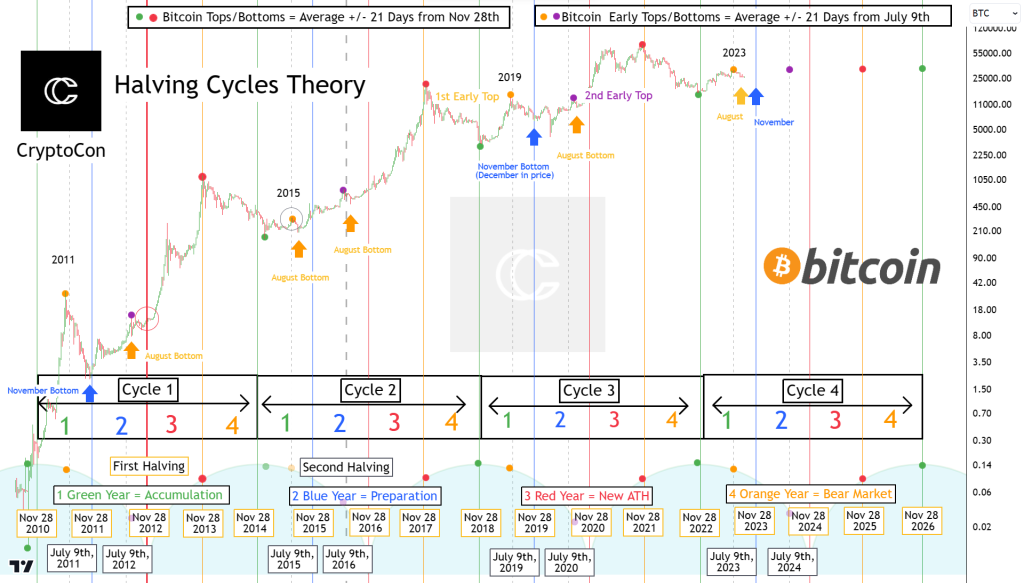

Recently, CryptoCon shared some perspectives about Bitcoin’s past performance and possible bottom levels. In a series of tweets, @CryptoCon_ highlighted patterns seen in previous Bitcoin cycles.

According to this technical analysis expert, out of the six early tops observed in Bitcoin’s history, four have found their bottoming point in August, while the remaining two have done so in November. With the first early top of the current cycle already in place, @CryptoCon_ suggests that the bottoming point for this cycle may have already occurred in August.

However, he acknowledges that many in the crypto community, including himself, are anticipating some additional downside. This caution is driven by the historical performance of September, which is often a poor-performing month for Bitcoin, and the fact that the price is currently below healthy bull market supports, such as the 20 Week EMA.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Despite these concerns, @CryptoCon_ raises an interesting question: Could those expecting a scenario similar to 2019 (minus unforeseen events like the black swan) be in for a surprise? Based on statistical analysis of early tops, it appears much more likely that Bitcoin has already hit its bottom for this cycle.

This insight from @CryptoCon_ highlights the importance of considering historical patterns and statistical analysis when making predictions about the cryptocurrency market, and it leaves the crypto community with an intriguing possibility: the bottom may already be in, even in the face of some short-term uncertainty.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.