In the ever-volatile world of cryptocurrencies, a significant event has recently occurred that has caught the attention of many within the community. A so-called ‘whale’, a term used to describe an entity with a substantial amount of a particular cryptocurrency, has made a move after a long period of inactivity.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

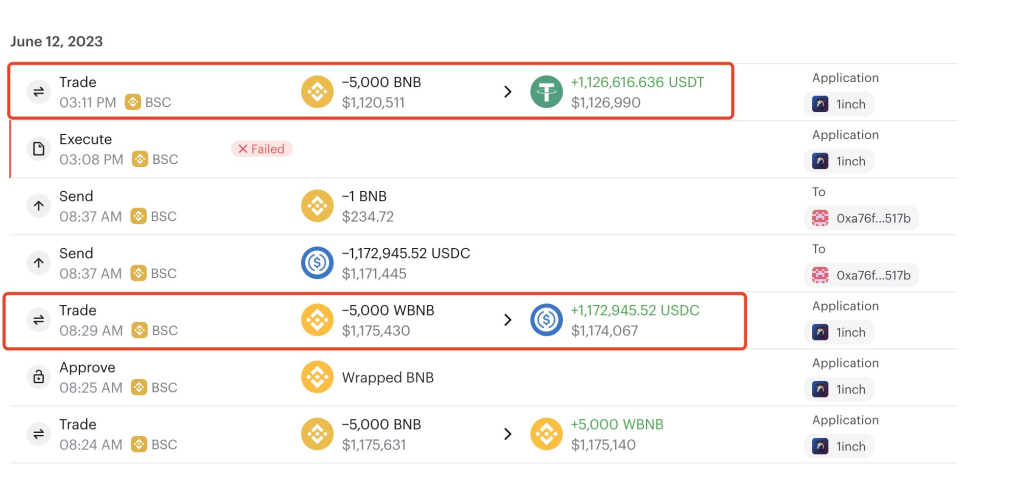

Show more +This whale, who had been dormant for a period of two years, sold a substantial amount of Binance Coin (BNB). The amount sold was 10,000 BNB, which at the time of the transaction was valued at approximately $2.3 million. This transaction was executed at a price of $230 per BNB.

Interestingly, this whale was not always a BNB holder. Previously, this entity had been a significant holder of SafeMoon, another cryptocurrency. The whale’s investment in SafeMoon was initially a mere 10 BNB, which at the time was worth around $2,400. However, this investment grew exponentially, and the whale was able to make 110,000 BNB, equivalent to $47.5 million at that time, from their SafeMoon holdings.

This event has led to a flurry of discussions and speculations within the cryptocurrency community. Some are intrigued by the whale’s decision to sell such a significant amount of BNB after a long period of dormancy. Others are fascinated by the whale’s previous success with SafeMoon and are curious about the strategies and decisions that led to such a profitable outcome.

The move by this cryptocurrency whale can have several implications for BNB coin and its holders.

- Market Impact: The sale of a large amount of BNB by a single entity can potentially impact the market price of the coin. If the supply of the coin in the market suddenly increases due to a large sale, it can put downward pressure on the price, at least in the short term.

- Investor Sentiment: The actions of whales are often closely watched by other investors. If a whale decides to sell a significant portion of their holdings, it could be interpreted as a lack of confidence in the future performance of the coin, which could influence other investors’ sentiment and decisions.

- Liquidity: On the positive side, such a large transaction can increase the liquidity of BNB in the market. Higher liquidity generally leads to more efficient markets with tighter spreads, which can be beneficial for traders.

- Speculation and Volatility: The whale’s move can also lead to increased speculation and potentially higher volatility in the BNB market. Traders and investors may try to interpret the whale’s actions and adjust their strategies accordingly, leading to increased trading activity and price swings.

This incident serves as a reminder of the unpredictable and dynamic nature of the cryptocurrency market. It also underscores the potential for significant gains (and losses) that can be realized in this space. As always, those involved in the cryptocurrency market are advised to proceed with caution and make informed decisions.