Another week of the gloomy bear market is upon us. This one had a twist that stirred up emotions a bit – Tether solvency bubbled up out of the deep sea of FUD and we had one day that trapped hopes of a significant number of traders that reversal is in sight.

Once that drama episode settled down, the market shrank again and even though BTC touched the $7k mark at one moment, it all collapsed back to the engraved price patterns.

Bitcoin did end this work-week in a green – comparing to the last week, the price jumped up +3.08% according to the data from OnChainFX.

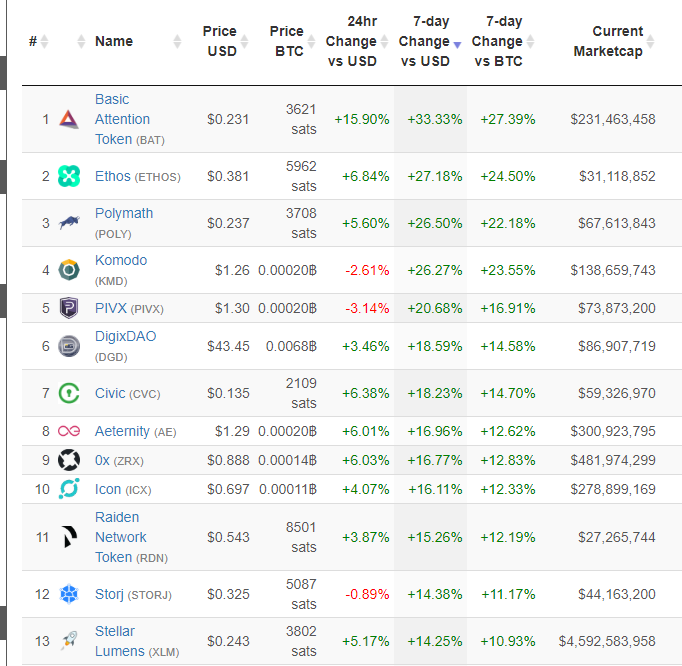

Out of the top 50 cryptocurrencies by market capitalization, BAT recorded the biggest jump in price – 33.33% in BTC followed by ETHOS – 27.18%, Polymath – 26.15%. Out of the top 10 cryptocurrencies, Stellar recorded the biggest price increase (measured in BTC) – 14.25% and 10.28% in USD.

On the other side of the spectrum was Dogecoin, a joke coin that seems to be having a brighter future than most of the market. Dogecoin slumped down by 14.24% in BTC or 16.92% in USD.

Volume is down

The troubling fact of the current market state is the trading volume. Bitcoin’s volume keeps sinking which is a sign of a lack of demand.

Trading volume of the bellwether cryptocoin was on a downward trajectory in the last 24hrs, falling from $5 billion to only $3.8 billion according to the data from CoinMarketCap. It looks even wearier if we look at the same metric on ShapeShift’s CoinCap.io where the volume dropped below $3 billion, to a paltry $2.54 billion.

For traders, volume hints at sustainability of a given asset. A drastic price increase with low volume might be fool’s gold. A drop with considerable volume behind it might mean a coin is in for an extended bear run. There are no certainties in cryptocurrency. But effectively assessing volume is an important tool in an investor’s belt.