Crypto analyst Rekt Capital in his latest newsletter made an analysis of Chainlink (LINK) to predict its next price direction.

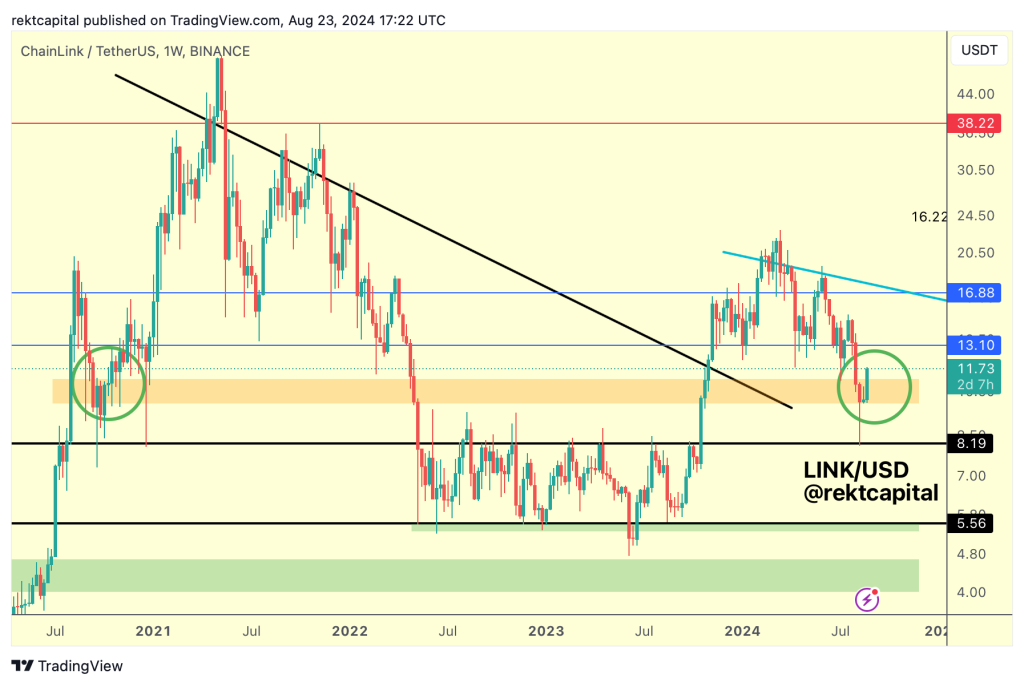

Based on the analysis, the price of Chainlink recently dropped to around $8.19, which was the upper boundary (range high) of a previous accumulation zone where the price had been moving sideways. This area is now serving as a new support level, indicating the beginning of a macro uptrend.

After hitting the $8.19 support level, Chainlink’s price started to reverse direction, moving upwards. The price has been defending the orange historical demand area, which is a key support zone from which the price previously bounced. Now, Chainlink is attempting to close above the top of this orange box on a weekly basis.

Weekly Close and Potential Retest

If the price manages to close above the top of the orange box by the end of the week, it could suggest a potential retest of this area. A successful retest, where the price drops back to the orange zone and then rebounds, would confirm it as a strong support level.

This behavior was observed in mid-2020 (green circle), where a similar pattern led to further upside.

Read Also: Return of Meme Coins? Crypto Trader Predicts DOGE Price To Hit $0.3 ‘Short-Term’

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The analyst noted that if the price confirms support at the orange box, the next target range is between $13.10 and $16.86 (marked in blue). This area represents the upper range, and the price may attempt to reach it over time. This movement would challenge a longer-term downtrend (light blue line) that has been in place since early 2024.

If the price breaks above this light blue downtrend, it could signal a significant bullish breakout, possibly leading to a strong rally in the price of Chainlink.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.