The projects Uniswap (UNI) and Matic (MATIC) have garnered significant interest from traders and analysts. As prices fluctuate, technical analysis from industry experts Rekt Capital and altFINs offers insights into the potential trajectories of these digital assets..

What you'll learn 👉

Uniswap (UNI) Analysis

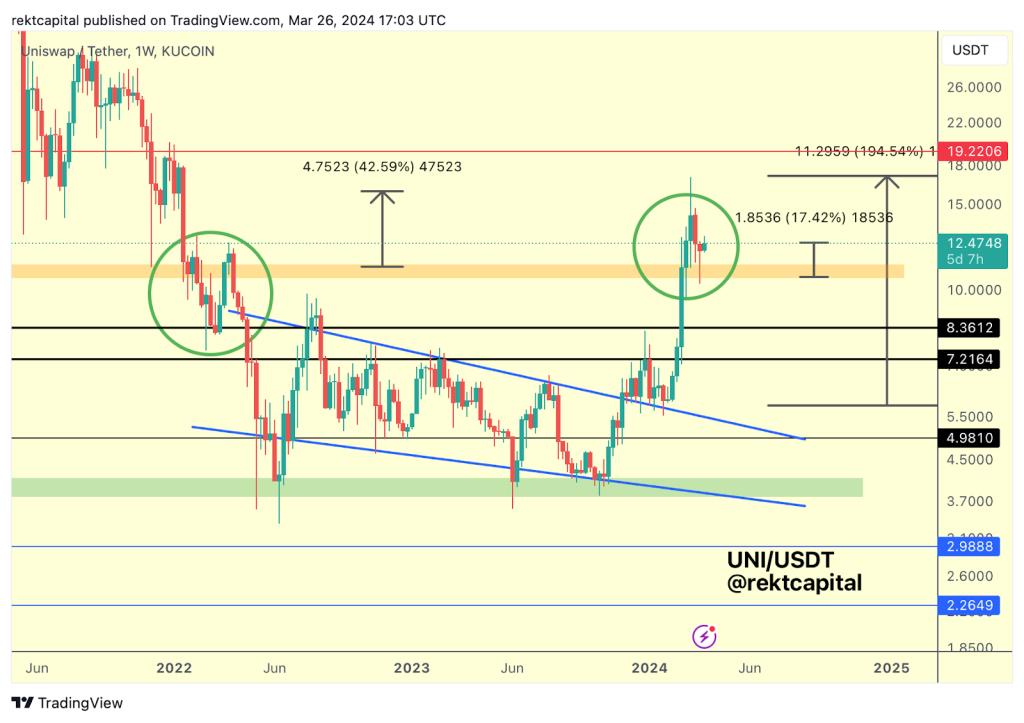

Over the past few weeks, Rekt Capital’s analysis has focused on the potential retest of an orange price area as new support for Uniswap (UNI). As anticipated, UNI did indeed drop into this orange area last week, allowing for a retest. Following this retest, UNI successfully bounced +17% from the orange area, potentially establishing it as new support.

Additionally, ccording to Rekt Capital, if UNI maintains stability above this orange area, it would be a bullish signal. Crucially, UNI needs to hold above the orange area leading into the Monthly Candle Close. A Monthly Candle Close above the orange area could indicate that UNI is positioning itself within the current macro range, defined by the orange Range Low and the red Range High at $19.22.

However, even if a Monthly Close occurs above the orange area, Rekt Capital notes that it could still technically trigger another pullback into the orange area for an additional retest. Although a retest isn’t assured, particularly since one has already happened, any dips that arise would indicate this retest action on the monthly timeframe.

The analyst suggests that a retest would be a healthy, normal technical phenomenon.

Rekt Capital emphasizes that UNI’s successful retesting on both the Weekly and Monthly timeframes would confirm its readiness to traverse across the orange-red macro range over time.

Matic (MATIC) Analysis

Turning to Matic (MATIC), altFINs provides a trade setup analysis. According to their assessment, the price is currently in an Uptrend. MATIC rebounded off support at $0.92 and could potentially revisit the $1.25 level in the near-term. Furthermore, momentum indicators suggest bullish momentum is building, as evidenced by the rising MACD Histogram.

altFINs recommends setting a Stop Loss (SL) level at $0.89 and advises traders to set price alerts for potential entry points. The analysis indicates that MATIC exhibits an Uptrend across short, medium, and long-term time horizons.

While momentum indicators show a mix, with the MACD Line below the MACD Signal Line (indicating bearishness) and the RSI around 50 (signaling neutrality), the increasing MACD Histogram bars indicate that bullish momentum might be strengthening.

In terms of key levels, altFINs identifies the nearest Support Zone as $1.00 – $1.05, followed by $0.92 and $0.75. On the resistance side, the nearest Resistance Zone is $1.25, with $1.50 as the next potential hurdle.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +As the cryptocurrency market continues its volatile movements, these analyses from Rekt Capital and altFINs provide valuable technical perspectives for traders and investors looking to navigate the potential paths of Uniswap (UNI) and Matic (MATIC).

You may also be interested in:

- Top 13 Real Estate Tokens Poised for 100x Growth as Blackrock and Coinbase Dive into RWA

- Ripple Analyst Says XRP Holders Can Earn 50X To 100X In this Bull Run

- DOGE, BONK, and NUGX: The Meme Coin Trio Defying Market Expectations

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.