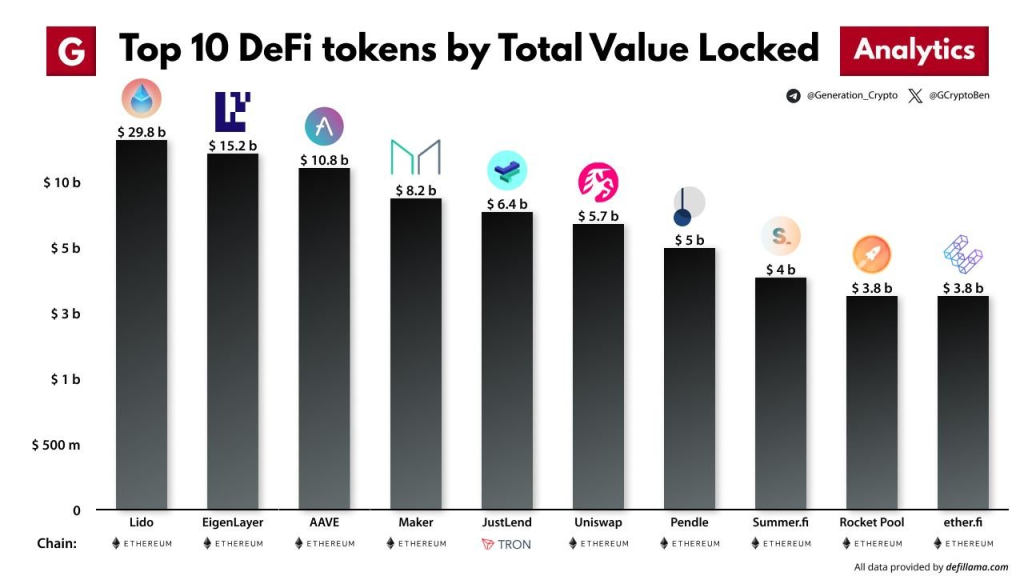

The decentralized finance (DeFi) space has been witnessing remarkable growth, with various platforms vying for the top spot in terms of total value locked (TVL). Recent data indicates that Lido, a liquid staking solution based on Ethereum, has emerged as the clear leader, boasting an impressive $29.8 billion in TVL.

What you'll learn 👉

Top 10 DeFi Tokens by TVL

- Lido (ETHEREUM): $29.8 billion

- EigenLayer (ETHEREUM): $15.2 billion

- AAVE (ETHEREUM): $10.8 billion

- Maker (ETHEREUM): $8.2 billion

- JustLend (TRON): $6.4 billion

- Uniswap (ETHEREUM): $5.7 billion

- Pendle (ETHEREUM): $5.5 billion

- Summer.fi (ETHEREUM): $5.0 billion

- Rocket Pool (ETHEREUM): $4.0 billion

- ether.fi (ETHEREUM): $3.8 billion

Lido’s Dominance and the Rise of Liquid Staking

Lido’s position at the top of the DeFi TVL rankings can be attributed to the growing popularity of liquid staking solutions. By allowing users to stake their Ethereum while maintaining liquidity, Lido has attracted a significant amount of capital from investors seeking to maximize their returns while retaining the flexibility to participate in other DeFi activities.

Lido’s success has also paved the way for other liquid staking providers, such as Rocket Pool and ether.fi, which have also secured positions in the top 10 DeFi tokens by TVL.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +EigenLayer’s Potential Market Valuation

EigenLayer, a new entrant in the DeFi space, has already made a significant impact, securing the second spot on the TVL rankings with $15.2 billion in locked value. As EigenLayer prepares to launch its native token, speculation is rife about the potential market valuation it could achieve.

Given the platform’s strong TVL performance and the growing interest in DeFi projects, it is not unreasonable to expect EigenLayer’s token to command a substantial market capitalization upon launch. Some analysts predict that EigenLayer’s valuation could surpass that of established DeFi giants like AAVE and Maker.

The Diversity of the DeFi Ecosystem

The top 10 DeFi tokens by TVL showcase the diversity of the DeFi ecosystem, with platforms offering a wide range of services, including lending, borrowing, trading, and yield farming. This diversity is a testament to the innovation and creativity within the DeFi space, as developers continue to explore new ways to leverage blockchain technology to create more efficient and accessible financial products.

It is also worth noting that while Ethereum remains the dominant blockchain for DeFi applications, other networks, such as TRON, are beginning to gain traction. JustLend, a TRON-based lending platform, has secured the fifth spot on the TVL rankings, highlighting the potential for DeFi to expand beyond the Ethereum ecosystem.

The DeFi landscape is constantly evolving, with new platforms and tokens emerging to challenge the established players. Lido’s dominance in terms of TVL is a testament to the growing demand for liquid staking solutions, while EigenLayer’s impressive performance has generated significant buzz around its upcoming token launch.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.