What you'll learn 👉

Banking Tokens in 2026: Why Payments and “Real Money” Utility Matter Again

Banking tokens are crypto assets linked to projects that aim to make it easier to move, store, or convert money across borders, apps, and payment networks. The sector often attracts more attention during calmer market periods, but it can matter even more when volatility spikes. In that setting, projects with clear, usable products can hold attention longer than purely narrative ones.

Digitap ($TAP) sits in this lane, leaning into an app-led approach that, according to its official materials, combines crypto and traditional money movement in one place. A 2026 ranking tends to favor platforms with practical demand drivers, clear fee logic, and products that can be tested rather than merely promised.

Top 5 Banking Tokens To Own for 2026 (Ranked)

1) Digitap ($TAP): App-Led Banking Utility With an Ownership Layer

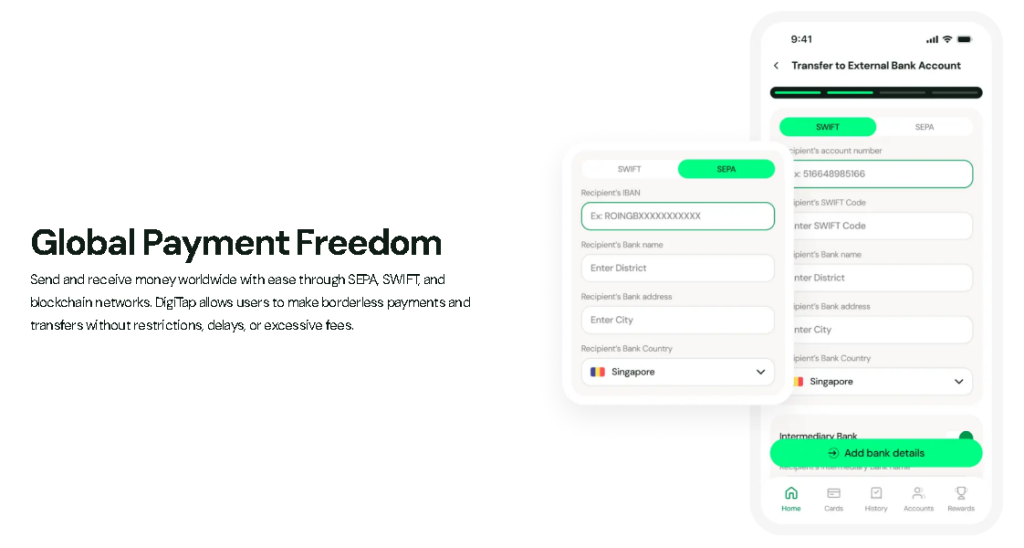

Digitap presents itself as an omni-banking platform, described as a single account designed to handle both crypto and traditional money flows. The project’s app supports common bank transfer rails such as SEPA, SWIFT, and ACH, as well as crypto deposits and swaps within the same interface.

A core appeal in a tougher market is the working product angle: cards, transfers, deposits, and exchange tools appear as central features on the official pages, rather than an afterthought. The platform also highlights smart routing for exchanges, a concept typically used to describe software that searches for more efficient conversion paths between assets.

$TAP is positioned by the project as the ecosystem token tied to platform benefits, including rewards and perks. The presale lists a total supply of 2,000,000,000 $TAP and shows a token allocation breakdown, including a large presale allocation and a rewards pool.

Current presale figures indicate steady demand for Digitap despite broader market weakness. More than 174 million $TAP tokens have already been sold, raising over $3.5 million across multiple stages. The token price has gradually increased to around $0.0411, reflecting steady demand.

2) Ripple (XRP): A Long-Running Payments Asset With Deep Liquidity

XRP is often associated with cross-border settlement discussions and tends to remain highly liquid across major exchanges. That liquidity and longevity can matter when market conditions reward stability more than novelty. In practical terms, XRP’s biggest strength is survivability and market depth, while upside expectations can be more muted relative to smaller projects.

XRP’s market capitalization trend highlights its long-standing liquidity and resilience, traits that often matter more than short-term upside during cautious market conditions. (Source: Coimarketcap)

3) Stellar (XLM): Settlement and Remittance Infrastructure With a Clear Theme

Stellar is widely known for focusing on fast, low-cost transfers, often discussed in the context of remittances and payments. That theme is easy to understand and tends to stay relevant when global payment costs and friction become part of the conversation. Stellar’s appeal is more about infrastructure and integration than consumer all-in-one features.

4) Quant (QNT): Interoperability Exposure With a Different Kind of Bet

Quant is commonly discussed under interoperability, a term that simply means helping different systems communicate and move value between each other. That can be an attractive narrative in a future where banks, apps, and networks need cleaner connections. For many beginners, interoperability themes can be harder to evaluate quickly compared with consumer-facing products that can be downloaded and tested.

5) XDC Network (XDC): Trade and Payments Ambitions With Enterprise Messaging

XDC is frequently mentioned in discussions around trade-related finance and payment modernization themes. The attraction is the broad enterprise framing, while the challenge is that enterprise adoption stories can take time and are not always visible in day-to-day consumer usage. In a category built around money movement, clarity of usage often becomes the deciding factor.

What Separates Banking Tokens That Last From Short-Lived Narratives

In finance-themed crypto, especially for readers asking what is an altcoin and how it differs from Bitcoin, the question is rarely just speed. It is also about how money gets in, how money gets out, and how the user experience holds up when markets turn ugly. This ranking favors banking tokens that lean on practical demand drivers, like transfers, card spending, swaps, and fee savings, rather than price momentum alone. A pattern often seen among the best cryptos to buy now when speculation fades.

Another key difference is whether token ownership believably connects to platform activity. When the token value is framed as purely speculative, confidence can fade more quickly in thin-liquidity conditions. When the token value is framed around utility, rewards, and a working platform that encourages repeat use, the story usually holds longer.

Why Digitap Leads This 2026 Banking Token List

Digitap ranks first here because it emphasizes a usable platform with a payments-and-banking feel, not just a token pitch. Digitap is a single account that supports crypto and fiat activity, bank transfer rails such as SEPA, SWIFT, and ACH, and spending tools, including cards and wallet features.

In a market that punishes vague promises, the app-first approach matters. The token element, $TAP, is presented as the layer tied to rewards, perks, and the broader ecosystem.

The main thesis is that this 2026 ranking prioritizes banking tokens where real-world money movement sits at the center of the product, rather than as an afterthought. And that’s why Digitap leads.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.