The price of JasmyCoin (JASMY) has gained about 20% from its May low and is still showing signs of life. After a period of consolidation, JASMY appears to be building momentum again. In May, the token traded between a low of $0.014 and a high of $0.021. That range has now tightened around the $0.017 area, and traders are paying close attention.

The chart shows that JasmyCoin has been respecting a trendline that’s served as strong support in recent weeks. Each time the price has approached this line, buyers have stepped in to defend it. This level remains a key zone as we head into June. If JASMY continues to stay above this line, the possibility of another rally becomes stronger.

Back in April, the price broke above a major resistance around $0.01. That level has since flipped into support. Right now, JasmyCoin is trading above that zone, around $0.017. This is an encouraging sign for bulls. However, if the broader market weakens, there’s still a risk that JASMY could fall back below the $0.01 mark, especially if volume fades or Bitcoin begins to drop.

What you'll learn 👉

JasmyCoin Project Momentum And Ecosystem Developments

The bullish sentiment around JasmyCoin isn’t just about the chart. In April 2025, the team unveiled a packed roadmap, which appears to have injected confidence into investors. The roadmap included plans for a decentralized exchange (DEX), mainnet improvements, staking features, and key partnerships.

What really boosted interest was Jasmy’s continued focus on Internet-of-Things (IoT) data management and its collaborations with established brands like Panasonic and VAIO. On top of that, the rollout of the JANCTION token economy, including incentives for developers and new validators, has helped strengthen the ecosystem.

Going into June, a few developments could significantly affect the JASMY price:

- The launch of the Jasmy App (alpha version) is on track and could drive user growth.

- Validator incentives, which reward node operators with JASMY tokens, are likely to boost staking activity and lower circulation.

- Integration of the SDK and PDL framework may attract more third-party applications.

- Any shifts in Japan’s crypto regulation could influence JasmyCoin, given its roots in the country.

- Progress on JANCTION partnerships will be closely watched by investors.

Also, like with most altcoins, the price of Bitcoin remains a key influence. If BTC goes through another leg up or down, it could drag JASMY with it.

What the Daily Indicators Are Saying

| Indicator (Full Name) | Value | Explanation |

|---|---|---|

| RSI (Relative Strength Index) | 49.866 | Neutral momentum |

| STOCH (Stochastic Oscillator) | 42.976 | Bearish tilt |

| MACD (Moving Average Convergence Divergence) | 0 | Bearish pressure building |

| ATR (Average True Range) | 0.0002 | Low volatility |

| Ultimate Oscillator | 55.112 | Slightly bullish momentum |

| Bull/Bear Power (13) | 0.0003 | Bullish signs emerging |

These indicators show mixed signals. The RSI is sitting in the middle, which means JASMY is neither overbought nor oversold. However, the Stochastic and MACD point to a possible bearish move if the current trend weakens. The low ATR tells us the price isn’t seeing wild swings right now, but that could change quickly with new triggers. The Ultimate Oscillator and Bull/Bear Power suggest there’s still underlying bullish energy trying to push the price higher.

Moving Averages Indicate Caution

Short-term moving averages are still giving some buy signals. Both the 20-day averages show JASMY above them, which often suggests short-term upside potential. However, all the major long-term averages, MA50, MA100, and MA200, are flashing sell signals.

The MA50 and MA100 are slightly above current price levels, and this could mean the price is facing some resistance in the medium term. The MA200 sits the highest at around $0.0179, and the current price below it shows that JASMY is still trading under its long-term trendline. Until the token climbs and holds above these levels, upside moves might struggle to sustain.

JasmyCoin Price Prediction For June 2025

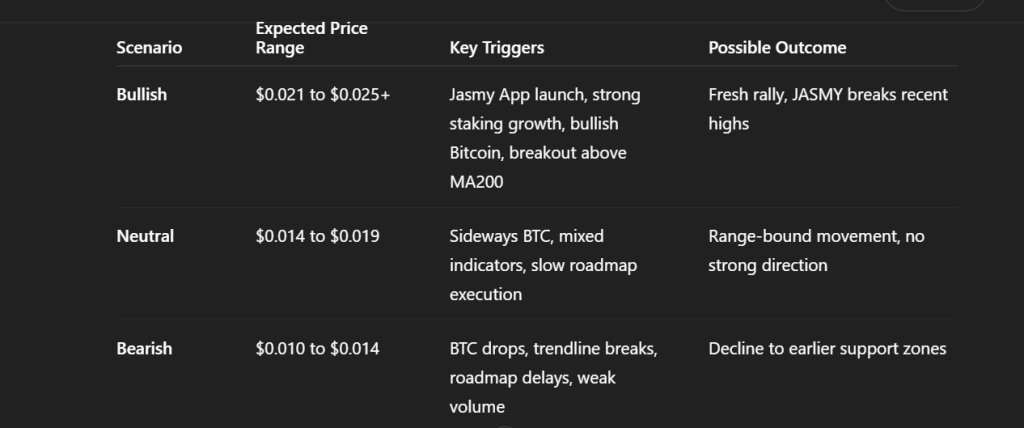

We asked ChatGPT for a JASMY price prediction for June, and it gave us the following scenarios.

Bullish Scenario

If the broader market improves and Jasmy’s ecosystem news triggers investor excitement, JASMY could retest its May high of $0.021 and even push toward the $0.025 zone. A successful launch of the Jasmy App and strong validator participation would support this move. A breakout above the 200-day moving average could accelerate gains.

Neutral Scenario

In this case, JasmyCoin remains stuck between $0.014 and $0.019 throughout the month. Mixed technical signals and uncertainty in Bitcoin price could cause sideways movement. Traders may prefer to wait until clearer bullish or bearish patterns form.

Read Also: We Asked AI to Predict Ripple (XRP) Price in June

Bearish Scenario

If the trendline breaks down and Bitcoin price declines, JASMY could fall below $0.014 and test the $0.01 level again. Weak volume, negative macro developments, or delayed roadmap execution might trigger this move.

JasmyCoin (JASMY) still has potential upside for June 2025, but its next move will depend heavily on ecosystem developments, market momentum, and external influences like Bitcoin’s direction. If the team delivers on its roadmap and market sentiment improves, a rally could follow. But without strong catalysts, the price may stay range-bound or even revisit lower supports.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.