With Bitcoin’s price showing bullish momentum in recent days, gaining over 14% to reach near $35,000, top experts are analyzing on-chain data and technical indicators to decipher where the cryptocurrency may be headed next. Although unable to break above the resistance at $35,000, the bullish signs are adding up.

What you'll learn 👉

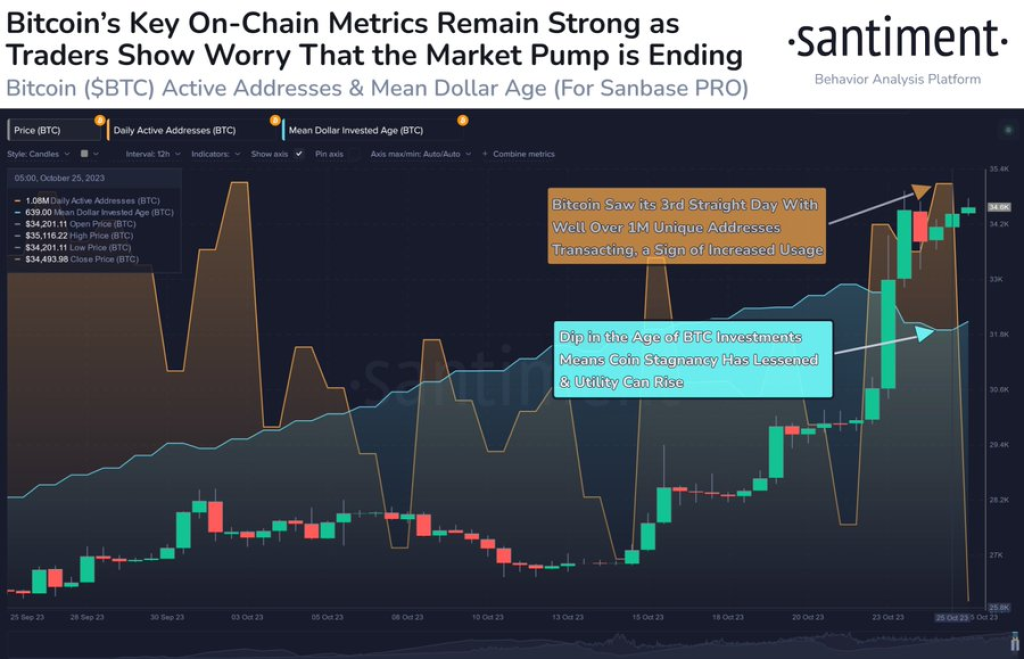

Santiment Sees Bullish On-Chain Activity

Source: Santiment – Start using it today

According to crypto analytics firm Santiment, on-chain data is flashing bullish signals. “If you’re concerned about a crypto retrace, note that Bitcoin still maintains a high pace of active addresses. Additionally, the top market cap asset is seeing a high level of dormant tokens now moving, typically synonymous with bullish conditions,” Santiment stated on social media. The increased on-chain activity points to building momentum.

CryptoCon: Technicals Show Path to $45,000

Analyzing Bitcoin’s technical charts, popular analyst CryptoCon sees a bullish setup forming. “Bitcoin smashed through the blue resistance on the volume profile, which makes the next largest block at 39.6k a magnet,” he explained. CryptoCon believes Bitcoin could reach $45,000 by next month based on historical trends around Bitcoin’s halving cycles.

He summarized, “Things are looking good for the next few months!” as Bitcoin holds within an ascending price channel.

Crypto Rover: Weekly MACD Crossing Bullish

Adding further evidence to the bull case, analyst Crypto Rover points out the weekly MACD (moving average convergence divergence) indicator for Bitcoin has crossed bullishly. MACD crossing over into positive territory on long timeframes is considered a strong buy signal by traders.

With on-chain activity ramping up, bullish technical setups, and historically favorable seasonal trends, the expert consensus seems to point toward continued upside for Bitcoin after its recent double-digit gains. However, breaking key resistance levels will be critical for confirmed bullish continuation.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.