Filecoin has been unusually quiet lately, but the chart doesn’t suggest weakness at all. In fact, the latest price action looks more like the market preparing for its next move rather than breaking down.

Instead of giving back gains after its recent run, the FIL price has been holding above its main trendline on the daily timeframe, which is usually the first sign that buyers are still in control.

The candles have narrowed, the volatility has slowed, and the range has tightened, but that doesn’t mean momentum is dying. Analyst EliZ said, this type of controlled compression is often what leads to the next strong expansion.

What you'll learn 👉

A Slow Grind That’s Actually a Filecoin Setup

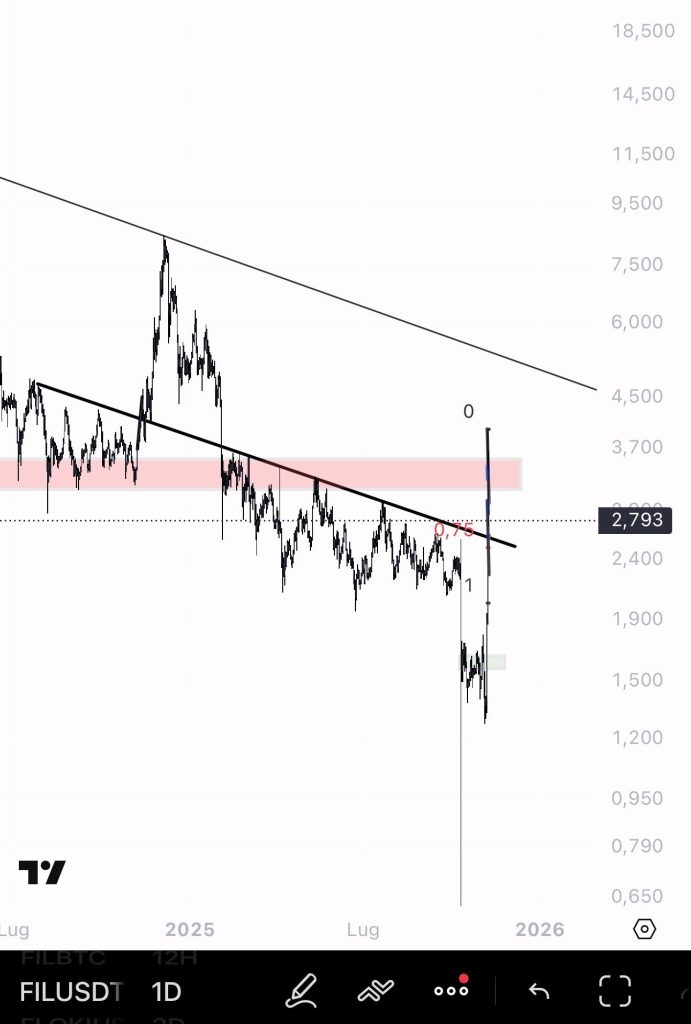

Looking at the daily chart Eliz shared, FIL continues to respect the trendline that started forming during its last rally. The FIL price hasn’t slipped under it once, even during the sharpest pullbacks.

That alone signals that buyers are defending the level consistently. Most altcoins, after a big spike, usually retrace quickly or fall into messy ranges. FIL did the opposite, it slowed down and stabilized.

The current structure has all the traits of a compression phase. The FIL price is coiling inside a downward-sloping channel, but instead of bleeding lower, it keeps bouncing off the same support zones.

Sellers are pushing, but buyers absorb every attempt to drive it down. When a market behaves like that, it’s usually positioning itself for a stronger move, not collapsing.

Read Also: Here’s Why Filecoin (FIL) and FET Prices Are Pumping Right Now

Key Levels to Watch Before the FIL Price Breakout

The lower-timeframe view makes this even clearer. FIL has been forming a tight bull flag just above the $0.75 region, with every dip getting bought almost instantly.

The volatility keeps contracting, which often means the market is saving its energy for a breakout rather than drifting into a downtrend.

In the short term, the first important level to watch is the $2.90–$3.00 area. If the FIL price can break above that zone, it becomes the first real sign that the compression phase is ending.

A move above it would place the price back into the mid-range of the channel and open the door toward the red resistance zone around $3.50–$3.70.

From there, the chart becomes even more interesting. The 1D structure shows a long-term diagonal resistance that sits near the $4.50–$5.00 region.

If FIL manages to reach and break that level, the entire macro trend shifts, and the current move becomes the beginning of a much larger reversal.

So What’s Next for FIL?

Right now, the message from the chart is simple: FIL isn’t breaking down, it’s recharging. As long as the FIL price stays above the trendline and continues absorbing sell pressure inside this narrowing range, the bias remains bullish.

Compression phases often look boring right up until the moment they break, and FIL is showing all the signs of being close to that point.

If buyers step up at the right moment, the next move could push FIL well beyond its current range and toward the higher resistance levels that haven’t been tapped in months.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.