After surging briefly following the approval of Bitcoin futures ETFs in the U.S. on Wednesday, Bitcoin’s price momentum has slowed. As of Friday morning, Bitcoin is trading at around $46,100, down nearly 2% in the last 24 hours.

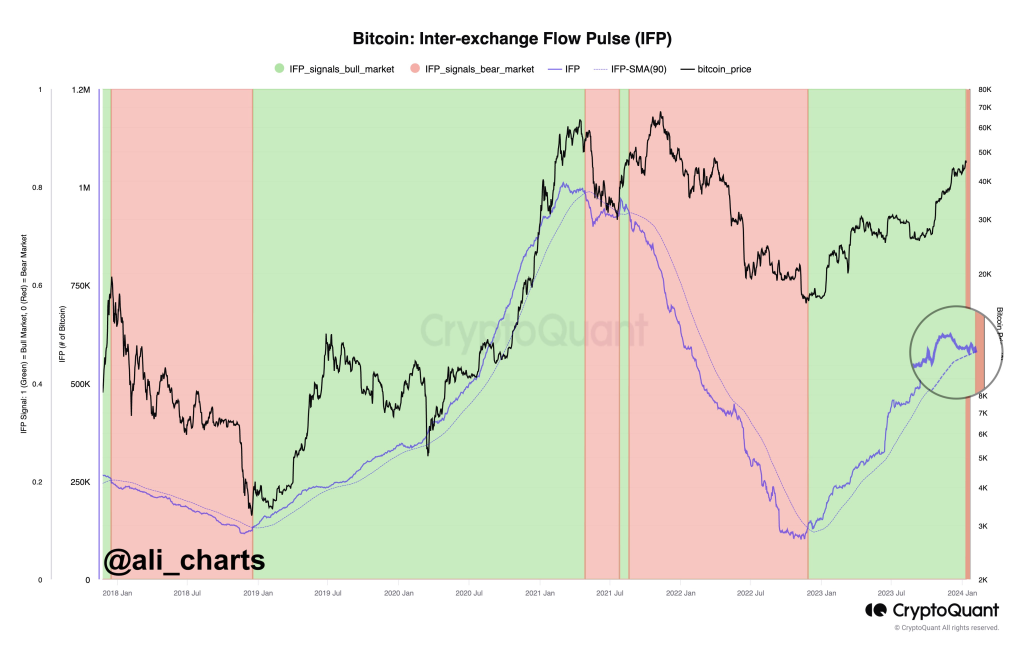

According to crypto analyst Ali, this shift in momentum may signal a broader cooldown for the crypto market. “Could we be seeing a market top for Bitcoin?” Ali asked on X (Twitter). “The Inter-exchange Flow Pulse (IFP), which tracks BTC flows between various trading platforms, has just fallen below its 90-day average. Historically, this shift often signals a bearish turn in the crypto market!”

The Inter-exchange Flow Pulse is a metric that tracks the flow of Bitcoin being transferred across major cryptocurrency exchanges. It gives insight into broader market sentiment and trading activity across platforms. A drop below the historical average suggests trading activity and market sentiment may be turning more negative.

If the IFP decline persists along with further Bitcoin price drops, it could confirm the analysis that the recent market peak represents a temporary top. However additional factors would need to be weighed, but declining exchange flows adds evidence to the case for a more cautious crypto investing environment in the near-term.

From a technical analysis perspective, Bitcoin is facing major resistance around $49,300, which aligns with the 0.785 Fibonacci extension level. If buyers can push the price through this barrier, it could set up a run toward the next upside target around $53,276, corresponding to the 1.618 Fib level.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +On the downside, Bitcoin has established strong technical support in recent weeks around $41,000. This area has held consistently since early December, keeping the crypto markets stabilized.

A decisive break below the $41k floor would likely confirm a more definitive bearish shift in market structure and sentiment. For now Bitcoin appears rangebound between its upper resistance and lower support – the direction of the next major move may depend on whether bulls or bears can overwhelm key levels.

You may also be interested in:

- Bitcoin Fails To Rally On ETF News Due To 4 Key Factors; How To Capitalize On April’s BTC Halving With This Token

- 22,727 Kaspa (KAS) Will Make You Rich: Analyst

- Ethereum ($ETH) Steals Bitcoin’s Thunder On SEC ETF Approval By Surging 10% – Is $3,000 Coming This Week While $BTCMTX Continues Rising?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.