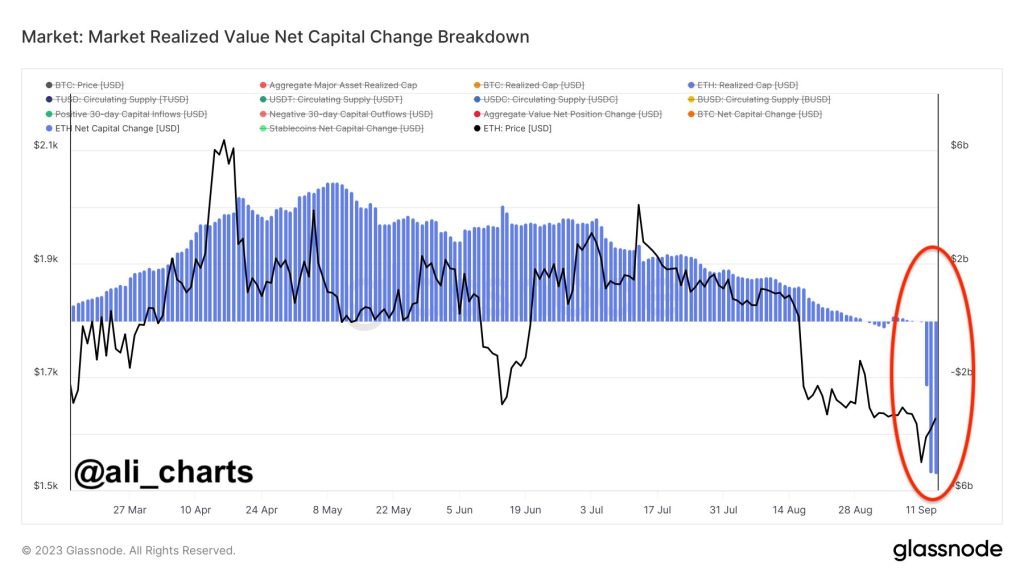

Ali (@ali_charts) pointed out that Ethereum has experienced a significant outflow of roughly $13 billion from its market in the past few days. This is a noteworthy development that signals a shift in investor sentiment.

What you'll learn 👉

What Does This Mean?

When a large amount of money is withdrawn from a particular asset, it generally indicates that investors are becoming less confident in its short-term prospects. In the case of Ethereum, this could be due to a variety of factors such as regulatory concerns, competition from other cryptocurrencies, or broader market volatility.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +What to Watch For

Investors should keep an eye on market trends, news, and regulatory updates that could further impact Ethereum’s market position. It would also be wise to monitor how Ethereum’s competitors are performing during this period.

In summary, the significant outflow of funds from Ethereum, as highlighted by Ali, a technical analysis expert, is a crucial indicator of shifting market sentiment that investors should not ignore.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.