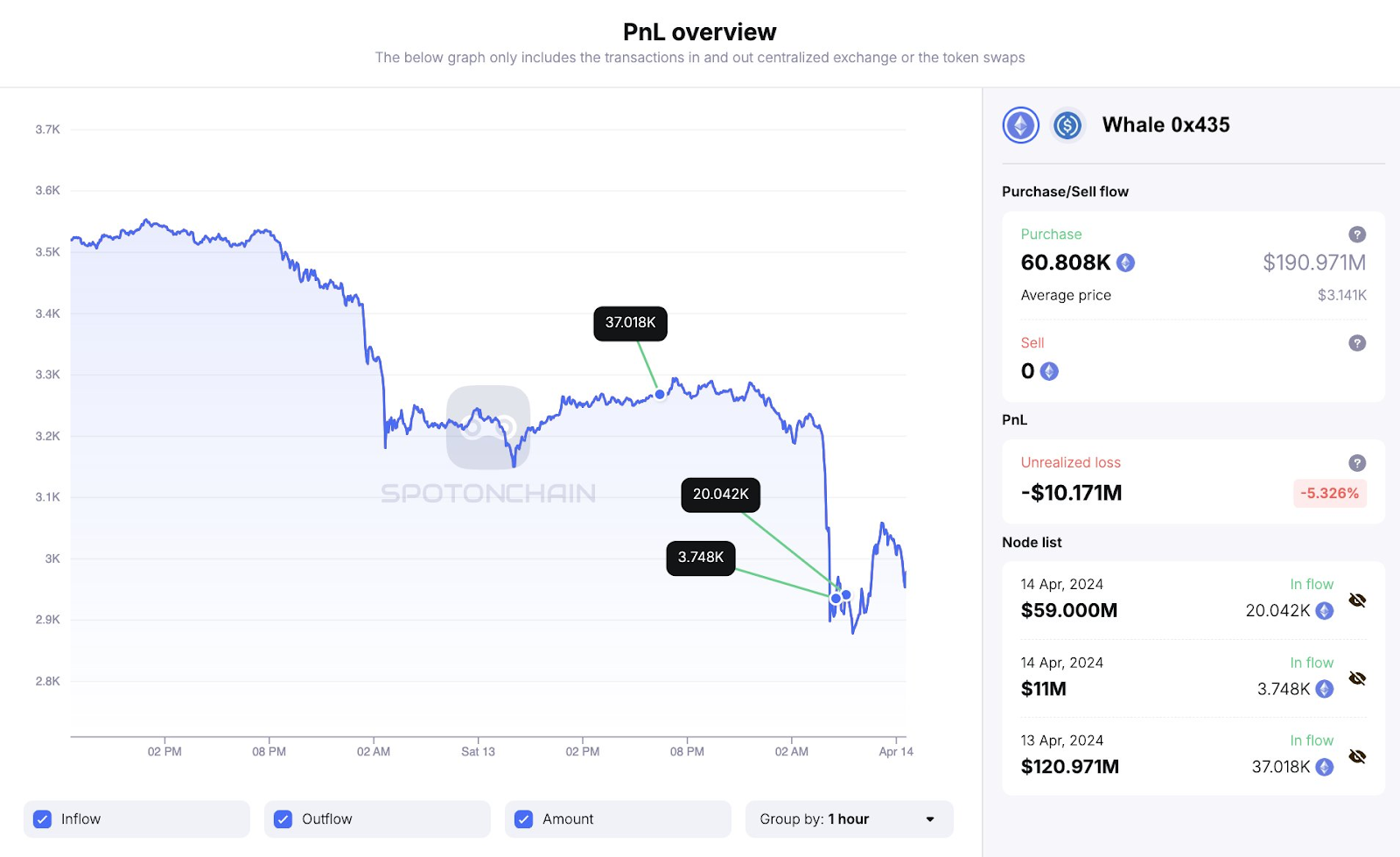

Whale 0x435 Scoops Up 23,790 ETH Worth $70 Million

The first instance involves a whale with the address 0x435, who spent $70 million in USDC to purchase 23,790 ETH at an average price of approximately $2,942. Significantly, this purchase indicates the whale’s conviction in Ethereum’s potential despite the price dip lately.

@spotonchain highlighted that this whale has been on an accumulation spree, amassing a total of 60,808 ETH (worth $191 million) from Binance and decentralized exchanges (DEXs) over the past 15 hours. This acquisition followed each sharp drop in ETH’s price, suggesting a strategic approach to capitalize on market volatility.

Currently, the whale holds an impressive 85,931 ETH (worth $278 million) and a substantial $136 million in stablecoins (USDT and USDC) on the Aave lending platform. This substantial holding underscores the whale’s bullish sentiment toward Ethereum and its potential for long-term growth.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

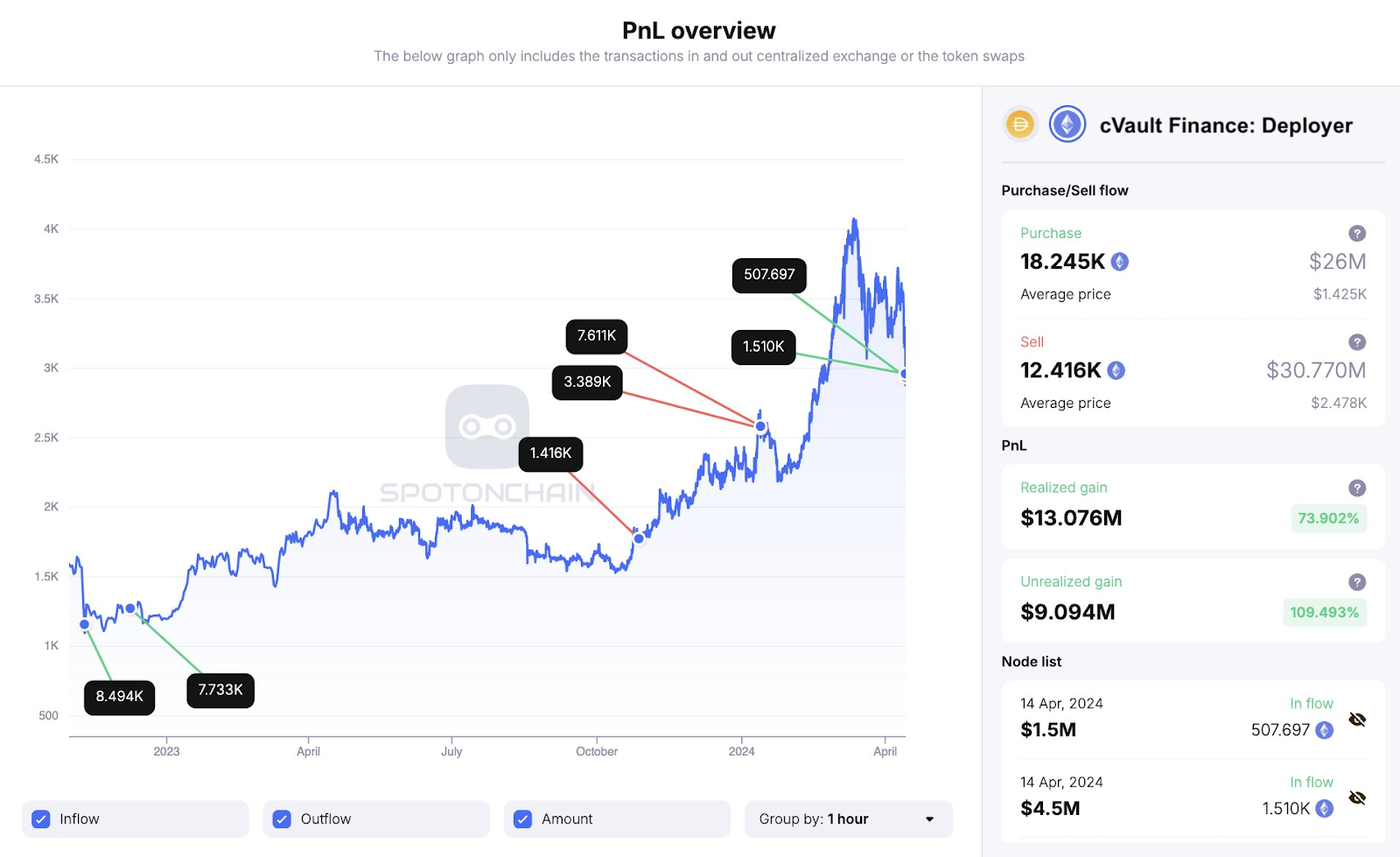

Show more +cVault Finance Deployer Acquires 2,018 ETH Worth $6 Million

The second instance of whale activity involved the deployer of cVault Finance, a decentralized finance (DeFi) protocol. This deployer spent $6 million in DAI to purchase 2,018 ETH at an average price of approximately $2,973.

Notably, @spotonchain revealed that this same deployer had previously dumped 12,070 ETH (worth $31.06 million) on the chain in January, realizing a substantial profit of $17.03 million – a 101% gain.

Whales Capitalize on Market Volatility

The accumulation of ETH by these whales during a period of price correction highlights their confidence in Ethereum’s long-term prospects. By purchasing ETH at lower prices, these whales are positioning themselves to potentially benefit from any future price appreciation.

Moreover, the substantial holdings of stablecoins by the whale 0x435 on Aave suggest a preparedness to deploy these funds for further ETH accumulation or other investment opportunities within the Ethereum ecosystem.

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.