Kaspa price has seen some dramatic moves in May. The price started the month at around $0.089 but as of May 31, it is trading below this level, currently at $0.083 at the time of writing.

The price was initially bullish and even broke above a major resistance level near $0.01. By May 12, KAS was trading around $0.013. However, it couldn’t hold the momentum. Since then, it has fallen steadily, dipping around 36% from that local high.

June is here and the big question now is where the Kaspa price could go next. But before looking forward, let’s review what happened in May.

What you'll learn 👉

What Drove Kaspa Price in May?

Kaspa had a busy month on the technical and ecosystem side. One of the most important events was the Crescendo hard fork that went live on May 5. This upgrade boosted the network speed from 1 block per second to 10 blocks per second, while keeping the emission rate stable by reducing block rewards from 55 to 5.5 KAS. It also brought updated consensus parameters for better security and smoother operation.

Several technical upgrades were also rolled out:

- KIP-9 helped regulate UTXO storage

- KIP-13 reduced memory usage

- KIP-10 added better scripting for advanced transactions

- The network also fully switched to a new Rust-based client

The infrastructure around Kaspa improved too. Smart contracts and Layer-2 deployment pushed the theoretical TPS to over 100,000. There was also the release of a mobile wallet, Ledger integration, better archive nodes, and support for custom data payloads.

Kaspa’s ecosystem kept growing as well. The DeFi sector saw its total value locked (TVL) surpass $1B. Active wallets rose from 500,000 in December 2024 to 1.8 million by May. This activity led to higher on-chain volume and greater trading activity.

What Could Influence Kaspa Price in June?

Looking at June, several factors could play a role in shaping the KAS price. On the protocol level, developers are expected to continue enhancing the network with more updates and bug fixes following the Crescendo upgrade.

There are also hints of DeFi and NFT platform launches, more partnerships, and possibly new exchange listings. The broader market conditions will also matter, especially if Bitcoin or other large caps see major moves. Regulatory news, global economic trends, and even social media buzz could tilt sentiment for or against Kaspa.

Within the community, decisions around governance, treasury usage, and project priorities could all affect market confidence.

What the Indicators Say About KAS Price

Several indicators point to caution at the end of May. Here’s a breakdown of how they apply to Kaspa:

| Name | Value | Explanation |

|---|---|---|

| RSI(14) | 34.957 | RSI is nearing the oversold region, showing selling pressure is still dominant. This usually signals weakness. |

| STOCH(9,6) | 31.077 | This is still in bearish territory and suggests momentum is not shifting yet. |

| MACD(12,26) | -0.003 | MACD is below the signal line, pointing to a bearish trend continuing. |

| ADX(14) | 33.863 | The trend strength is high. Since the price is going down, this shows strong downward momentum. |

| Williams %R | -75.47 | This confirms that the asset is in the oversold range, which may indicate short-term pressure. |

| CCI(14) | -40.6369 | CCI is in neutral territory, showing no strong trend but still leaning bearish. |

| ATR(14) | 0.0023 | ATR shows high volatility. That means we can expect big price swings. |

| Highs/Lows(14) | -0.001 | This means the price is below recent highs and continues to show weakness. |

| Ultimate Oscillator | 46.009 | This is below 50, indicating no bullish momentum has taken over yet. |

All in all, these indicators paint a picture of a weak trend with strong selling pressure still in play. There is also volatility in the market, which means Kaspa price could see sharp moves both ways.

What the Moving Averages Suggest

We also checked the moving averages to get a better sense of direction. These indicators compare average prices over time.

Right now, the short-term averages (5 and 10 days) are starting to lean slightly positive, but the longer-term averages (20, 50, 100, and 200 days) are still showing a bearish trend.

This means that while there might be short-term bounces or recoveries, the broader trend is still downward unless something changes in June.

AI Predictions for Kaspa Price in June

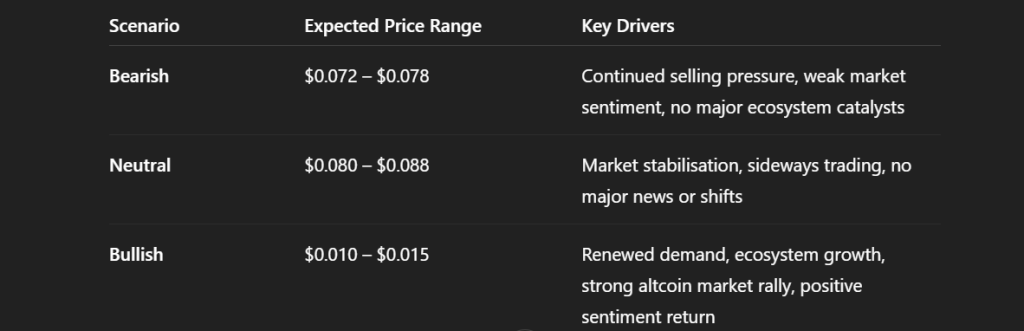

We asked ChatGPT to provide possible KAS price scenarios based on current market signals, technical data, and recent ecosystem changes. Here are the predictions:

Bearish Scenario

If market sentiment remains low and Kaspa doesn’t see any significant new inflows or hype, the price could fall further. A possible range for June in a bearish scenario would be between $0.072 and $0.078. This would follow the longer-term trend lines and reflect continued selling pressure from May.

Neutral Scenario

If things stabilize and no major catalysts occur, Kaspa might stay in a sideways range. In this scenario, the price could move between $0.080 and $0.088. This would reflect a period of consolidation after the steep drop from the May high.

Bullish Scenario

If Kaspa starts attracting attention again, especially from DeFi platforms or large traders, and if the broader altcoin market rallies, it could break above the key psychological level of $0.01. In that case, a spike toward $0.012 or even $0.015 is possible. That would bring Kaspa back to its previous local highs and reflect renewed bullish momentum.

Read Also: How Low Can Onyxcoin (XCN) Price Go If Bitcoin Dips to $85k?

Kaspa had a busy and impressive May on the development front, but the price action didn’t match the progress. Now in June, a lot will depend on how the market reacts to those ecosystem upgrades and whether traders regain interest. Technical indicators remain bearish for now, but there is potential for a turnaround if demand returns.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.