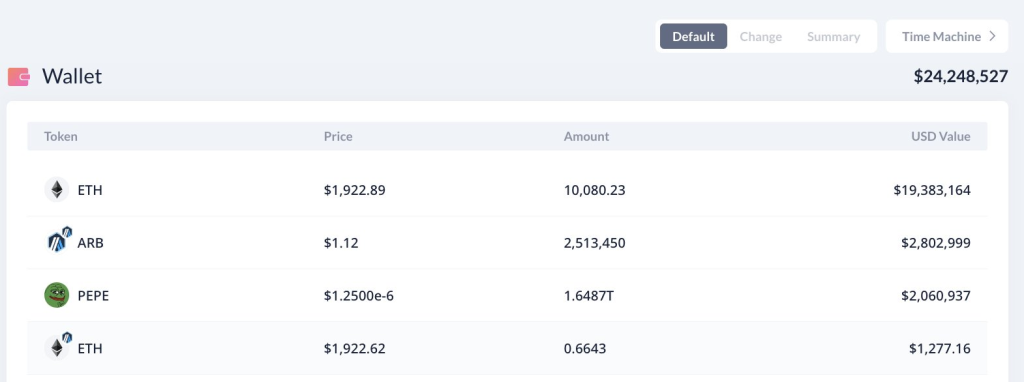

LookOnChain reported that a whale holding over 10,000 ETH (worth around $19.4 million) made two large purchases of altcoins ARB and PEPE.

The whale spent 1,433 ETH (around $2.6 million) to acquire 2.51 million ARB tokens at $1.045 each. They also spent 1,038 ETH (around $1.9 million) to buy 1.65 trillion PEPE tokens at $0.000001154 per token.

At the time of writing, the whale is currently up around 7% on their ARB position and 8% on their PEPE position. ARB is trading around $1.11, while PEPE is trading around $0.0000034.

When whales or other large investors put significant capital into smaller cap coins like ARB and PEPE, it often signals growing sentiment and potential uptrends in the prices of those assets. The large purchases show that high net worth cryptocurrency holders have confidence in the projects, and are willing to take substantial positions in them.

Their trading strategies rely on driving up prices after accumulating large amounts of tokens. As prices increase, it validates their investment thesis, allowing them to sell portions of their holdings at a profit. This dynamic can lead to self-fulfilling prophecies, at least for temporary price spikes.

Of course, traders should always do their own research before investing based on whale activity alone. But large purchases by seasoned whales can be a useful data point to incorporate into analysis of momentum and market psychology for cryptocurrencies. The whale’s willingness to place multi-million dollar bets on ARB and PEPE hints at potential growth ahead, if community sentiment aligns.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.