In a shocking turn of events, the stability of the popular cryptocurrency USDT (Tether) has been compromised, leading to its depegging from the US dollar. The crypto community is now left wondering about the implications of this unprecedented incident that unfolded earlier today. Let’s delve into the details.

What you'll learn 👉

A Tale of Whales and Transactions

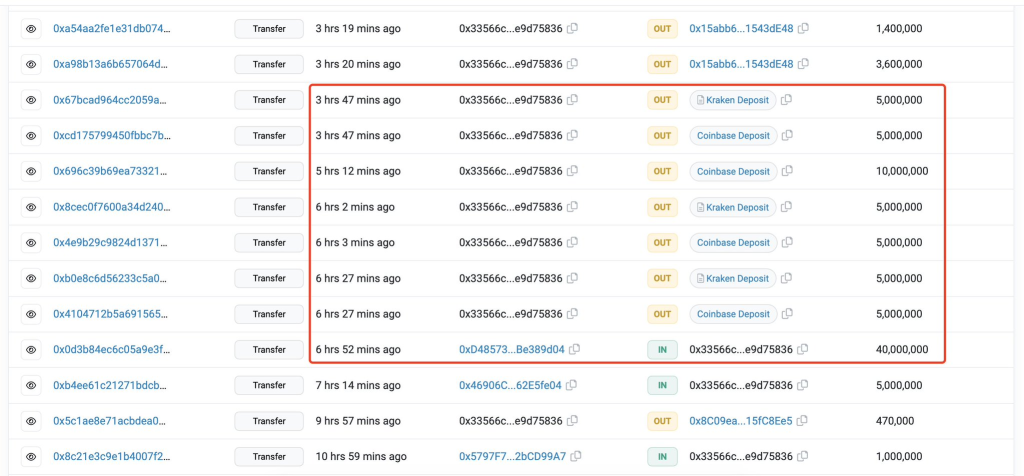

Approximately 12 hours ago, an individual known as “whale0x3356” made a bold move by creating a new address. In a calculated maneuver, they proceeded to deposit a substantial amount of 52.5 million USDC (USD Coin) and borrowed a staggering 40 million USDT (Tether) using platforms such as Aave and Compound. This strategic maneuver set the stage for a series of events that would send shockwaves throughout the cryptocurrency landscape.

Soon after, “whale0x3356” initiated the depositing of the borrowed 40 million USDT into prominent exchanges like Coinbase and Kraken, effectively injecting a significant amount of the troubled cryptocurrency into the market.

The Depegging Begins

It didn’t take long for the consequences of these actions to manifest. As “whale0x3356” started pouring USDT into the exchanges, the stability of Tether started crumbling, resulting in its depegging from the US dollar. This sudden development sent ripples of panic and uncertainty across the crypto community.

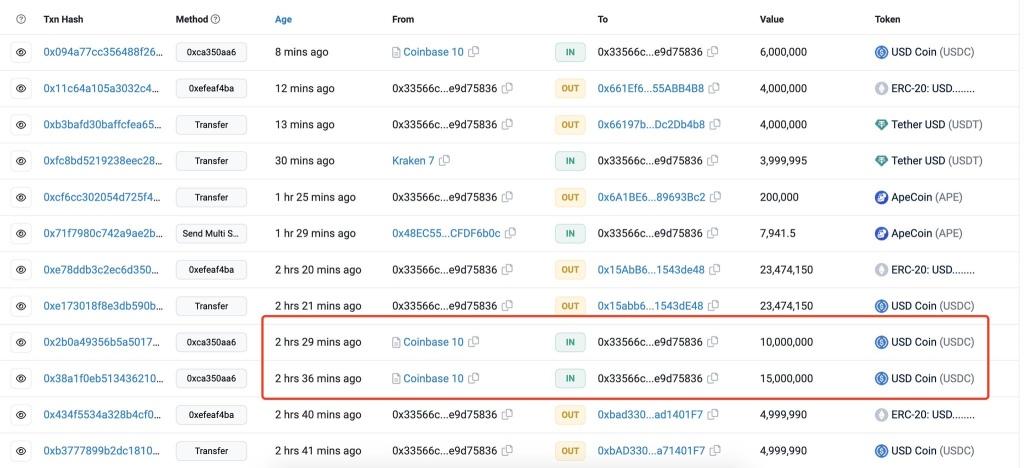

Adding to the intrigue, “whale0x3356” swiftly withdrew 25 million USDC from Coinbase merely four hours after depositing the USDT, raising questions about their intentions and involvement in this unfolding drama.

Whales in Action

Continuing the saga, two other significant players emerged onto the scene approximately five hours ago. These mysterious whales synchronized their efforts and executed a synchronized sell-off of 9.6 million USDT, amplifying the chaos and further eroding confidence in the already fragile USDT.

AaveV2 Enters the Picture

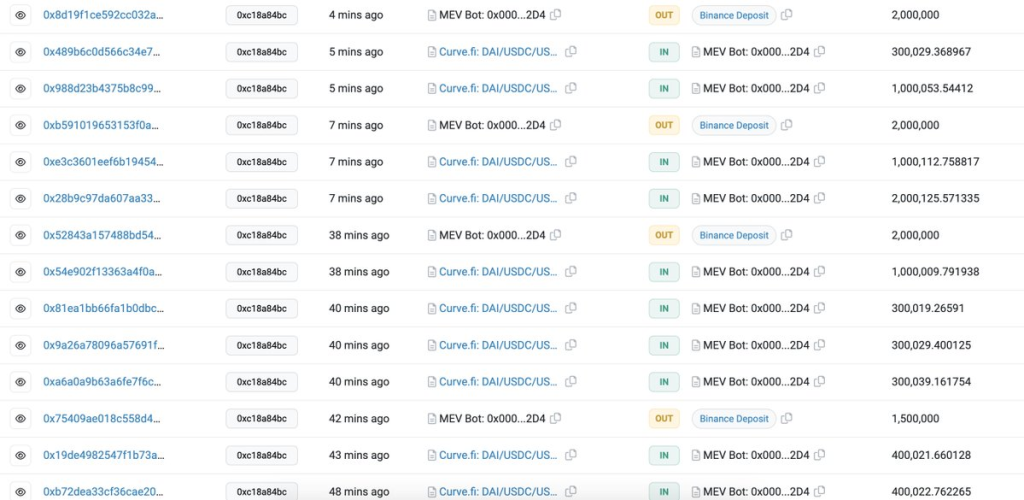

While chaos reigned in the crypto realm, a prominent figure by the name of CZSamSun seized the opportunity to capitalize on the depegging of USDT. CZSamSun, utilizing the AaveV2 platform, opted to short USDT. In a strategic move, they borrowed a staggering 31,544,278 USDT from AaveV2 and exchanged it for 31,475,408 USDC at a rate of $0.9978. Moreover, CZSamSun boldly deposited an additional 10 million USDC back into the AaveV2 ecosystem, indicating a confidence in their speculative actions.

Implications and Speculations

As the fallout from the USDT depegging continues to unfold, the cryptocurrency market is now bracing for the potential consequences of this unprecedented event. Traders and investors alike are left pondering the stability and credibility of stablecoins in general, raising concerns about their role in the broader financial ecosystem.

Authorities and experts in the field are now closely monitoring the situation, analyzing the actions of the whales and the impact on the overall market. The long-term implications of this depegging event remain uncertain, but one thing is clear: the stability of stablecoins has been cast into doubt, and the crypto community eagerly awaits further developments.

This is a developing story. Stay tuned for updates as more information becomes available.