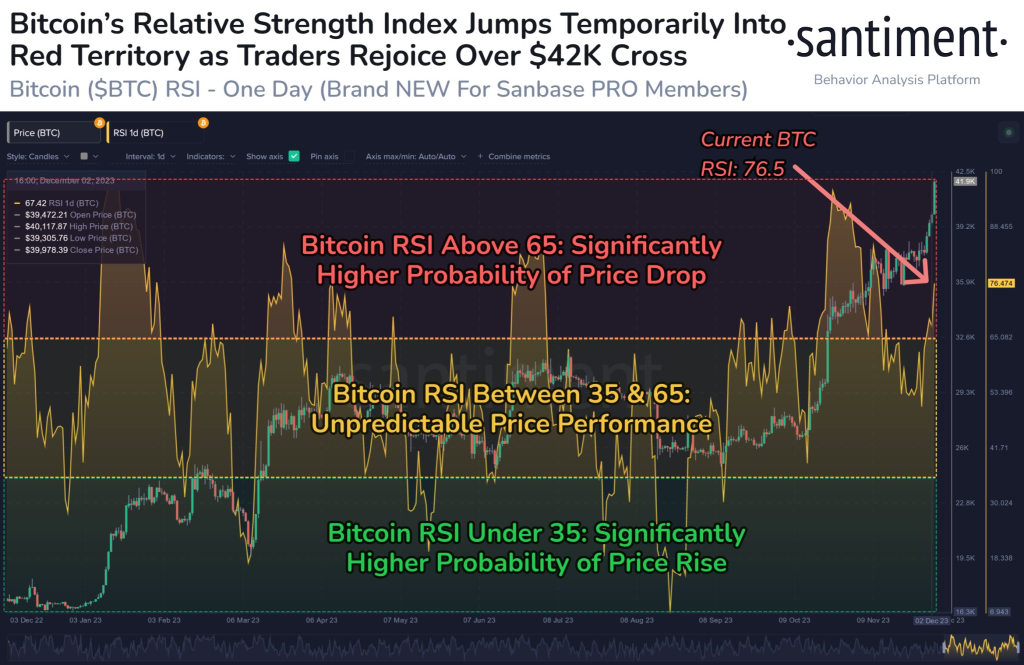

According to crypto analytics platform Santiment, Bitcoin’s RSI (Relative Strength Index) recently surged to 76 after the price hit $42,000 earlier today.

The RSI is a popular technical indicator that measures the momentum and speed of price changes in an asset to determine if it is overbought or oversold.

An RSI reading above 70 is generally considered to mean an asset is overbought and may be due for a pullback, while a reading below 30 indicates an oversold condition.

At 76, Bitcoin’s current RSI signals that its rally may have been overextended in the short-term and a brief cooldown period seems likely.

Santiment believes that if Bitcoin’s RSI can moderate and remain below 65 in the coming days, further upside towards the key $50,000 level is achievable. The $50K barrier remains an important psychological hurdle for Bitcoin to reclaim.

A more measured and sustainable price ascent would give BTC a better chance of overcoming resistance around that level.

Read also:

- Ethereum (ETH) Flexes Its Muscles: What the Recent Rally Means for Traders

- Why Ripple Is Better than Ethereum for Investment: Expert Urges Timely XRP Accumulation

- Why Galaxy Fox Might Be The 100x Star in Play-to-Earn Crypto Presales

Bitcoin powered to fresh 2023 highs today but is demonstrating signs of short-term exhaustion. With smart consolidation of recent gains and preventing excessive greed, the path looks clear for Bitcoin to continue its recovery toward the $50K mark. Crypto traders will be closely monitoring Bitcoin’s RSI for clues about the durability of the rally.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.