The price of Uniswap (UNI) has taken a significant hit, dropping by approximately 16% over the past 7 hours, after the U.S. Securities and Exchange Commission (SEC) warned that it may sue the decentralized exchange platform.

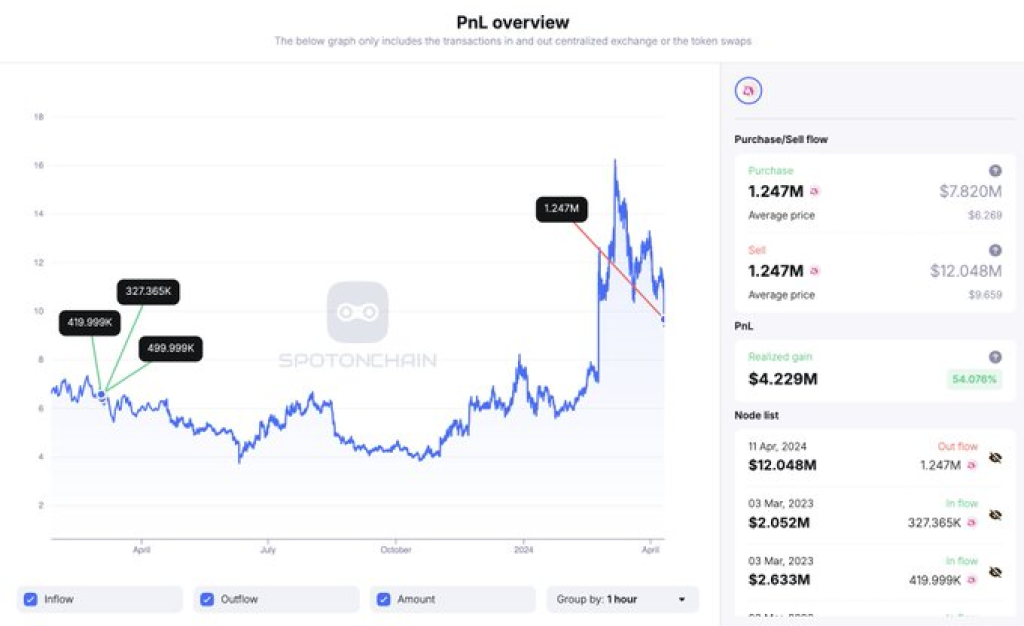

Amidst the turmoil, a smart trader identified as 0x335 has made a significant move, depositing 1.25 million UNI tokens (worth $12.05 million) to Binance via two wallets in the past hour.

The trader realized an estimated profit of $4.23 million, representing a 54.7% gain. This substantial deposit has raised concerns about a possible further price drop for UNI, as the trader’s actions may signal a lack of confidence in the token’s short-term prospects.

Interestingly, the same trader has also made significant profits from other cryptocurrencies, including $5.76 million in total from Ethereum (ETH), Compound (COMP), and Aave (AAVE) prior to this UNI trade.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +What you'll learn 👉

Liquidation of whitzardflow.eth’s UNI Position on Aave

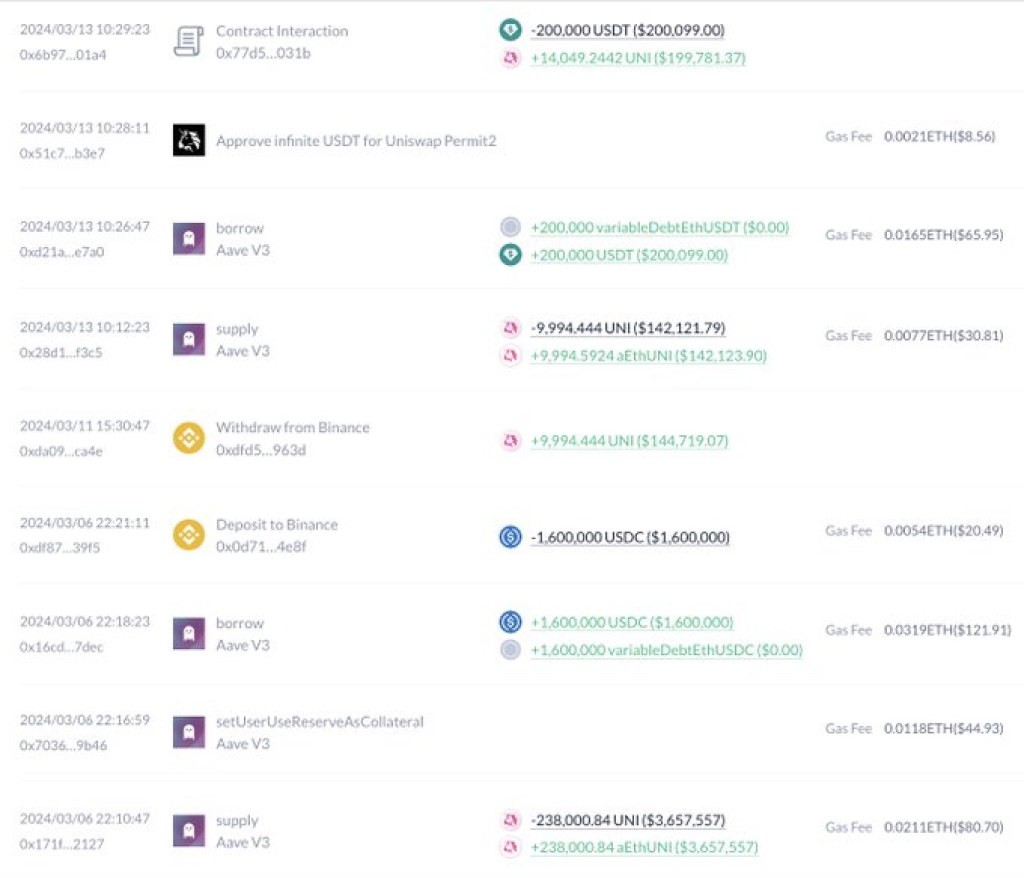

A related development saw the liquidation of an Ethereum address associated with whitzardflow.eth for 107,010 UNI, or approximately $1 million. The owner of this address had purchased 262,045 UNI (worth $3 million) between March 1 and March 13 at an average price of $11.42 per token. The owner deposited the acquired UNI into Aave, a decentralized lending platform, and used the UNI collateral to borrow $1.8 million in stablecoins.

However, due to the recent decrease in UNI’s price, the Aave platform liquidated 107,010 UNI to repay the outstanding debt. As a result, whitzardflow.eth now holds 155,034 UNI (worth $1.46 million) with a health rate of 1.19, indicating that the remaining collateral is still at risk of further liquidation if the UNI price continues to decline.

Potential Impact on the Uniswap Ecosystem

The SEC’s warning and the subsequent price drop have raised concerns about the potential impact on the Uniswap ecosystem. Uniswap, one of the leading decentralized exchanges, has been at the forefront of the DeFi movement, facilitating billions of dollars in daily trading volume.

A prolonged legal battle with the SEC could hinder the platform’s growth and adoption, as well as dampen investor sentiment towards UNI and other DeFi-related tokens.

Moreover, the liquidation of large UNI positions, such as that of whitzardflow.eth, may lead to further selling pressure on the token, as borrowers seek to mitigate their losses and reduce their exposure to the asset.

The recent developments surrounding Uniswap and the SEC’s warning have sent shockwaves through the cryptocurrency market, with the UNI token bearing the brunt of the impact.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.