Bitcoin has an interesting relationship with its halving events, as crypto analyst Rekt Capital recently explored. A halving refers to when the reward miners receive for processing Bitcoin transactions is cut in half, which occurs every 210,000 blocks or about every four years.

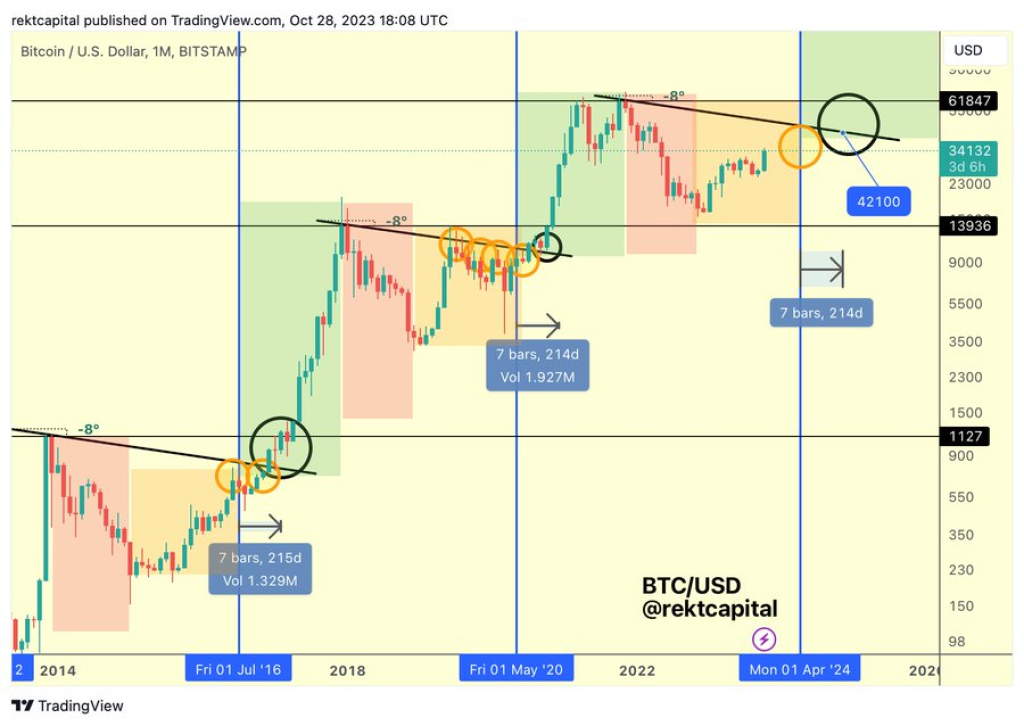

Rekt Capital noted that historically, Bitcoin tends to get rejected by a key diagonal resistance level right before a halving takes place. This repeated pattern of rejection can be seen with orange circles on a price chart. However, after the halving occurs, Bitcoin is finally able to break through this diagonal resistance, turning it into support instead.

A successful retest of the former resistance-turned-support tends to happen around 200 days after the halving event, as illustrated by the black circle on the chart. So in summary, the halving seems to give Bitcoin the boost it needs to power through resistance levels that thwarted its price appreciation previously.

Read also:

- Why Kaspa (KAS) Will Mirror Solana’s 2021 Success

- Top BTC Expert Explains Why This Bitcoin Pump Is Just Getting Started

- XRP and SEC likely to go for settlement in November, as InQubeta eyes $4 million in presale

This fascinating market behavior around Bitcoin halvings gives traders insights into planning entry and exit strategies around these predictable events. The next halving is estimated to occur in 2024, so it will be interesting to see if Bitcoin once again gets rejected by overhead resistance pre-halving, before bursting through post-halving. Rekt Capital’s analysis provides a blueprint for what to potentially expect.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.