No matter their expertise, traders are not immune to emotional reactions. Significant market fluctuations can often lead to impulsive decisions and assumptions about future market trends.

In this sector, which is now 15 years old, market sentiment continues to play a crucial role. So, what’s the aftermath of Bitcoin plummeting to $26.1K and the subsequent crash in altcoins? Let’s examine some key indicators:

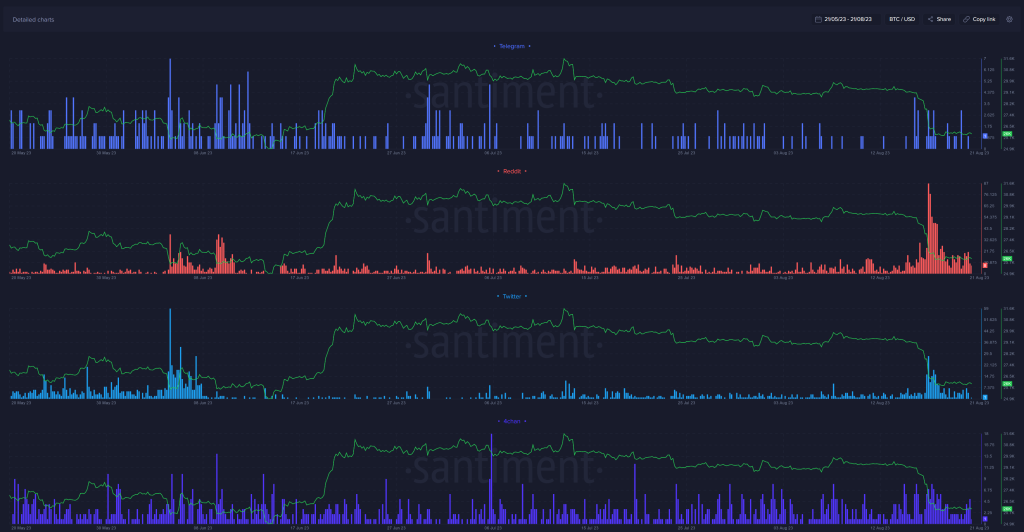

First off, it’s hardly shocking that there was a surge in mentions of “buy the dip.” This suggests that traders were highly optimistic about a swift market rebound. However, this optimism has noticeably waned in recent days.

Source: Santiment – Start using it today

Interestingly, the decline in certainty about buying the dip is actually a positive sign. It indicates a growing sense of caution as market values decline.

When it comes to social media platforms, Reddit seems to be the most optimistic about a quick price recovery. While Twitter experienced a brief surge in optimism, it has now returned to a more neutral stance.

Source: Santiment

Historically, the best opportunities for patient traders have come when all major social platforms show neutral sentiment about buying the dip.

Additionally, conversations about Bitcoin reached a yearly high following the market crash. Yet, this focus on Bitcoin has quickly normalized, suggesting traders are now eyeing other promising altcoins.

Ideally, we’d like to see sustained high levels of discussion about Bitcoin, as this is often linked to a robust and thriving crypto market. High levels of chatter about Bitcoin usually correlate with market fear, which is often a precursor to market gains.

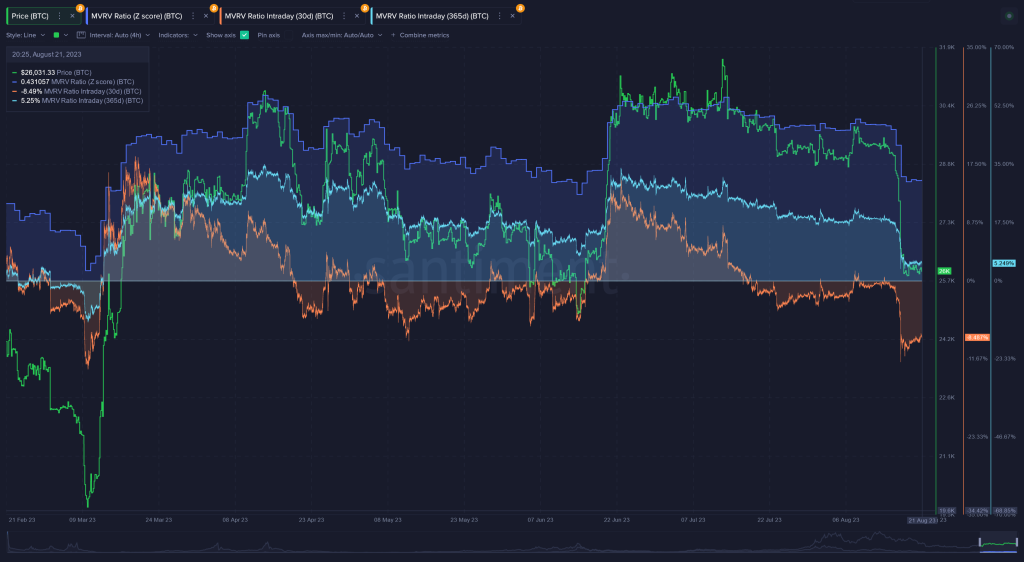

As for trading returns, swing traders are currently experiencing their worst performance since early March, with an average 30-day return of -8.5%. This could indicate a safer opportunity to increase positions.

Source: Santiment

However, it’s important to note that long-term traders with a 365-day activity are still marginally profitable, with a +5.2% return. When both short and long-term MVRVs are negative, as was the case in early March, it’s generally a strong bullish indicator.

Finally, the high number of open short positions on exchanges is encouraging. It suggests that there might be an upward movement to deter these short positions and balance out funding rates as traders continue to bet against the market.