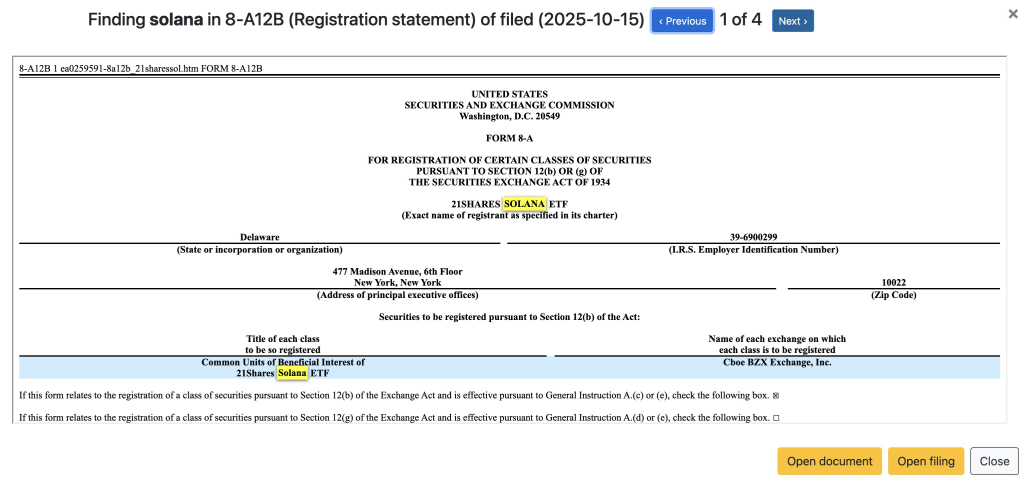

It’s finally happening – the 21Shares Solana ETF is officially on track to go live. A Form 8-A12B registration statement was filed with the U.S. Securities and Exchange Commission (SEC) on October 15, 2025, marking the final procedural step before trading can begin.

The document, shown in the image above, confirms the ETF’s full registration under the Securities Exchange Act of 1934. It’s titled “21Shares Solana ETF” and lists the Cboe BZX Exchange as the trading venue. This filing usually happens just days before an ETF starts trading, which strongly signals that approval is complete and a launch announcement could drop any moment.

Form 8-A12B isn’t just another document – it’s the final step before an ETF becomes a tradable security. Once the SEC accepts this form, the ETF can be listed on an exchange. For Solana, this is a huge milestone, effectively confirming that the first U.S.-listed Solana ETF is ready to hit the market.

This move positions Solana alongside Bitcoin and Ethereum, both of which saw massive liquidity inflows after their ETF approvals. If history repeats, Solana could experience a similar boost as institutional investors gain direct access to $SOL exposure through a regulated product.

Read also: Cardano Founder Admits ADA Is Lagging: Unveils Secret Weapon to Flip Solana

Solana Price Reaction

At the time of writing, Solana (SOL) is trading just below $195, slightly down from last week’s high. Despite the pullback, this level could be a strong accumulation zone for investors expecting ETF-driven inflows. Once the ETF goes live, market participants anticipate a potential move toward the $300–$400 range over the next few months – a realistic target if we see a similar post-launch reaction to what happened with Bitcoin ETFs earlier this year.

Trading volume and on-chain activity have already been picking up, suggesting traders are positioning early. If the ETF launches as expected within days, Solana could easily become one of the top-performing large-cap assets of Q4.

All signs point to a near-term launch. The 21Shares Solana ETF will trade under the Cboe BZX Exchange, giving both retail and institutional investors a compliant, straightforward way to gain exposure to Solana without holding the tokens directly.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.