Prominent crypto analyst McKenna, with over 70k Twitter followers, recently predicted that the long-awaited approval of Bitcoin spot ETFs in the U.S. could actually trigger a market sell-off event. Here’s a closer look at his rationale:

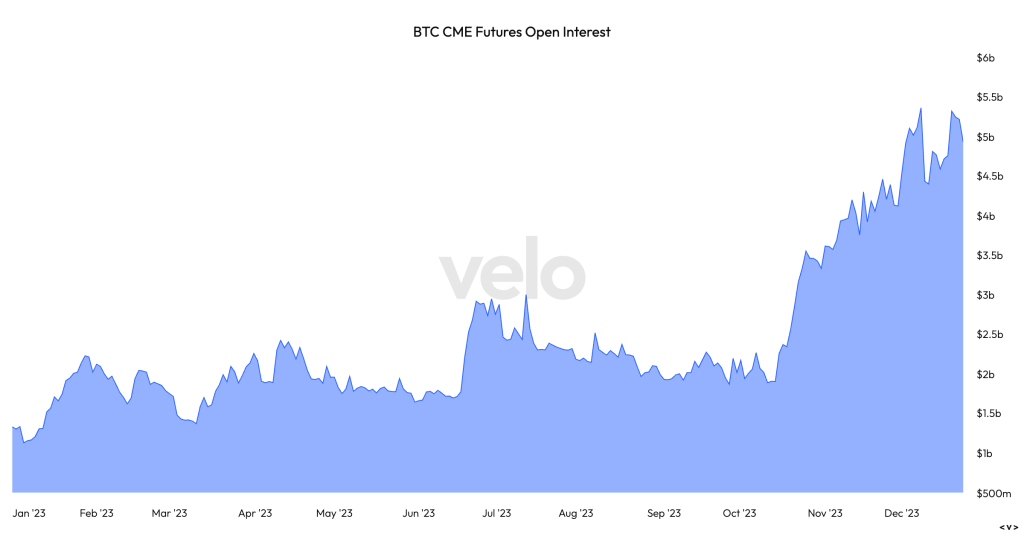

In a recent tweet, McKenna stated “I’m around 70-80% confident that the approval of filed Bitcoin spot ETFs will be a sell the news event.” He points to data showing that since BlackRock filed for a Bitcoin ETF on June 16th, open interest in CME Bitcoin futures has skyrocketed by over $3 billion.

As McKenna explains, “These positions need to unwind and I think many who were buying post FTX insolvency will begin to de-risk some of their position.” In other words, investors who piled into Bitcoin after the FTX crash to buy the dip may decide to take profits if the ETF news boosts prices.

Specifically, McKenna predicts “we should see a 20-30% selloff with market wide de-risking across the board.” The logic is that euphoria over the ETF approvals could trigger a short-term Bitcoin price peak, leading opportunistic investors to sell into that strength. This could then spiral into a broader deleveraging event.

While McKenna sees potential downside short-term, he remains constructive long-term. As he notes, “Post selloff expect Ethereum & its beta to outperform in Q1 2024.” So once the volatility settles, altcoins could begin outshining Bitcoin as investors rotate into higher risk-reward plays.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +In summary, McKenna cites heavy futures positioning and post-FTX euphoria as reasons why ETF approvals may catalyze a tactical market reversal. For crypto investors, being aware of this possibility could help navigate volatility around these pivotal regulatory developments.

You may also be interested in:

- Analyst Links Ripple’s Current Consolidation to 2017 Bull Run Setup: Is a 600x XRP Surge Inevitable?

- VCs Bet Over $360 Million on Top Projects in Q4 as Crypto Investments Show Signs of Recovery

- Here Are Potentially The Two Biggest Gainers of 2024 – Meme Kombat (MK) and Bitcoin Minetrix (BTCMTX)

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.