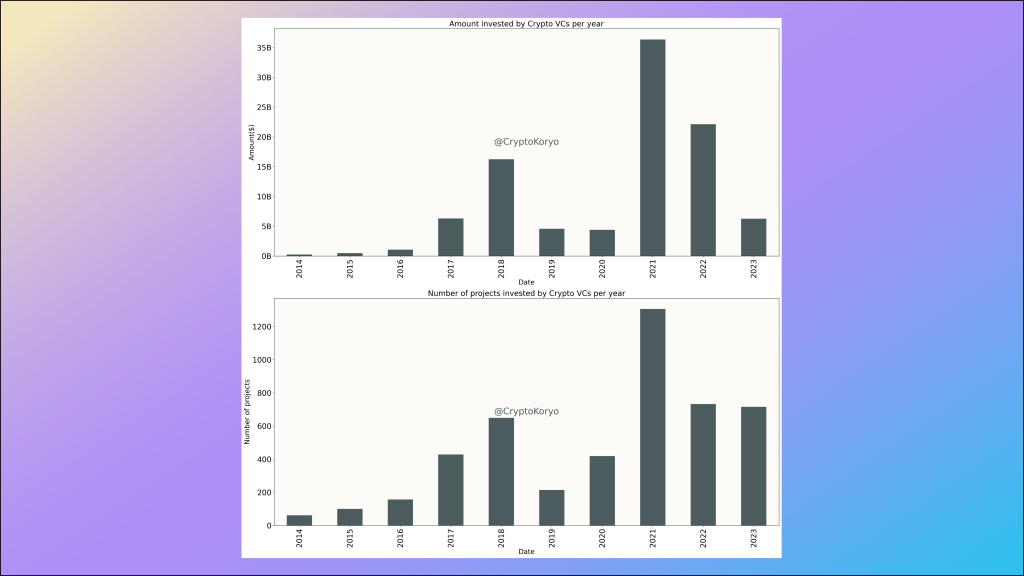

After two years of plunging crypto venture capital (VC) investments, Q4 2023 finally brought a break in the downtrend, according to a recent analysis by Crypto Koryo, an analyst with over 30k Twitter followers.

“Compared to last year, total VC investment is down by more than 75%! All while the number of projects invested remain similar. Valuations took a hit!” said Crypto Koryo about the long-term trend.

However, since Q4 2021, VC investments were declining every quarter until now. “But this quarter, we are finally breaking this trend and investments in Q4, both in total amount and number of projects, are larger than Q3,” explained Crypto Koryo.

While the increase is still modest and we can’t confirm a new bullish investment trend yet, it’s an encouraging sign to see the multi-quarter downtrend stop. This comes as the total crypto market cap increased by over 50% since October amid a renewed crypto bull market in Q4 2023.

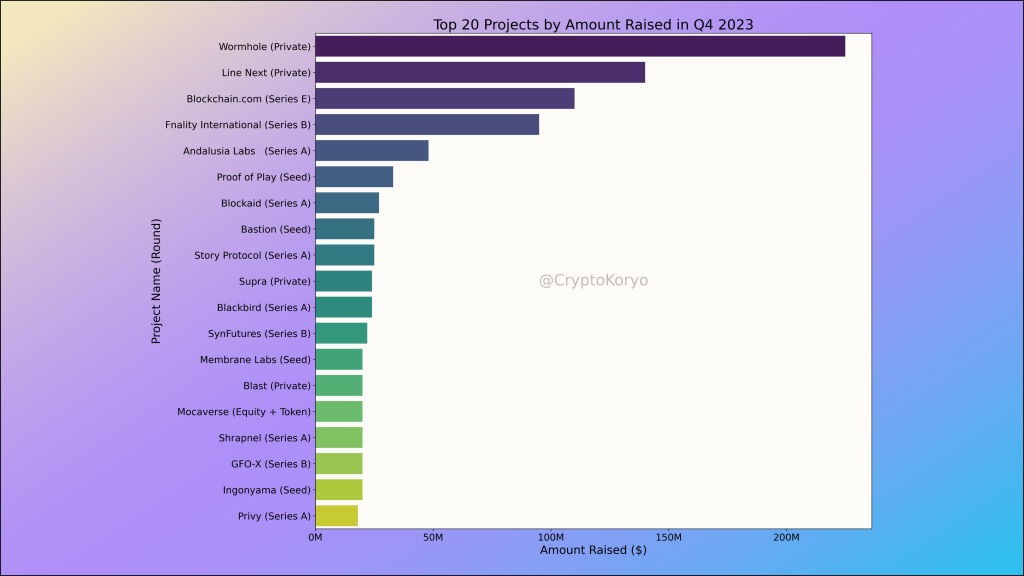

As usual, seed and pre-seed investment rounds continue to make up most of the VC deals in crypto. However, there was one major Series E investment in Q4, which we will cover shortly.

Surprisingly, prominent crypto VC Andreessen Horowitz (a16z) only ranked third in terms of lead crypto investors this quarter. “Probably the first time I see this,” noted Crypto Koryo. Meanwhile, more traditional finance firms like TradeFi continue entering crypto investments. For example, Goldman Sachs and BNB Paribas made a $95 million Series B investment in Fnality, a project focused on “tokenized cash for banks.”

According to Crypto Koryo, “You are still underestimating RWA [real-world assets] anon. It’s coming sooner than you expect, and it’s gonna vastly transform our industry. If GS is investing into it, you shouldn’t ignore it.”

Other top Q4 crypto investments included $225 million raised by Wormhole, a platform for Web3 developers, $140 million raised by LINE (China’s dominant messaging app) to expand its NFT platform, and over $20 million invested into various Layer 2 and DeFi protocols like Andalusia Labs, Proof of Play, SynFutures, and more.

While a16z’s activity declined somewhat, other VCs like Coinbase Ventures and Kingsway Capital increased investments substantially in Q4.

But what’s more interesting is the new trend of VCs investing into Bitcoin-focused projects unrelated to mining – a first. As Crypto Koryo explained, “For the 1st time, VCs are investing into Bitcoin projects unrelated to mining. Bitcoin is even surpassing Arbitrum, Optimism and Avalanche here! This is big.”

Based on descriptions of funded projects in Q4 2023, major investment themes seem to include AI, Bitcoin ecosystem development, gaming, stablecoins, Layer 2 scaling solutions, NFTs, DeFi, and more.

For example, Animoca Brands is investing in Bitcoin gaming, multiple VCs are funding Bitcoin art and NFT projects, while new Bitcoin Layer 2 solutions are also gaining steam.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +“Banks are investing. China is investing. Despite AI’s huge potential, VCs are not turning their back to crypto,” concluded Crypto Koryo. “In fact, VC investments increased in Q4. The tech is improving. A big focus on scalability through rollups, UI through intents, more and more uses cases through Digital identities, NFTs, Game-Fi and more. I only see bullish trends. We are here for the long-term.”

So while crypto VC investments are still down substantially from 2021 peaks, Q4 2023 brought the first signs of a potential recovery with an increasing focus on Bitcoin and Web3 infrastructure. If these early positive signs persist into 2023, the crypto venture capital environment could look very different next year.

You may also be interested in:

- Analyst Urges Kaspa Enthusiasts to Reconsider Selling KAS Post-Coinbase Listing, Draws Parallel to ADA

- Why Was $1.3 Billion in Bitcoin Moved to Binance? A Hot New Altcoin Prepares for Launch

- Ripple (XRP) Price Set to Soar in 2024; Render (RNDR) & RebelSatoshi ($RBLZ) Poised for 1,980% Increase

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.