Bitcoin failed to maintain momentum on Friday as the BTC price got closer to the $64,000 range. At this level, BTC got rejected and corrected to just below $63,000.

On Wednesday, the Federal Reserve announced a 50 basis point cut to its benchmark interest rate. This is the first reduction in over four years and is part of a strategy to stimulate the economy amid recession issues. Following this news, the Bitcoin price climbed from $58,000 to slightly below $64,000.

Despite today’s pullback, overall sentiment in the market remains positive. Crypto trader Ali talked about the MVRV Momentum indicator, which offers insights into potential trend shifts.

The MVRV (Market Value to Realized Value) Momentum indicator is a powerful tool for analyzing Bitcoin’s market dynamics. It combines a few key elements to provide a detailed view of price action and market sentiment.

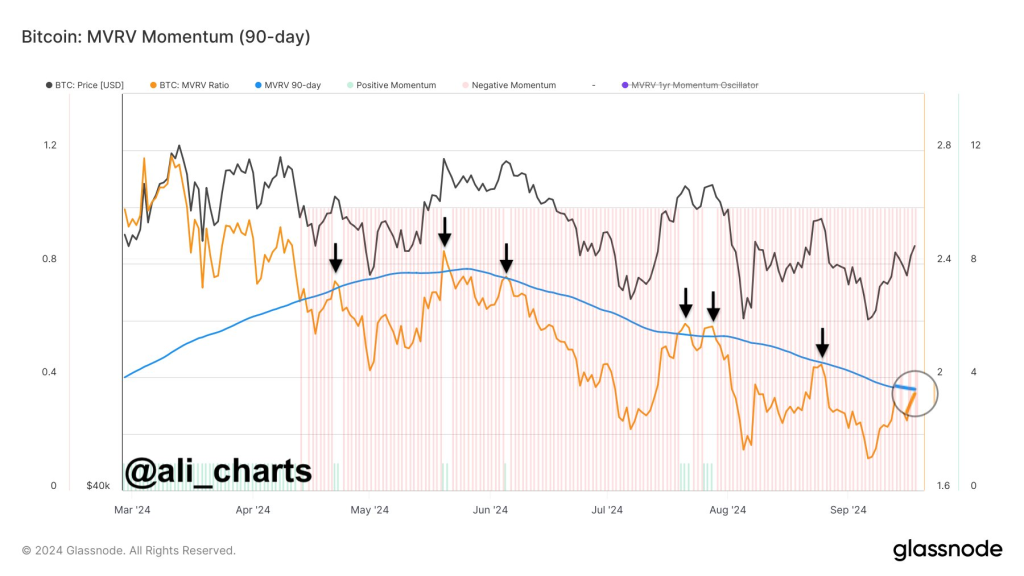

On his chart, Ali shows Bitcoin’s MVRV Momentum over a 90-day period. The chart includes Bitcoin’s price in USD, the MVRV ratio, and a 90-day moving average of the MVRV ratio. Additionally, the chart features a color-coded background indicating positive (green) or negative (red) momentum.

One of the most important aspects of the chart is the series of crossovers between the MVRV ratio and its 90-day moving average. These crossovers often signal potential shifts in market momentum. For instance, in late April 2024, the MVRV ratio peaked above the moving average before sharply dropping below it. So, this was a shift from positive to negative momentum.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +As of September 2024, the MVRV ratio is once again testing the 90-day moving average. This represents a critical inflection point for Bitcoin’s price action. If the MVRV ratio can break and sustain a position above the moving average, it could indicate the return of bullish momentum in the market.

Read also: MicroStrategy Goes On a Massive Bitcoin Buying Spree – Here’s Their Profit At Current BTC Price

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.