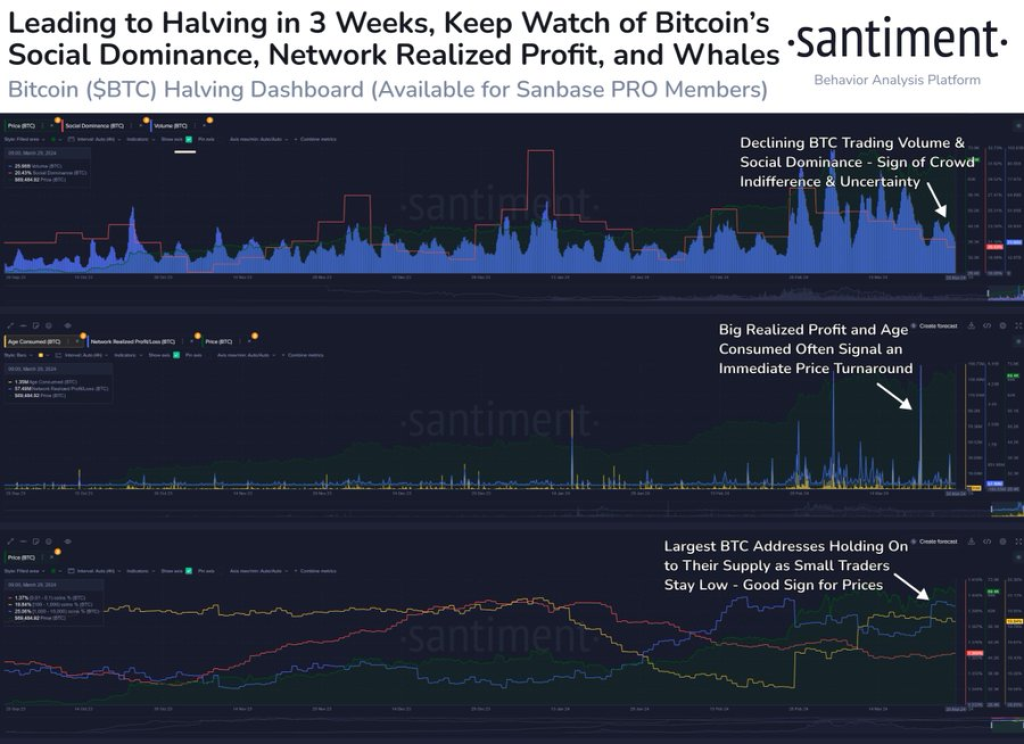

As the highly anticipated Bitcoin halving event draws near, the cryptocurrency analytics platform Santiment has identified three crucial metrics for investors to monitor. With the halving scheduled for April 19th, Santiment suggests tracking these indicators to gauge potential market movements and make informed investment decisions.

Source: altFINS – Start using it today

- FOMO Indicators: Santiment recommends keeping an eye on rising trading volume and Bitcoin’s social dominance as potential signs of a Fear Of Missing Out (FOMO) mentality taking hold among investors. An uptick in these metrics could signal impending price surges as more participants enter the market.

- Realized Profits: By closely monitoring the occurrence of significant realized profits on the Bitcoin network, investors may gain early insights into potential price reversals. Substantial profit-taking events often precede shifts in market sentiment and price direction.

- Whale Accumulation: Santiment advises tracking the holdings of large Bitcoin whales (entities holding substantial amounts of BTC) in relation to the overall circulating supply. An ideal bullish setup involves whales continuously increasing their holdings while smaller addresses reduce their positions.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The Bitcoin halving is a pre-programmed event that occurs roughly every four years, where the reward for mining new Bitcoin blocks is cut in half. This mechanism is designed to control the supply of Bitcoin and is seen as a potential catalyst for price appreciation due to the decreased rate of new BTC entering circulation.

As the halving approaches, investors are encouraged to closely monitor the metrics highlighted by Santiment to better manage their portfolios and potentially capitalize on emerging market trends.

You may also be interested in:

- Price Pattern That Triggered the Last 200x Move for Dogecoin (DOGE) Re-emerges; Here’s the Potential Target

- Chainlink Continues Uptrend with Bullish Forecasts and Mixed Signals Amid RWAs Expansion: How High Can LINK Go?

- From Playful to Profitable Dogecoin (DOGE) and Shiba Inu (SHIB) Investors Pounce on Koala Coin (KLC) Opportunities

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.