Popular crypto analyst Miles Deutscher laid out his strategy for capitalizing on the next crypto bull run expected in 2024/2025. With over 360k Twitter followers, Deutscher’s insights provide a comprehensive blueprint for investors looking to make the most of the coming cycle.

Deutscher believes Bitcoin will continue leading the crypto market higher, just as it did in previous bull runs. He explains that a strong Bitcoin price attracts liquidity and benefits the entire crypto ecosystem, including altcoins. Many investors think altcoins bleed against Bitcoin when it is strong, but Deutscher argues the opposite – Bitcoin strength brings funding that eventually flows into altcoins.

Given this framework, Deutscher plans to continue building his Bitcoin and Ethereum holdings using “adaptive DCA” – a strategy that involves buying more aggressively during price dips and taking some profits on extreme rallies. This aims to accumulate larger long-term positions in a balanced manner.

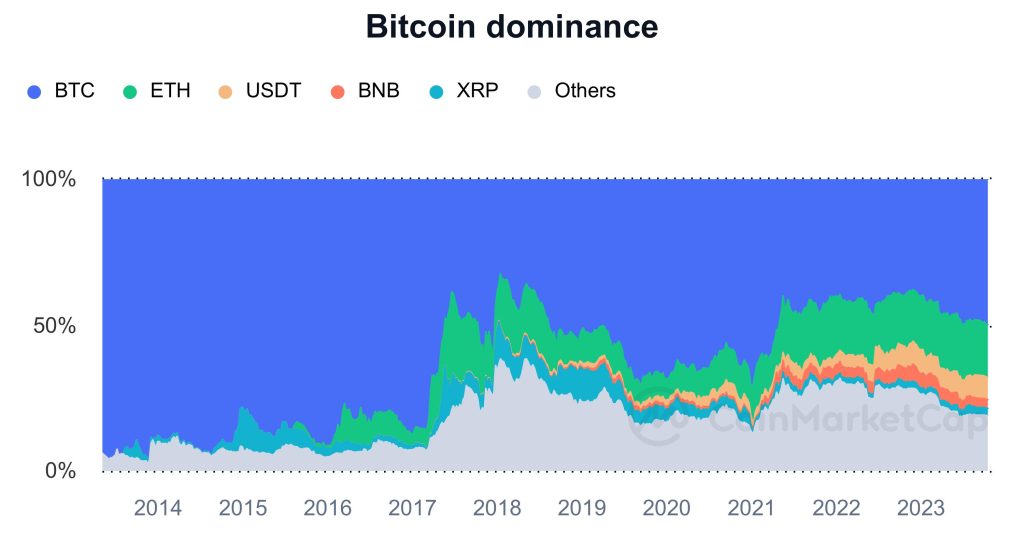

For altcoins, Deutscher recommends focusing on relevant narratives like Bitcoin proxy assets and real-world use cases rather than temporary hype trends. He advises being selective and using technical analysis to time entries into quality projects. With Bitcoin dominance currently over 51% – the highest since April 2021 – most altcoins are lagging against Bitcoin. Deutscher cautions against catching these falling knives without a high timeframe reversal signal.

Bitcoin Dominance – Source: CoinMarketCap

Deutscher views this as an accumulation phase where the goal is steadily building positions. He suggests maintaining around 50% in cash and deploying it slowly, saving larger purchases for extreme red days in the market. Patience is key rather than rushing to build positions.

While individual risk tolerances may differ, Deutscher provides an insightful overview for constructing a balanced, forward-thinking crypto portfolio. His approach aims to maximize gains when the next major bull market inevitably comes. By selectively accumulating Bitcoin, Ethereum and quality altcoins, investors can strategically prepare for the crypto boom ahead.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.