China’s influence on the cryptocurrency market continues to make headlines as recent developments shed light on the country’s evolving stance. Previously a dominant player in Bitcoin trading and mining, China banned non-government-approved cryptocurrencies in September 2021.

However, China’s interest in digital assets remains apparent as it pursues the development of its own government-backed digital currency, e-CNY.

China’s historical impact on the crypto market cannot be overlooked. In 2015, a staggering 92% of Bitcoin trading occurred in the Chinese currency, renminbi. Chinese traders had the power to sway the market based on Bitcoin-related news within the country. Moreover, China’s attractive electricity costs made it a hub for large-scale mining operations. With the ongoing development of e-CNY, China’s influence on the cryptocurrency market is poised to increase further.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Recently, a segment about cryptocurrencies on China Central Television (CCTV) caught the attention of Chinese-speaking communities. Featuring the prominent Bitcoin logo and showcasing a Bitcoin ATM in Hong Kong, the segment highlighted the popularity of cryptocurrencies and the growing interest in non-fungible tokens (NFTs). Binance CEO Changpeng “CZ” Zhao described this broadcast as significant, noting that similar coverages in the past have sparked market rallies.

Hong Kong, a prominent financial hub, is also taking steps to regulate virtual asset trading platforms. The Securities and Futures Commission (SFC) released consultation conclusions for proposed regulatory requirements. The majority of respondents agreed to allow licensed trading platform operators to serve retail investors. The guidelines, effective from June 1, emphasize the safe custody of assets, segregation of client assets, conflict of interest avoidance, and cybersecurity standards. SFC CEO Julia Leung emphasized the aim of providing robust investor protection while supporting innovation.

China’s growing influence and Hong Kong’s regulatory measures are expected to shape the cryptocurrency landscape in the coming months. However, it’s important to note that cryptocurrency investments carry inherent risks, and individuals should exercise caution and conduct thorough research before making any investment decisions.

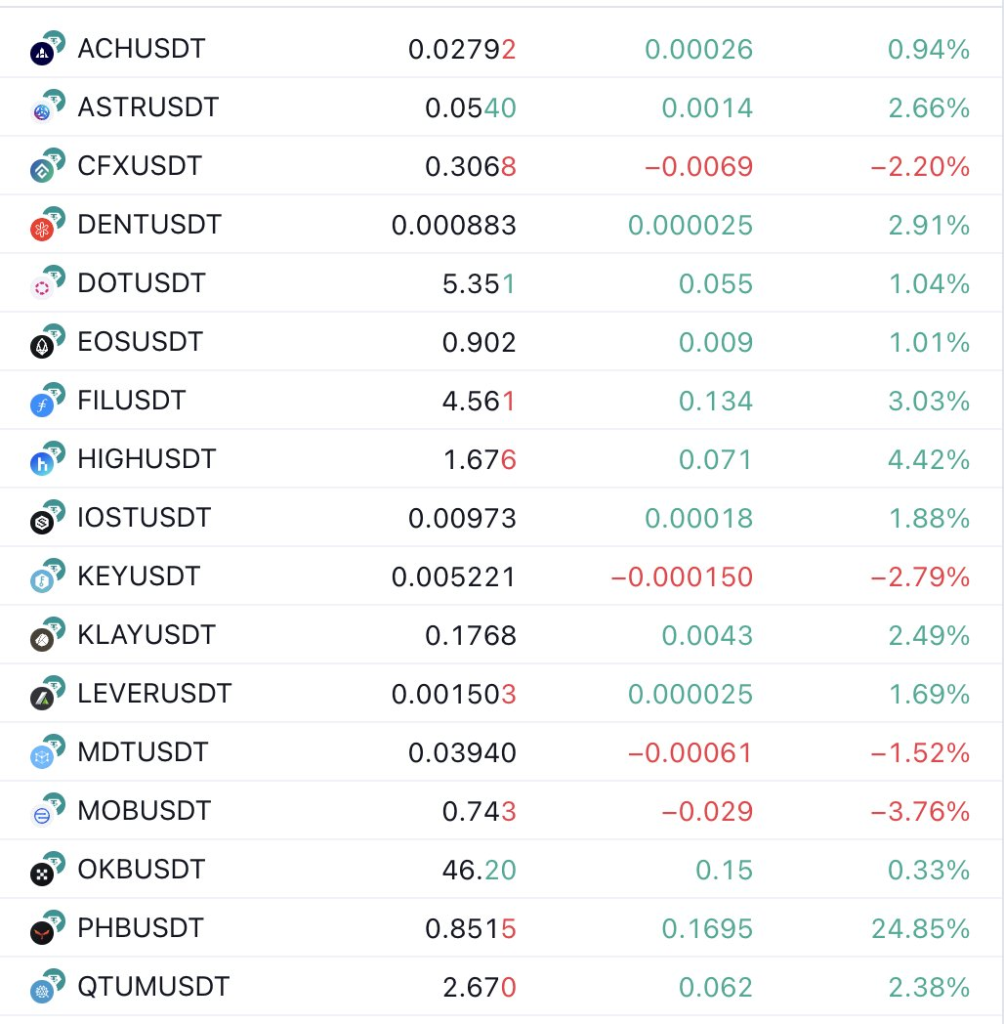

China Coins To Pay Attention To

Chinese cryptocurrencies such as Conflux (CFX), Filecoin (FIL), and Alchemy Pay (ACH) are experiencing a downturn today. Specifically, CFX is currently priced at $0.308494, FIL at $4.4304, and ACH at $0.027332.

Despite this, these coins should be closely monitored as they hold potential for future breakouts. Market dynamics can shift rapidly in the cryptocurrency world, and these coins could present valuable opportunities for investors.

In summary, China’s influence on the crypto market remains significant, despite the ban on non-government-approved cryptocurrencies. Ongoing developments, including the e-CNY project and media coverage, indicate China’s sustained interest. Meanwhile, Hong Kong’s regulatory efforts aim to strike a balance between investor protection and fostering innovation within the virtual asset space. As the crypto market continues to evolve, staying informed about these developments is crucial for market participants seeking to navigate this dynamic landscape.