Cardano (ADA) had a tough time in March, coming after a difficult February. The price broke below the important $0.80 support level that had been holding for two months. Though buyers tried to push ADA back above this key level in March, they couldn’t keep the momentum going, and the price fell back down.

ADA price ended March at $0.66, just a bit higher than February’s closing price of $0.62, forming an inverted hammer pattern.

We asked ChatGPT to tell us what might happen to Cardano price in April. Here’s what it predicted.

What you'll learn 👉

Pessimistic Scenario

If things go badly, Cardano could drop to between $0.55 and $0.60. After March’s bearish signal (the inverted hammer), ADA might try once more to reach the $0.80 zone. But if buyers remain weak, the price could fail and go lower.

If ADA falls below March’s low of $0.62 with heavy trading, it might sink toward $0.55. This could happen if Bitcoin and Ethereum prices fall, if there’s fear in the crypto market, if there are interest rate hikes or new regulations, or if Cardano doesn’t have any good news to share.

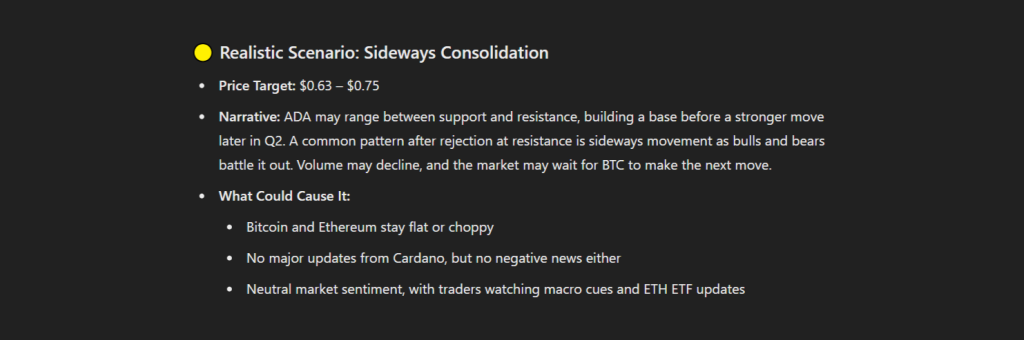

Realistic Scenario

ChatGPT thinks ADA will most likely trade sideways between $0.63 and $0.75. After being rejected at resistance, cryptocurrencies often move sideways as buyers and sellers fight for control. Trading might slow down while everyone waits to see what Bitcoin does next.

This sideways movement could happen if Bitcoin and Ethereum prices stay flat, if there’s no major news about Cardano (good or bad), and if market sentiment stays neutral while traders watch for economic signals.

Optimistic Scenario

In the best case, Cardano could reach between $0.80 and $0.95. If the market turns bullish, especially for Bitcoin and Ethereum, ADA might test the $0.80 resistance again and break through with strong trading volume. This could send the price toward $0.90 or higher, especially if the Cardano ecosystem grows with new projects, scaling improvements, or partnerships.

This could be triggered by Bitcoin breaking above $100,000 and lifting other cryptocurrencies with it, Cardano announcing major upgrades or partnerships, growth in Cardano’s DeFi ecosystem, or renewed interest from both big investors and everyday traders.

Key Factors to Monitor in April

Several things will affect Cardano’s price in April. Bitcoin and Ethereum’s movements are important, as ADA usually follows their lead. Updates to Cardano’s development plans, especially about scaling, Hydra, or new apps launching, could change how investors feel.

Read Also: How Much Will 8,500 HBAR Tokens Be Worth By 2026? Hedera Price Prediction

Growth in Cardano’s DeFi ecosystem, including total value locked and number of active wallets, will show how healthy the network is. Economic events like Fed meetings, inflation reports, and new regulations in the US or Europe could impact all cryptocurrencies.

Finally, what people are saying about Cardano on Twitter, YouTube, and Reddit can drive short-term price changes, especially among everyday investors.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.