Crypto markets have spent years tracking government Bitcoin holdings, ETF inflows, and institutional accumulation. But a new claim circulating on X indicates traders may have missed something much bigger hiding in plain sight.

According to analyst Serenity, Venezuela may have quietly built one of the largest Bitcoin reserves in the world; a so-called “shadow reserve” estimated at more than $60 billion. If accurate, that would place Venezuela alongside names like MicroStrategy and BlackRock, and ahead of the U.S. government in total Bitcoin holdings.

The idea sounds extreme at first glance. But the numbers, timelines, and geopolitical context make it harder to dismiss outright.

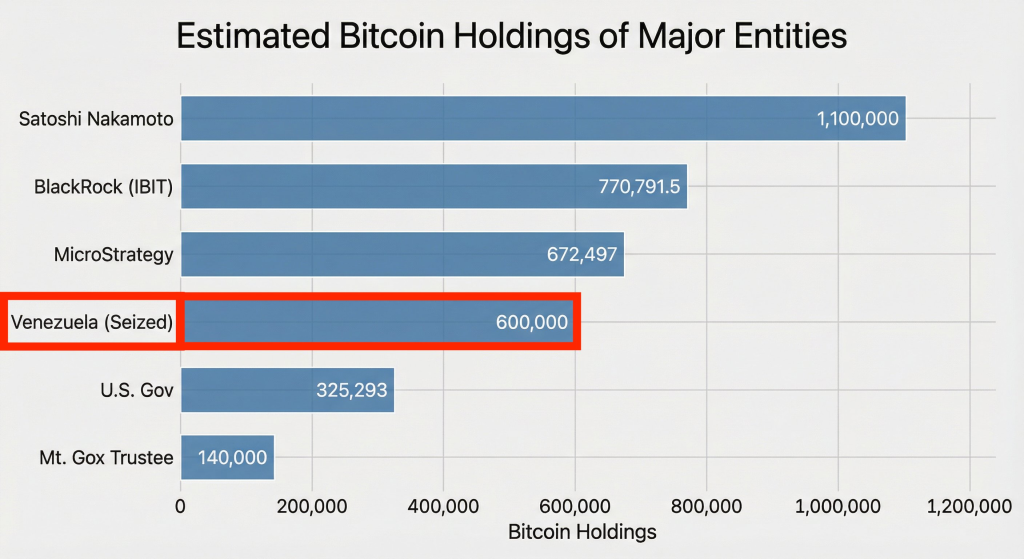

The image shared by Serenity compares estimated Bitcoin holdings across major entities. It places Venezuela (seized) at roughly 600,000 BTC, ranking fourth globally behind Satoshi Nakamoto, BlackRock’s IBIT ETF, and MicroStrategy.

To put that in perspective, 600,000 BTC represents close to 3% of Bitcoin’s total supply. It is more than 12 times larger than Germany’s 2024 sale of roughly 50,000 BTC; an event that triggered a 15–20% market correction and weeks of bearish sentiment.

If even a portion of this estimate is accurate, it immediately changes how traders should think about supply dynamics in 2026.

What you'll learn 👉

How Venezuela Allegedly Built a Bitcoin Reserve

Serenity’s analysis points to several channels through which the Venezuelan regime may have accumulated Bitcoin over the past eight years.

The first phase reportedly began around 2018, during the aggressive liquidation of gold reserves from the Orinoco Mining Arc. Intelligence estimates suggest roughly $2 billion in gold proceeds may have been converted into Bitcoin at average prices near $5,000, implying potential accumulation of around 400,000 BTC from that tranche alone.

Later, after the failure of the state-backed “Petro” experiment, Venezuela allegedly pivoted to settling crude oil exports in USDT to bypass sanctions. Over time, portions of that stablecoin flow were reportedly washed into Bitcoin, partly due to concerns over Tether’s ability to freeze addresses.

Additional accumulation may have come from mining seizures between 2023 and 2024, adding several hundred million dollars’ worth of BTC.

Taken together, Serenity estimates Venezuela’s total Bitcoin exposure at 600,000 to 660,000 BTC, with a conservative floor around 600,000.

Why This Matters for Bitcoin Markets

The most important takeaway is not whether Venezuela can sell this Bitcoin, but whether it can move it at all.

If these assets are seized and tied up in litigation, they effectively become illiquid for years. That would remove a meaningful chunk of Bitcoin from active circulation, acting as a de facto supply lock-up.

History shows how sensitive Bitcoin is to forced selling narratives. The German government’s sale of 50,000 BTC moved markets sharply. A reserve twelve times that size being frozen, rather than sold, could have the opposite effect.

Serenity outlines three possible outcomes. An immediate fire sale is viewed as low probability, especially given the current political climate around Bitcoin in the U.S. More likely scenarios involve long-term asset freezing or a strategic reserve approach, both of which reduce circulating supply rather than increase it.

Read also: ChatGPT Predicts BTC and ETH Prices Following Trump–Venezuela Dispute

The Second-Order Effect Traders May Be Missing

Markets are currently focused on Venezuela’s oil reserves, sanctions, and geopolitical risk. Bitcoin barely features in that discussion.

That may be a mistake.

If these holdings transition from an “active rogue-state reserve” to a frozen sovereign asset controlled by the U.S. Treasury, Bitcoin’s available supply tightens quietly but meaningfully. The impact would not be immediate price fireworks, but a structural shift that supports higher prices over time.

This is especially relevant as Bitcoin enters 2026 with ETFs absorbing supply, long-term holders refusing to sell, and institutional demand remaining steady.

Whether Serenity’s estimate proves fully accurate or not, the broader point stands: large, illiquid Bitcoin holders matter more than headlines suggest. And markets may still be underestimating just how much supply is already locked away.

If even half of this “shadow reserve” exists, it would rank among the most important supply-side developments Bitcoin has seen since ETFs launched.

And right now, it is barely priced in.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.