Ondo price has had some good times; one of the recent ones is the four-week rally that saw it break some key resistance and reach a new all-time high. So, what’s next for the token price?

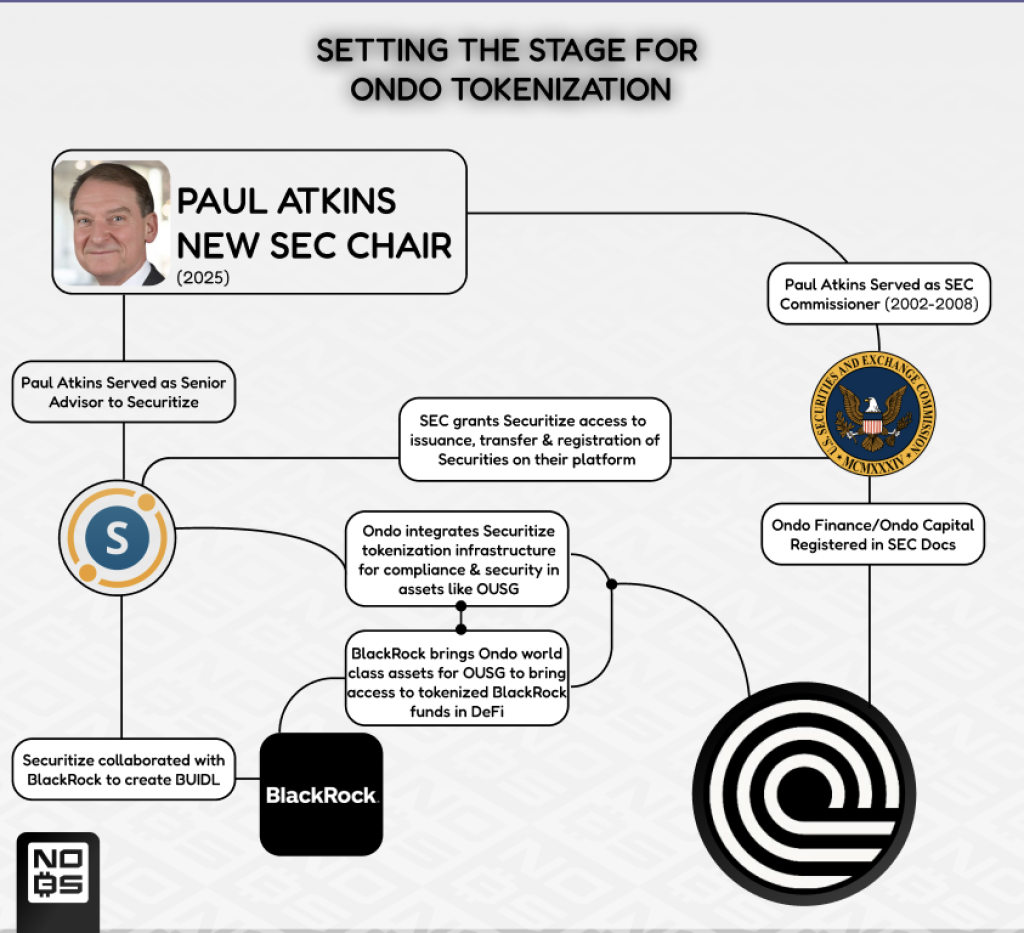

A crypto analyst Kyren from the X has noted a potentially game-changing scenario developing for ONDO. In his words: “The perfect storm for $ONDO is loading.” The analyst points to Paul Atkins’ involvement and Ondo’s established connections in the TradFi tokenization space as key catalysts.

According to the analyst, Securitize emerges as the central player, orchestrating relationships between Ondo, BlackRock, and regulatory frameworks.

The analyst emphasizes Ondo’s strategic position through its connection with Securitize and subsequent BlackRock partnerships. Notably, Ondo utilizes BUIDL in their OUSG offerings, demonstrating their integration with institutional-grade financial products. The SEC-vetted status of Securitize’s platform adds a layer of regulatory compliance to Ondo’s operations.

ONDO Price Action With Fibonacci Retracement Analysis

Despite the optimistic outlook, ONDO has experienced significant price volatility.

The price of ONDO spiked by more than 200% between November 5 and December 4. Since then, the price has struggled to break above the resistance at around $1.78. After multiple attempts, the price started to decline.

The ONDO price has experienced a decline of more than 13% in the last 3 days. However, this looks like the beginning of a long retracement, especially if some key supports fail to hold.

The first major support level is around $1.45. If this level holds, we might expect a price recovery. This level is crucial because it also represents the top of the descending channel pattern that the price broke out from a few weeks ago.

If this area fails to hold, we might see another support level at around $1.23, which would represent an additional 15% decline.

Generally favorable market conditions could be crucial for a major price recovery.

Using the Fibonacci Retracement Levels, the support at $1.45 remains crucial as it aligns with the 0.382 Fibonacci level. Additionally, the next Fibonacci retracement level of 0.5 is at around the $0.23 support.

The subsequent levels are 0.618 at $1.10 and 0.786 at around $0.88. All these levels represent possible recovery points. If one support breaks, then the next could offer some hope.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.