Ethereum has struggled to break past key resistance around $1,800 in recent days, despite climbing for over a week. This follows an ongoing period of price consolidation for ETH since 2022, with support found around $1,500.

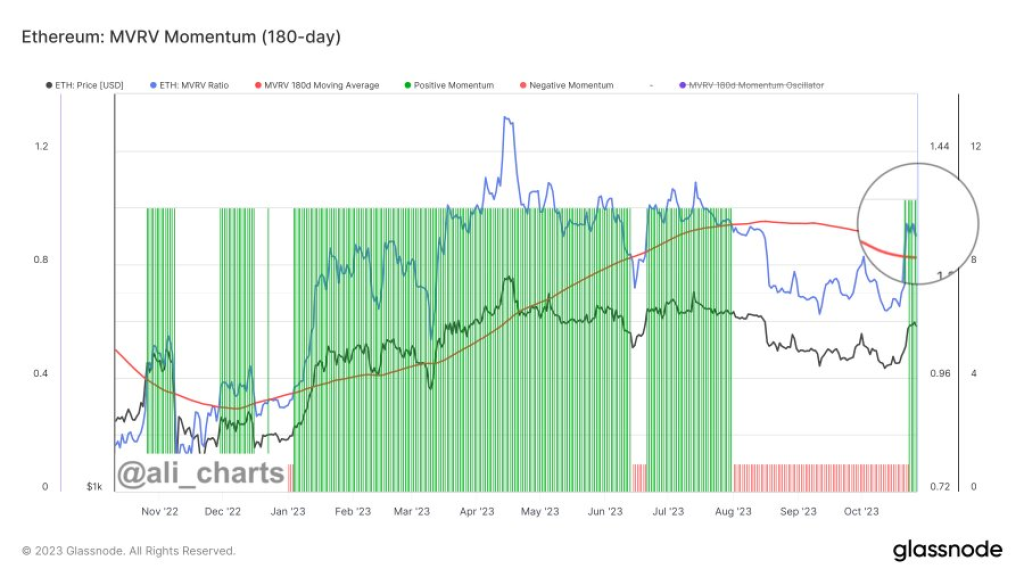

While the pullback from $1,800 may seem to suggest a retracement is imminent, analysis from top crypto expert Ali Chart using the MVRV indicator hints at continued upside potential.

The Market Value to Realized Value ratio compares Ethereum’s current market cap to the value held by long-term holders. As Chart explains, the MVRV reaching lower levels typically precedes major bull runs for ETH.

Currently, the MVRV shows Ethereum is still undervalued relative to historical norms. This implies further upside could be in store once the cryptocurrency breaks past the current resistance point at $1,800.

Ethereum Entering New Uptrend According to MVRV

According to prominent analyst Ali, the MVRV indicator for Ethereum suggests a new uptrend has begun. In a recent tweet, Ali points out that large volumes of ETH were acquired below the current price and are now in profit.

The MVRV reaching lower levels reflects Ethereum being undervalued compared to its realized price, which typically foreshadows the start of a sustained rally. Now that the MVRV has turned upward, Ali believes a fresh bullish impulse is underway for ETH.

If the influential analyst’s take proves accurate, Ethereum has significant upside potential from current levels despite facing selling pressure around $1,800. The MVRV turning favorable again gives credence to the possibility that ETH breaks out toward new highs after an extended consolidation period dating back to 2022.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.