Understanding price movements in the crypto market often hinges on discerning market sentiments and analyzing trading patterns. In this light, a trend within the market dynamics of Bitcoin, the pioneering force in the crypto universe, has been spotlighted by Santiment (@santimentfeed), a reputable provider of analytics in the cryptocurrency sector. This insight is crucial as it presents nuanced dynamics providing market participants with valuable perspectives.

Source: Santiment – Start using it today

What you'll learn 👉

Shorting Momentum on Bitcoin

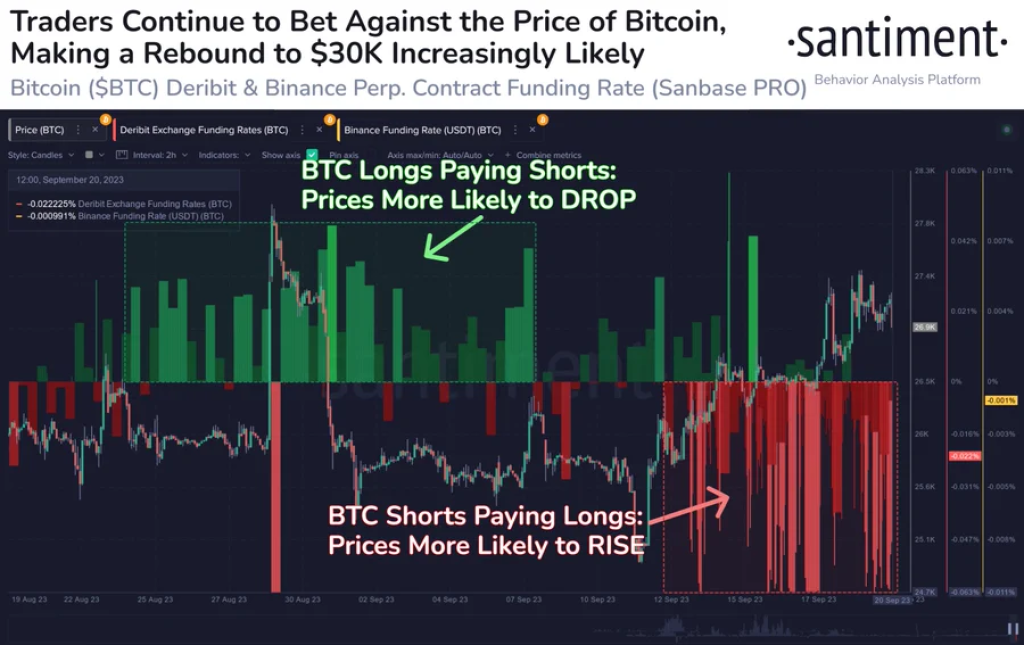

Bitcoin traders have demonstrated aggressive shorting strategies on major cryptocurrency exchanges, namely Deribit and Binance. This strategy is where traders are betting against Bitcoin’s price, anticipating a decrease. According to the analysis presented by Santiment, this heightened shorting activity has markedly increased the likelihood of potential liquidations.

Possible Price Boost Trigger

This wave of shorting is intriguing as it creates a scenario where liquidations could significantly impact Bitcoin’s price. In the instance where market conditions force the closure of these short positions, it may trigger what is known as a “short squeeze”, leading to a rapid price ascent as traders rush to buy Bitcoin to cover their positions. Since the inception of this pronounced shorting trend last week, Bitcoin’s price has already experienced a 4% increase, a movement seemingly counterintuitive given the negative market sentiment that shorting implies.

Probability of Continuation

Santiment’s analysis implies that there is a high probability that this pattern will perpetuate, potentially leading to further increments in Bitcoin’s price. The aggressive shorting by traders might be a precursor to substantial market activity and heightened volatility, with the likelihood of it causing more upswings in the price trajectory of Bitcoin.

Market Context

Understanding the current market context is crucial when interpreting these aggressive shorting instances. It could reflect a myriad of trader expectations and sentiments. It could be a manifestation of a perceived overvaluation in the market, speculative trading behaviors, or potential market manipulations.

The cryptocurrency market is inherently volatile and laden with risks and opportunities. For traders and investors, understanding the nuances of market dynamics, trading behaviors, and underlying sentiments is imperative in navigating the crypto landscape proficiently.

Conclusion

The revelation from Santiment brings to light the dichotomy within the market sentiment and actual price movements in the crypto world. While aggressive shorting generally denotes a bearish outlook, the potential for consequential liquidations presents opportunities for price boosts, thereby creating a convoluted yet fascinating market scenario.

The crypto community will be closely monitoring these developments, gauging the unfolding market patterns, and reassessing strategies, keeping the principles of risk management at the forefront in this unpredictable and ever-evolving digital asset landscape.

This market analysis does not constitute financial advice and investors are urged to conduct their own research or consult with a financial advisor before making investment decisions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.