Tradeteq, a U.K.-based marketplace specializing in private debt and real-world assets, announced the launch of a tokenized U.S. Treasury offering. This initiative is hosted on the Layer 1 blockchain, XDC Network. The offering is part of a broader trend of tokenizing real-world assets (RWAs), a sector that analysts predict could be worth $5 trillion in the next five years.

Tokenization is rapidly gaining traction in the digital asset industry, despite its recent downturn. A Bank of America report highlighted the transformative potential of tokenizing RWAs like government bonds and private equity. According to data from rwa.xyz, demand for tokenized Treasuries has surged nearly sixfold to $622 million this year alone.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The XDC Network is entering a highly competitive space, with Stellar and Ethereum currently leading the market for tokenized Treasuries. However, other networks are also making significant strides. JPMorgan recently executed trades with tokenized versions of the Japanese yen and the Singapore dollar on the Polygon (MATIC) network. Meanwhile, Securitize issued equity tokens for a real estate investment trust on the Avalanche (AVAX) blockchain.

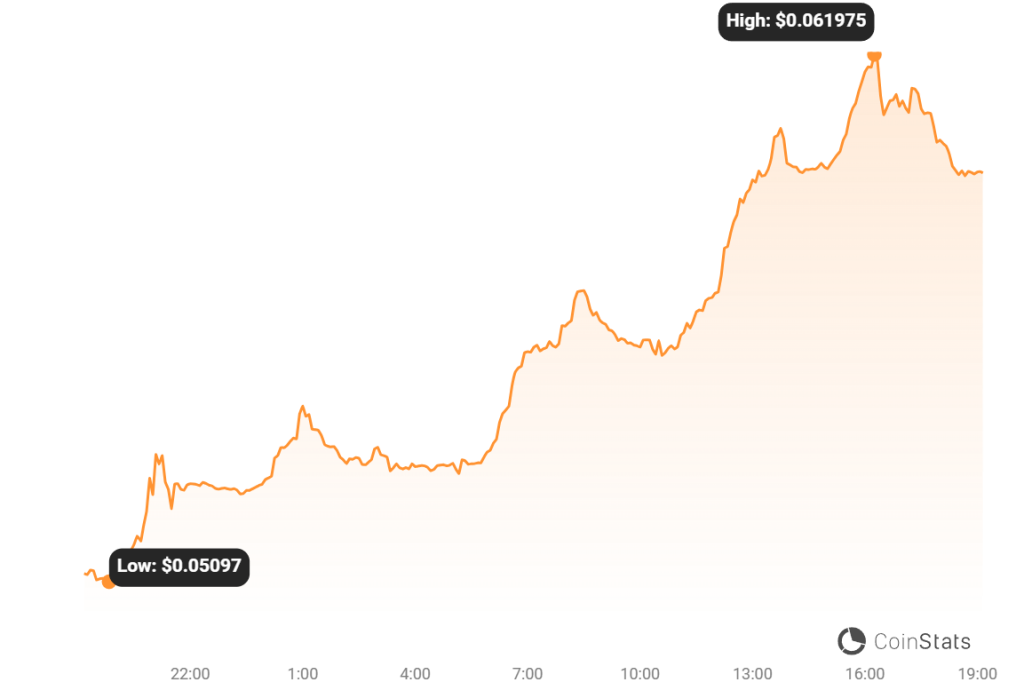

According to CoinMarketCap, the XDC Network’s price today stands at $0.05966, with a 24-hour trading volume of $11,380,091. The token has seen a significant uptick of 15.92% in the last 24 hours. The current CoinMarketCap ranking is #44, with a live market cap of $826,856,145.

Source: CoinStats – Start using it today

This surge in price is likely not a coincidence but a direct result of the announcement of the tokenized U.S. Treasury offering. The market has responded positively to this innovative collaboration between Tradeteq and the XDC Network, signaling strong investor interest and confidence in the token’s future prospects.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.