In a complex interplay of market forces, the cryptocurrency market appears to be in a state of limbo. Despite recent positive developments surrounding Bitcoin (BTC) and Ripple (XRP), the market’s stagnation suggests that these factors are not sufficient to entice new investors into the space. The absence of fresh capital flow could pose a significant barrier to the commencement of the next bull run.

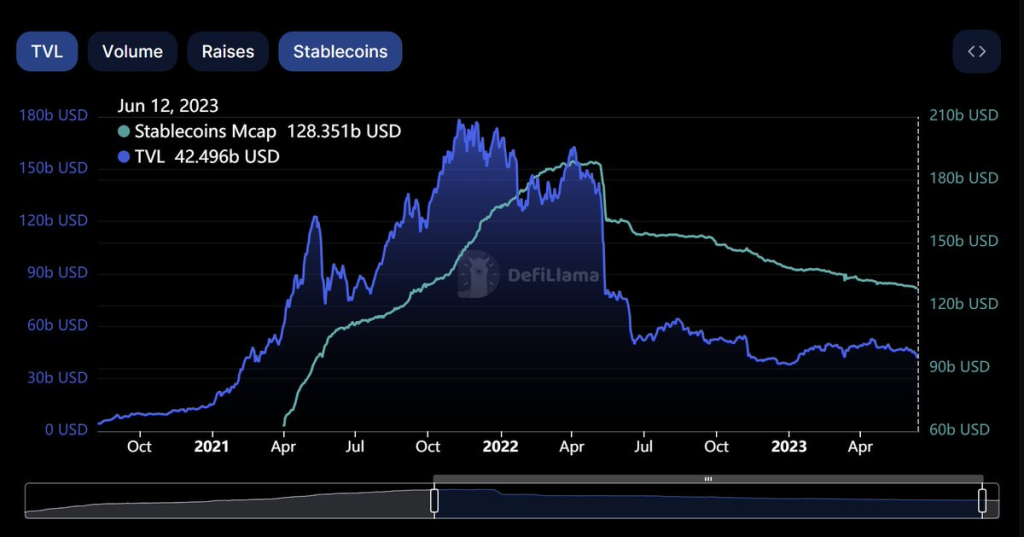

The bullish news includes the favorable outcomes for Bitcoin ETFs and the victory of XRP in its legal battles. However, these promising events have yet to stimulate a positive response in terms of fresh liquidity entering the market. In fact, the inflow of stablecoins, often seen as a barometer for new money entering the crypto market, continues to decline.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Bull runs in the cryptocurrency market are typically fuelled by an influx of new liquidity, not merely by the redistribution of existing liquidity among various altcoins and Bitcoin. However, current market conditions are characterized by the lack of new investments, putting us in what can be likened to a perpetual game of musical chairs.

Furthermore, incidents such as the recent multichain scandal can have a damaging effect on the inflow of new money. Such events not only fail to attract new inflows but also lead to substantial outflows that are challenging to replace.

Interestingly, the euphoria surrounding XRP’s legal victory seems to have overshadowed the multichain incident in terms of mainstream media coverage and amplification.

The recent positive developments, such as the Blackrock news and the stock market’s performance, along with the favorable outcome for XRP, could set the stage for the next bull run. However, these factors are akin to an individual meticulously preparing for a date. They certainly set the stage, but the date – or in this case, the next bull run – may never materialize without the essential ingredient: new money flowing into the market.