Miles Deutscher – a prominent analyst and trader on Twitter – shared his weekly watchlist of top tokens and narratives in crypto. Deutscher has his finger on the pulse of the market, constantly evaluating trends, price action, fundamentals, and sentiment.

What you'll learn 👉

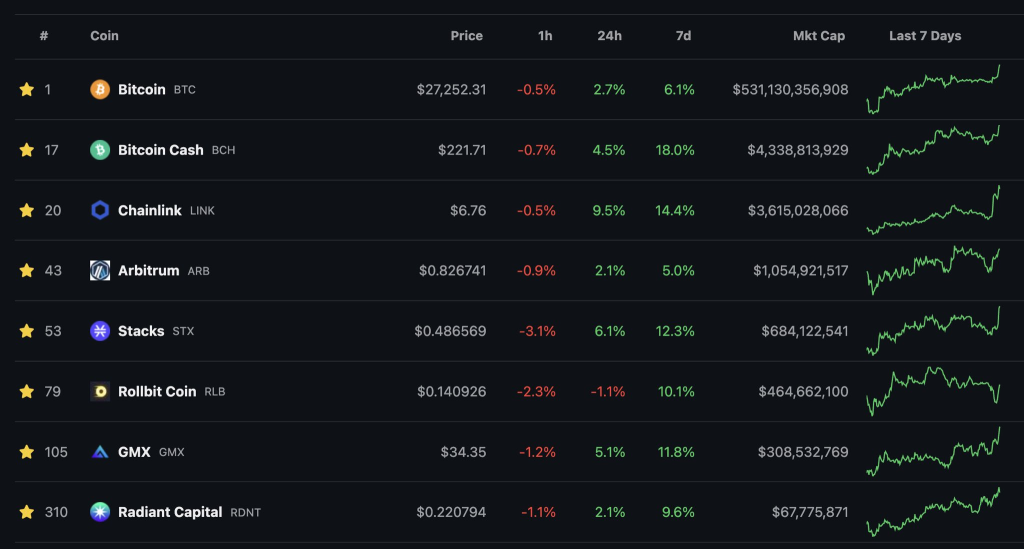

Bitcoin ($BTC)

Miles notes that Bitcoin has managed to hold its ground at the crucial $25,000 support level, despite facing challenges. A significant 15% uptick in open interest and its outperformance against equities suggest that something big might be on the horizon—perhaps an ETF approval. Miles advises keeping a close eye on Bitcoin’s movements.

Stacks, Bitcoin Cash & eCash ($STX, $BCH, $XEC)

These tokens are considered beta Bitcoin alt plays. With Bitcoin’s dominance on the rise, investing in these could offer a decent upside. However, Miles cautions that these tokens come with higher risk, especially as the market anticipates Bitcoin’s halving event.

Arbitrum ($ARB)

Last week saw large players exiting their positions in ARB, resulting in the token hitting its most oversold level ever, according to the RSI on the daily chart. Despite this, Arbitrum has announced a new incentive program, and the upcoming EIP-4844 could serve as a strong tailwind for Layer 2 solutions like Arbitrum.

Chainlink ($LINK)

Miles is particularly impressed with LINK’s weekly chart, which shows a clear accumulation pattern. The token has recently rebounded from the bottom of its range and still has room to grow, with a 25% upside to the top of the range at $8.5.

Rollbit ($RLB)

On-chain tokens like RLB are making a comeback, with Friend Tech possibly peaking for the time being. Miles finds the Rollbit thesis straightforward: the chart looks promising, sports season is kicking off, and the token continues to burn at a rapid pace.

Radient ($RDNT)

RDNT is showing signs of relative strength, likely fueled by the upcoming launch of their Mainnet and the Radpie platform. Additionally, RDNT stands to benefit from Arbitrum’s short-term incentive program.

GMX

Although the market has been lacking in volatility, Miles believes that GMX could be a major beneficiary when volatility returns. This is particularly due to the Arbitrum incentive program, which could reignite interest in the ecosystem.

In summary, Miles Deutscher’s analysis provides a comprehensive look at the current crypto market, highlighting potential opportunities and risks. As always, it’s essential to conduct your own research and exercise caution when investing in the volatile world of cryptocurrencies.