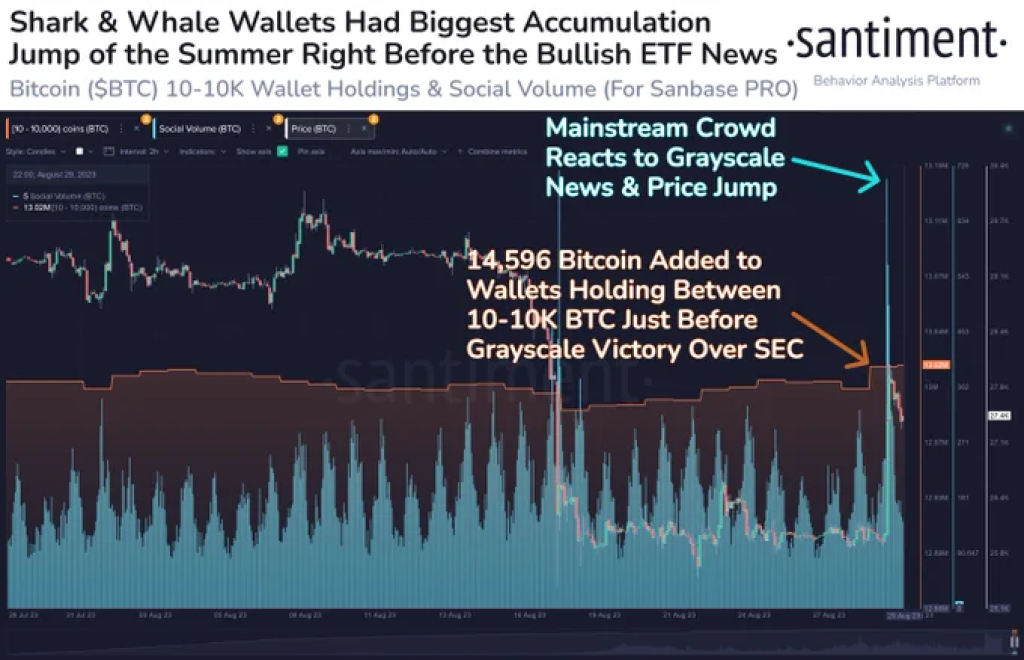

Just 24 hours before the high-profile lawsuit between Grayscale Investments and the U.S. Securities and Exchange Commission (SEC) reached a resolution, something curious happened in the crypto markets.

Wallets holding between 10 to 10,000 Bitcoin ($BTC) suddenly swelled, accumulating a staggering $388.3 million in BTC according to Santiment data. This spate of activity could not have been more timely—Bitcoin’s price jumped 6% following the lawsuit’s conclusion, yielding a handsome reward for those who bought in ahead of the news.

Source: Santiment – Start using it today

In the crypto ecosystem, entities holding substantial amounts of Bitcoin or any other cryptocurrency are colloquially known as “whales.” A subclass of whales, often referred to as “sharks,” holds moderately large amounts—neither as small as individual retail investors nor as large as institutional funds. These whales and sharks appeared to have foreknowledge or, at least, a high degree of foresight concerning the lawsuit’s outcome.

The Stakes: Grayscale and SEC Lawsuit

The lawsuit between Grayscale and the SEC was a landmark case, critical for setting precedents around cryptocurrency regulations. Grayscale Investments, one of the largest digital asset managers, was under scrutiny for its handling of its Bitcoin Trust, a product that allows investors to gain exposure to Bitcoin without directly holding it. This case had implications far beyond Grayscale; it was seen as a litmus test for how the SEC could approach the regulation of crypto assets.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Blockchain analytics show a discernible pattern of large transactions made by 10-10K BTC wallets in the day leading up to the lawsuit’s conclusion. Approximately $388.3 million worth of Bitcoin was moved into these wallets, far above the typical daily transaction volume for this cohort.

As the lawsuit concluded favorably for Grayscale, Bitcoin’s price experienced a surge, appreciating by 6% almost immediately. This quick price increase disproportionately benefited those who had loaded up on Bitcoin beforehand. While it’s difficult to ascertain whether these activities were guided by insider information, they certainly paid off handsomely.

Was this strategic accumulation a result of insider information or just savvy speculation? The timing is unquestionably suspicious but proves nothing definitively.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.